PYMNTS.com: AI Reduces Loss Shares of Annual Sales to Fraud by Nearly 50%

Artificial Intelligence is major topic across all industries. We are seeing AI performing remarkable feats -- everything from automating processes to creating new pieces of art. In contrast, there are those individuals who are utilizing AI for nefarious purposes.

PYMNTS.com discusses how, the world of banking, AI offers the same sort of conundrum. While AI technologies have enhanced tools to increase fraud detection capabilities, the technology is also accessible by the "bad guys" to create new ways to commit fraud.

In order to properly defend themselves against today’s fast-moving, digitally deployed fraud, firms need to strike the perfect balance of tech-first defenses that protect against tech-first attacks, while simultaneously addressing the evergreen behavioral elements still lying at the root of scams.

Crucially, enterprises themselves need to take advantage of new tools and innovations like AI to cover up their most sensitive attack vectors before they get taken advantage of by bad actors using the same technologies.

“When you think about financial services, the [immediate use case of AI] is obviously fraud protection,” Jeremiah Lotz, managing vice president, digital and data at PSCU, told PYMNTS.

Legacy Systems Come Up Short

There are a startling amount of financial institutions that lag behind, PYMNTS reports, relying on legacy solutions in an environment where more and more mid-level fraudsters have easy access to AI. The difference in "damage inflicted" between banks and firms using AI and machine learning and those clinging to older technology is clear:

Keeping organizational walls secure requires an investment in modern solutions. PYMNTS’ research has found that companies relying on legacy reactive and manual digital identity verification solutions lose above-average shares of annual sales to fraud, at 4.5%. However, firms using proactive and automated solutions, such as those powered by AI and ML, reduce their share of lost sales to 2.3%.

AI and machine learning (ML) defenses are crucial, PYMNTS says, because they are "more holistic," leveraging contextual and behavioral clues to identify, flag, and "defang" attacks in a much more integrated manner.

“The industry in fraud is shifting to real-time learnings because the fraudsters are now real-time. In cyberspace you have something called a zero-day attack, which basically means you’re going to get attacked on day zero, and you’re going to be attacked before you even know what the solution is. Because the bad actors are way ahead of you,” Shimon Steinmetz, chief financial officer at risk assessment and fraud prevention solution Vesta, told PYMNTS.

Proactive Fraud Detection, NOT Reactive

Because bad actors have ready access to effective tools, it's more important than ever to stay on the leading edge of technology.

“Fraudsters, as a general rule of thumb, tend to be very sophisticated and are always finding new ways to defraud individuals and businesses,” Doriel Abrahams, head of risk in the U.S. at fraud prevention provider Forter, told PYMNTS.

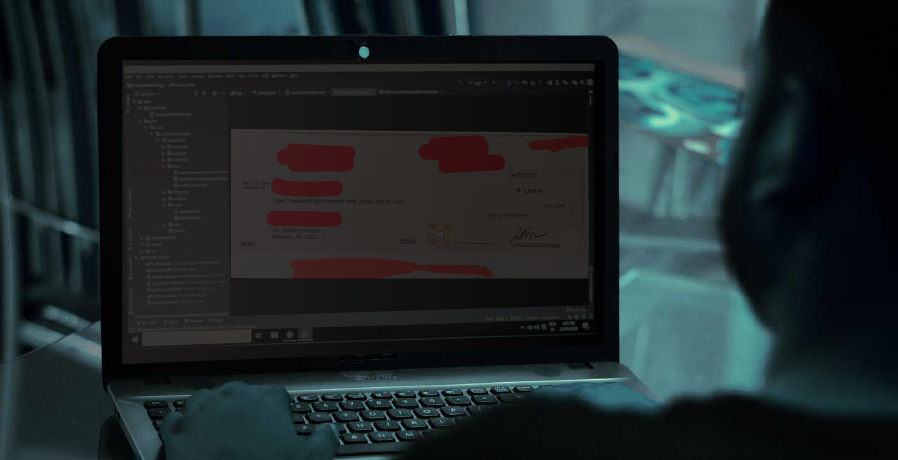

Check fraud detection continues to provide a perfect use case example for the utilization of AI. Fraudsters are finding new ways to commit check fraud -- everything from leveraging technologies to create counterfeits to altering checks for deposit through mRDC.

As noted in a previous article, legacy systems with teller scrutiny catches about 75%-85%, according to John Calderon, chief compliance officer of Bison State Bank. Nowever, the remaining 15%-25% gap can costs hundreds of thousands -- even millions -- of dollars. And, we would be remiss not to note that fraudsters are avoiding depositing with tellers all-together, depositing checks to "drop accounts" via ATM and mRDC.

However, financial institutions that were proactive in deploying AI and deep learning technologies for behavioral analytics and image forensic AI are seeing tremendous results, from reducing losses to eliminating a significant portion of false positives that need manual review. Financial institutions have even reported detection rates as high as 95%+ when deploying AI and deep learning technologies.

Fraudsters will always work to stay one step ahead of financial institutions. FIs need to act now before its too late.