Should Banks Incentivize Front-Line Staff to Catch Check Fraud?

- Performance-based incentives can motivate staff to detect check fraud and protect customers

- Incentives must be paired with strong training on schemes, red flags, and escalation

- Overly aggressive vigilance can hurt customer experience if legitimate checks face delays

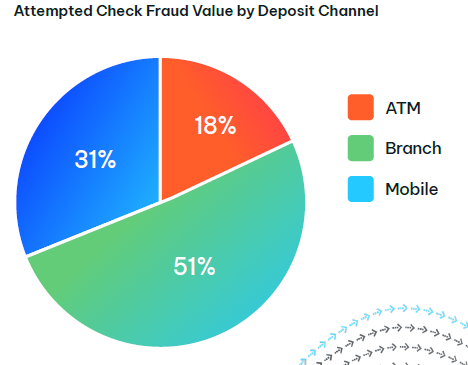

Solving the challenge of check fraud is not just an investment in technologies, it is an investment in your front-line staff. While many would think that check fraud would mostly occur at deposit channels where the fraudster or money mule can avoid being face-to-face with a bank employee, that is not the case according to a report from NICE Actimize. In fact, 51% of attempted check fraud is at the bank branch.

This makes it critical for your front-line staff to be vigilant for fraudulent checks. But, is there more that can be done?

Incentivizing Front-Line Staff

In a recent LinkedIn post, Lloyd McIntyre, Examination Specialist for the FDIC shares a recent conversation he had with a banker. The exchange provides details on how the bank has boosted their check fraud detection strategy by incentivizing their employees through recognition and cash incentives.

Incentives based on performance can indeed be a powerful way to motivate employees, especially when those incentives are tied to meaningful outcomes like preventing fraud and protecting customers. When staff know their extra vigilance matters—and is recognized—they naturally become more attentive to red flags, helping to spare individuals and businesses from the financial and emotional hardship of stolen or altered checks.

Recognition and Incentives NEED Continuous Training

However, it should be noted that employee recognition and incentives MUST be paired with strong employee training. Banks need ongoing, structured education on emerging check fraud schemes, red‑flag indicators, and clear escalation paths so employees are confident in what to question and how to respond. Regular refreshers, real‑world scenarios, and strong communication from leadership reinforce that fraud detection is a core part of everyone’s role, not just a path to a bonus.

Additionally, there are pitfalls that must be avoided at all costs. Customer experience can suffer when a legitimate check is delayed, held, or questioned, because customers expect quick access to their money and may become frustrated or even angry—no matter how clearly you explain that you are trying to protect them. In these moments, front‑line staff need solid training in communication and de‑escalation so they can set expectations up front, explain the “why” behind additional verification, and turn a potentially negative interaction into an opportunity to reinforce trust instead of damaging it.

Front-Line Staff Vigilance and Technology: A Winning Combination

Of course, front-line staff vigilance is just one component for a strong check fraud detection strategy. However, as we noted, nearly half of check fraud attempts are committed in deposit channels that avoid human eyes. That's where technologies are needed to sift through the thousands to millions of check items being deposited.

Solutions like Anywhere Deposit Fraud utilize a combination of technologies that include advanced transactional analyzers and image forensic AI to identity if a check deposit is a counterfeit, forgery, or alteration. When an item is flagged, an internal fraud analyst from the bank is able to review the item to make the final determination if the check deposit is indeed fraudulent. Additionally, through our OrboAnywhere Turbo 6.0 release, the solution leverages explainable AI (XAI), providing clarity as to the reason an item is flagged -- enabling fraud analysts to focus their attention on the areas of concern.

What is your opinion on incentivizing your front-line staff? Are there any possible pitfalls we may have missed? Let us know in the comments below.