ThreatAdvice Interviews Frank Abagnale for His Thoughts on Modern Fraud

- Mr. Abagnale was an infamous fraudster before "going straight"

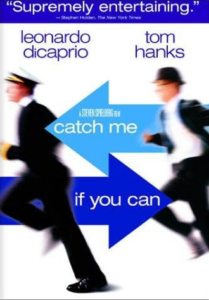

- The film Catch Me If You Can is based on his life

- As a fraud-prevention consultant, Mr. Abagnale warns that check fraud is now easier than ever

Who better to give fraud-avoidance advise than a famous (infamous) ex-fraudster?

Steve Hines of ThreatAdvice sat down with Frank Abagnale, a former con-artist turned 40+ year FBI consultant, as well as spokesperson for ThreatAdvice cybersecurity solutions. Mr. Abagnale's misadventures were the basis for the film Catch Me If You Can.

Mr. Abagnale came from a broken family -- his parents divorced when he was a child -- leaving him to largely fend for himself at an early age. As he grew up, he learned to bend the rules.

I went to New York City, which was just a 30-minute train ride, but I soon realized I had to find a way to support myself. I did have a little money in a checking account that my dad had set up for me from working so I started writing checks and I found it very easy to go in and ask somebody to cash a check for me and they did -- you know, there was fifteen, twenty dollars -- but it then started to get more difficult they'd start to ask me, "you don't have a bank account here we can't cash your check for you."

So, one day was walking down the street on Fifth Avenue and I saw an airline crew come out of a hotel and I thought to myself, "boy if I could get this uniform and I could become a pilot then I walk in the bank as a pilot that would give me such credibility." And, so I've finagled the uniform; I basically changed my date of birth on my driver's license -- at 16 we had a driver's license back then they didn't have photos on it, just an IBM card -- so I was actually born in 1948. I dropped the four, converted it to a three that made me ten years older, and I started going into the bank as the pilot and said, "Hey I'm going to lay over here; I ran a little short on cash....," and cash a check.

Never had a problem and I quickly realized the power of that uniform...

... And It's Only Getting Easier

While you might think simply donning a fake pilot's uniform made for easy pickings, Mr. Abagnale is quick to point out that check fraud is much easier today than it was in the days when he was running scams:

Today it is so much simpler to do because of the internet and all that -- you can change into many hundreds of different identities, so it was a lot more work involved in doing it back then. So, it always amazes me that you would think what I did fifty years ago would be more difficult today when actually it's four thousand times easier today than when I did it.

Checks, of course, are a prime target.

Let's take a perfect example. When I started actually really printing checks I needed a Heidelberg printing press -- it was a million dollar press back then; it was 60 feet long, it was 18 feet high, it required three operators -- so I spent eight months learning how to operate this press there were color separations there were negatives there were plates there were type setting there were chemicals to make plates.

Today, basically, you sit down at a laptop, you open it up, and you ask for a diagram of a check and a very sophisticated blank check comes up on your screen.

In effect, you can check all the boxes for check fraud prep while sitting in a Starbucks coffee shop for an hour.

The rise of mobile deposits and ATMs has removed the obstacle of visual inspection from the teller. With the establishment of Check 21, many physical checks are never handled by an employee of the financial institutions -- which, if you've watched Catch Me If You Can, is one of the best defenses of check fraud.

This has lead to the industry deploying image forensic AI technologies that analyzes the images of checks for indications of counterfeits, forgeries, and alterations. This enables FIs to ensure visible inspection of the check, reducing the manual review of all checks to just a handful of suspicious images, and reduce fraud losses.

Check back soon for our synopsis of Part 2 of the series!