Tips for Consumers to Spot a Fake Check

When examining a check to determine whether it's real or not, it's also worth looking for other general irregularities and mistakes. Look for spelling errors or typos in the printed information on the check, such as a misspelled business name or address. You can also check to make sure that the address of the check's sender matches up with their actual address. If not, the check may likely be fake.

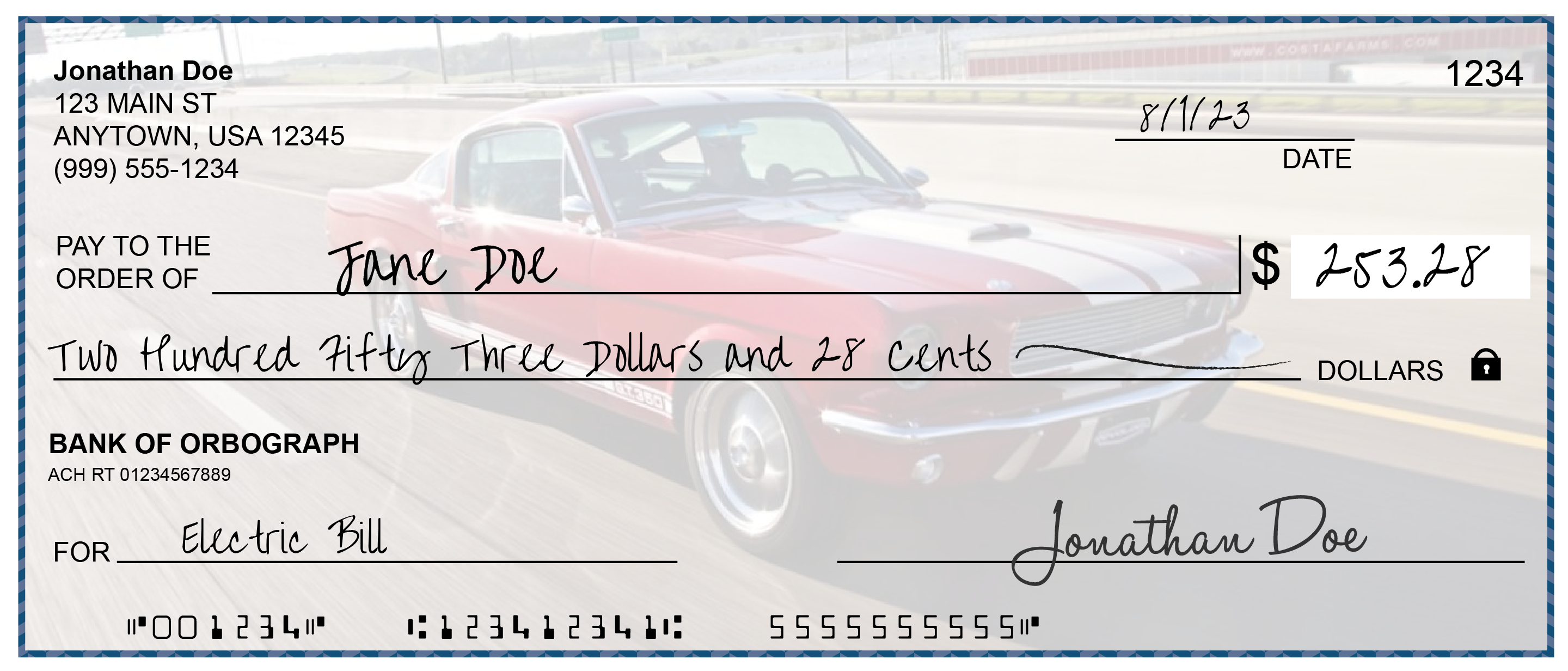

In addition, check that the numerical dollar amount and the written amount on the check match up. Any discrepancy is a good indication that the check is not legitimate.

- A review of simple -- but vital -- check review practices

- Check fraud is becoming more and more widespread, necessitating vigilance

- While fraud detection is getting more sophisticated, fraud techniques are simpler than ever

It's never a bad idea to encourage people to review simple safety guidelines, particularly in the realm of finance and protection against theft. PNC Insights recently posted the telltale signs of a fraudulent check, along with useful essential strategies on how to tell if a check is fake and safeguard your bank account today.

PNC reports that check fraud is on the rise, with a 23% increase in filed complaints between 2020-2021 and nearly double the number in 2022. Therefore, being aware of the following simple ways to spot a fake check:

Staying Alert: Consumer and Financial Institutions

Of course, the best advice is simple: if you suspect a check is fake, do not cash it. Consumers should contact the bank directly to verify the check's legitimacy, and report it to the proper authorities if it is fraudulent. Depositing a fake check, of course, can lead to the bank withdrawing funds, closing the account, and negatively impacting the depositor's banking history. In extreme cases, you could even face jail time.

For financial institutions, raising awareness and providing their consumers with helpful tools and information like this is important to curb the rise in check fraud. Furthermore, deploying the latest innovations like AI and machine learning to detection anomalous behaviors and transaction and interrogating the images of checks will further decrease losses to both the financial institution and their consumers.

It will take a collaborative effort from all parties to stop fraudsters, including consumers, law enforcement, and banks. By working together, we will undoubtedly see a decrease in check fraud losses.