The Advantages and Benefits of ATM-as-a-Service

- ATMs are becoming more and more popular

- As such, banks need to incorporate them into their strategy

- Physical and digital channels require cutting-edge protective technology

As banking continues its digital transformation, ATMs are becoming increasingly vital to a bank's overall strategy. The article "ATM-as-a-Service: Exploring the Value and Players of This Newest 'X-as-a-Service' Offering" from Datos Insights examines this emerging trend and offers a summary report of their observations and findings.

The report notes that ATMs are shifting from simple cash withdrawal machines to "multifunctional devices designed to reduce, or arguably eliminate, the need for a branch." This elevated importance is adding complexity, as banks must stay on top of the latest ATM technology and compliance requirements.

Staying abreast of the latest ATM technology and compliance requirements is challenging for all institutions, particularly smaller ones that lack the internal departments dedicated to this technology.

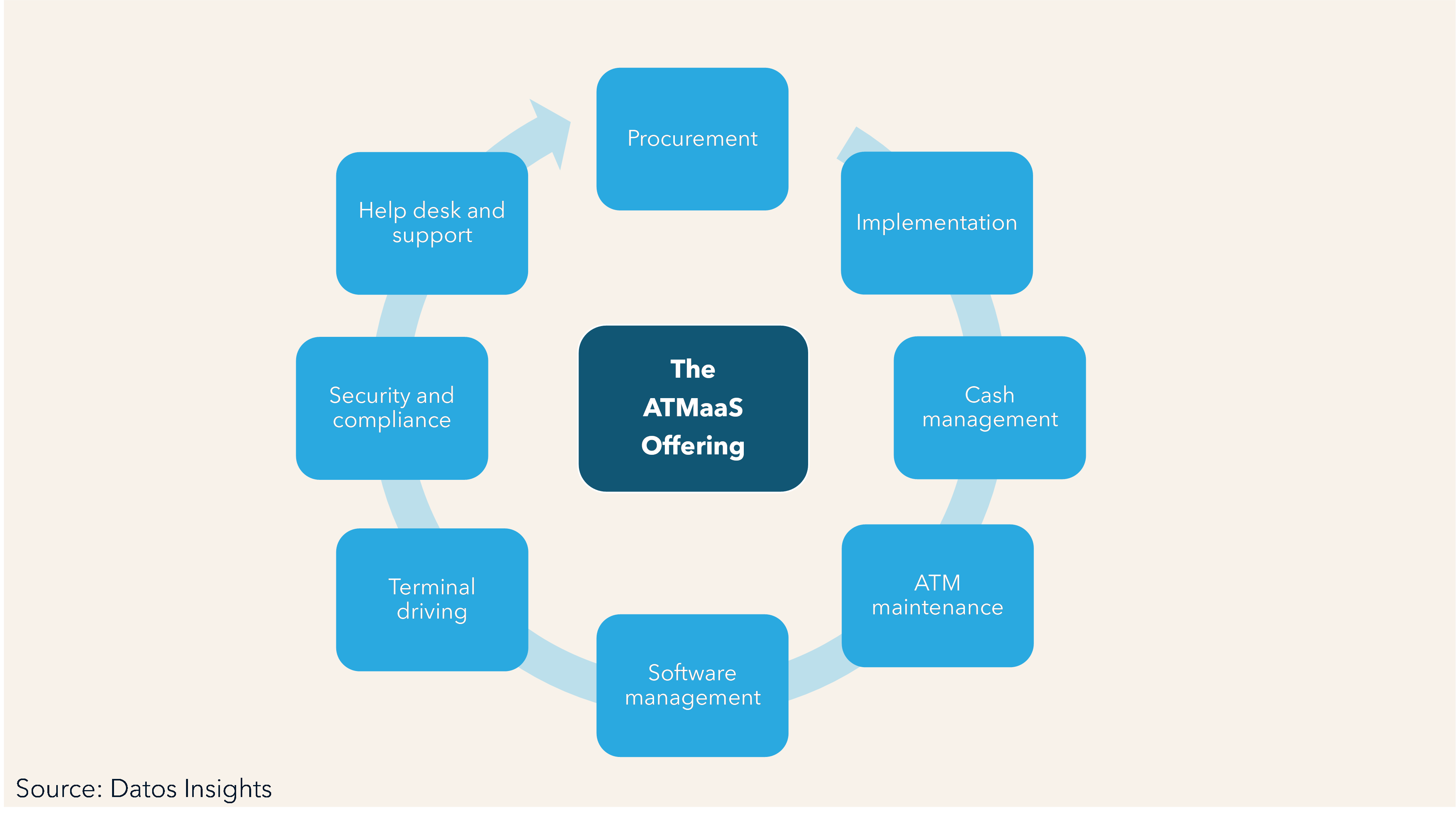

This is where ATM-as-a-Service (ATMs) comes in, allowing banks to outsource the entire ATM lifecycle to third-party providers.

The Pandemic's Effects on ATMs

Prior to the pandemic, ATMs were mainly used to review account balances and cash withdrawals. While ATMs were evolving to enable more banking capabilities, these were being underutilized. However, an article from PYMNTS.com published back in February 26, 2021, provides critical data on how the pandemic affected ATM usage:

ATMs are no exception to the sea change currently affecting the global financial industry. The machines themselves require no contact with other humans and only minimal interaction with touchpads and other interfaces, but transactions are nonetheless slipping in some markets.

Many of these declines can be blamed partly on record-low cash use. Getting cash from ATMs may be considered safe, but handling hard currency in stores can create health concerns as funds are passed from customer to cashier. Customers’ fears of infection have prompted them to use cash up to 5 percent less during the pandemic than they did before it began, which — coupled with overall payments revenues declining by 22 percent — could account for the lion’s share of declining ATM use.

PYMNTS.com goes on to explain the advantages of ATMs-as-a-Service, as the third party would provide the following:

- ATM sourcing

- Distribution and operation

- Including installation

- Maintenance

- Security

- Compliance

- Cash management

This can lead to many benefits -- including improved cost efficiency, enhanced security, and better customer experience -- according to Datos Insights.

ATMs and Check Deposits

ATMs are a major deposit channel for checks. As many individuals do not have the time to walk into a branch to deposit a check -- particularly as hours are typically limited for branches -- an account holder can simply search for an ATM on a bank's website and drive to the location. And, while mRDC via banking apps enable the individual to deposit the check, the ATMs enable the individual to withdraw physical cash as well -- a benefit over mRDC.

The key for financial institutions is customer experience. It's difficult to maintain ATMs; outsourcing this to a third-party can alleviate this burden. However, customer experience is paramount. As noted by OrboGraph's Marketing Manager and Check Fraud Detection Specialist James Bi in a recent podcast, no deposit channel should be different in that respect -- from the customer experience to the policies. Banks need to balance all aspects of the deposit channel, ensuring a consistency throughout -- whether they are depositing a check via mRDC, ATM, or teller/branch.

This is a major factor in OrboGraph's development of OrboAnywhere with OrbNetAI, which is deployable in any deposit channel and enables banks to automate the processing of checks through any deposit channel, while assuring that customer deposits will be error free.