Rules Engine: Balancing Check Fraud Detection and Customer Experience

- Fighting fraud requires a delicate balance

- Despite digital payments, checks remain a valid form of payment

- Rules engines play a key role in detecting and preventing fraud

In a recent ATM Marketplace podcast, Bradley Cooper spoke with Scott Fieber, Chief Strategy Officer at Cook Solutions Group, and Austin Smith, Director of Product Development at Cook Solutions Group, about the delicate balance banks must strike to prevent check fraud without compromising the customer experience.

Despite the rise of digital payments, checks remain a valid form of payment, especially for businesses and individuals. With mobile deposit and ATM deposits, it's more convenient than ever to deposit a check. However, this brings with it a risk for fraud.

During the interview, Mr. Fieber details how banks must strike a delicate balance, putting in place strong procedures and processes -- particularly funds availability -- so that the banks can be protected from fraudulent check transactions, but also ensure that their customers can access their funds in a timely manner. One major way that Cook Solutions has approached this is by building a strong Rules Engine.

Rules Engines: Enable Customers to Tailor Check Fraud Detection to Their Needs

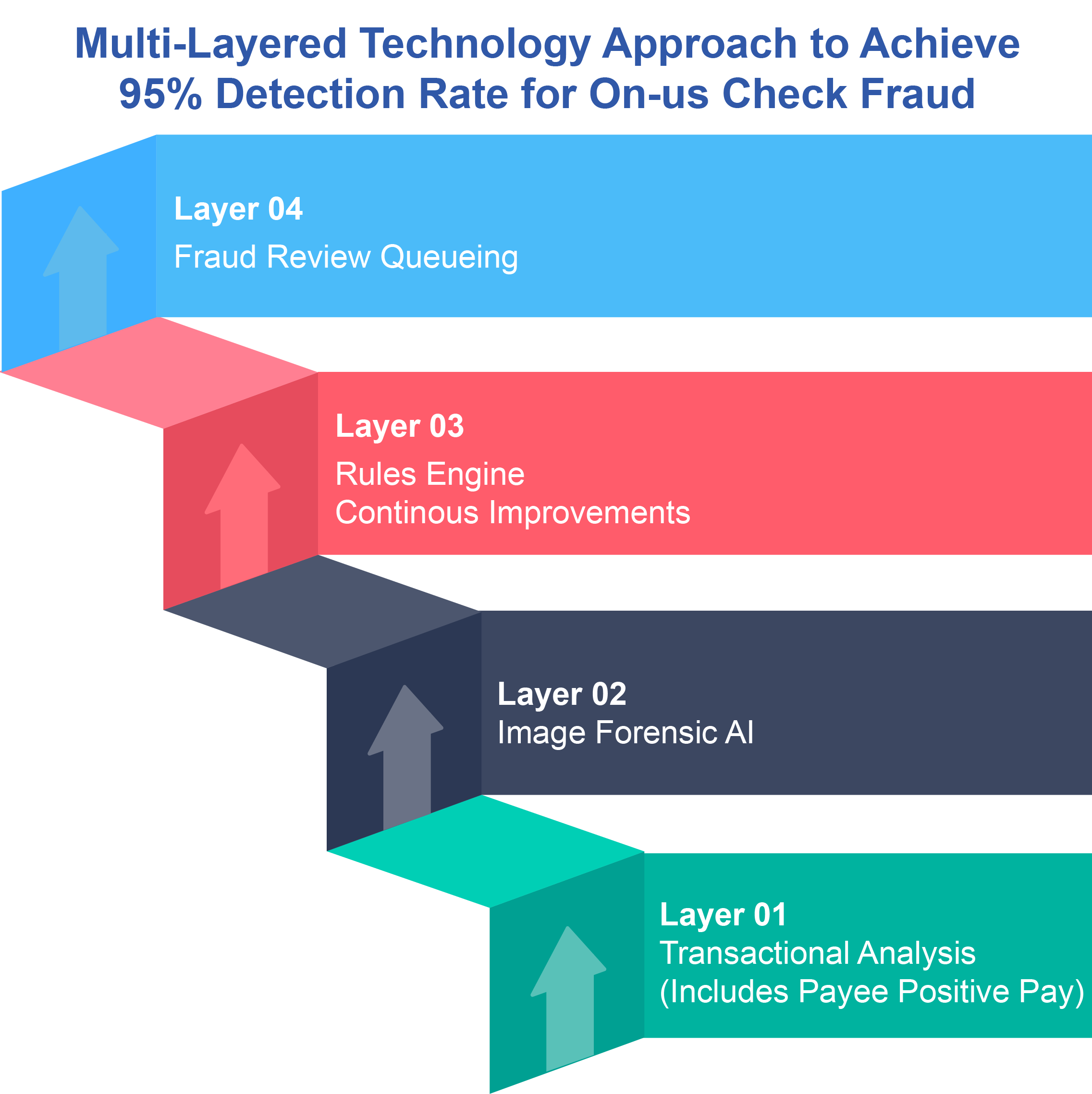

Rules Engines are a key part of the multilayer technology approach banks must take to combat check fraud. By analyzing check deposit patterns and other data points, rules engines can help identify potentially fraudulent activity in real-time.

In many cases, this topic is a balancing act for banks. They need to provide funds for deposited checks in a reasonable time frame, but they also have to be aware of individuals attempting to commit fraud by withdrawing cash before a check bounces.

According to Fieber and Smith, AI can also play a crucial role in fraud prevention, by learning from past patterns to spot anomalies more effectively than rules-based systems alone.

Smith notes that each customer is different and has their own unique process for handling checks -- and their own risk tolerance. This is why they built a flexible rules engine that enables customers to create highly specific, custom rules to their needs.

This is where many banks have seen tremendous success, particular OrboGraph clients who are leveraging our new Rules Engine released in our OrboAnywhere Sherlock 5.3. By analyzing the vast data and check transactions that are created each day, banks are able to see new trends from a macro and micro level. The bank can create rules to target specific use cases, or highly specific rules per account or account type -- which has become increasingly important with new accounts seeing 17X higher fraud rates according to a recent NICE Actimize Report.

It is important for banks to remember that it is important for banks to utilize all the technology available to them like image forensics, but there must be a balance where the customer experiences is not affected or else customers will look elsewhere for their banking needs.