Blog Post

Faster payments can actually increase fraud risk Banks must focus on education and building trust Instant payment apps bring new scam risks Banks and financial experts often advocate for moving consumers to faster payment systems-such as real-time transfers or instant payments-to combat check fraud. The reasoning is that current data show faster payments like FedNow…

Read MoreThe value of stolen checks in the “black market” has gone down substantially This is due to a massive “oversupply” of available stolen checks Plummeting prices may also be a result of lower ROI on stolen checks Just a few years ago, stolen checks were considered premium commodities in the criminal underworld. As noted in…

Read MoreCheck fraud attempts remain high Claims of 90% check fraud detection rates across the industry are likely too high Technologies like pattern recognition and machine learning significantly reduce check fraud Check fraud continues to make headlines, but the true impact-and the relative effectiveness of prevention measures-are often misunderstood. A recent LinkedIn article, “Check Fraud: How…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe Milwaukee Business Journal hosted a Table of Experts to explore Check Fraud While the number of checks has gone down, their individual value has gone up A.I. is growing more and more integral to spotting fraud During the most recent Milwaukee Business Journal’s “Table of Experts” discussion, a group of industry experts gathered to…

Read MoreCheck deposit fraud is rising, with criminals targeting business accounts. Bank branches see most check fraud due to less staff training Better training and AI are key to stopping check fraud Check fraud is on the rise across the United States, with metro areas emerging as key hotspots. The main reason is the concentration of…

Read MoreGen Z is becoming recognized as a prime fraud target A quarter of Gen Z fraud victims do not report incidents Financial institutions have stepped up educating their customers WebWire’s report on the latest Barclays Scams Bulletin has revealed a worrisome trend among Gen Z: A striking 35% of young adults would be willing to…

Read MoreFinancial crime data for 2025 is sobering These crimes are interconnected A FRAML approach to fraud strategies is recommended As digital and financial environments continue to evolve, so do the fraud threats that face American consumers. In a recent post from Forbes, Dr. David Maimon paints a sobering portrait of consumer-targeted financial crime in 2025,…

Read MoreCompanies lost 7.7% of their annual revenue to fraud in the past year The United States has a fraud loss rate that is 27% higher than the global average U.S. House Committee on Financial Services recently convened to discuss the issue Fraud is inflicting record-setting damage on businesses worldwide, according to TransUnion’s H2 2025 Global…

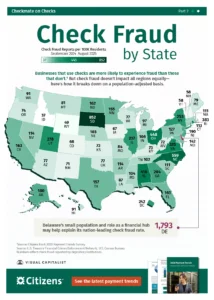

Read MoreMajor populated regions and business attract more check fraud A look at which states rank highest for check fraud per 100K population New tools offer a path to lower fraud incidents in the future Back in May of this year, we wrote a post pointing out which regions of the USA were “hotspots” for mail…

Read More