Up Close and Personal: YouTuber Visits Scammer’s Operation

- YouTuber Tommy G goes "deep dive" with actual scammers

- The video discusses the motivations behind scamming, particularly among Gen Z

- It's suggested that disillusionment with the financial system, which is see as corrupt and unjust, fuels their involvement in fraud.

A recent YouTube video by Tommy G. offers a pretty comprehensive, 30-minute dive into the pervasive world of scammers. Various types of fraud -- including check scams, credit card fraud, and skimming devices used at gas stations -- are explored with actual scammers.

Early on an eerily hooded scammer meets with the filmmaker and explains -- keeping the hood on throughout -- how he got into the scam game, including a look at his first racket, which involved Telegram and checks.

At one point, Tommy G offers the following theory:

"The generation that saw their parents lose their house in the '08 mortgage crisis as the bank executives responsible got rewarded by multi-million-dollar bonuses and the banks that fundamentally scammed the country got bailed out by the tax money of the very people they scammed; so, essentially, these kids witnessed a financial system that openly didn't give a [beep] about them or their parents. So, heck -- why not pull a scam of their own?"

It doesn't help that the scam lifestyle is being glamorized:

"From a cultural standpoint, we've seen the rise of scam rappers ... and these are guys who look effortlessly cool, ridiculously rich, and they seem to be easily getting away with scams on major banks and institutions. So, yes, it's easy to point the fingers at the scammers you see here and, yes, they have a moral responsibility of what they are doing -- but are they not just an underworld byproduct of a system that white collar scammers created? I don't know -- that's just a theory I'm working with..."

Techniques and Schemes

Scammers leverage social engineering and technology, such as artificial intelligence and the dark web, to steal personal information, money, and even credit card details, often targeting vulnerable individuals and institutions.

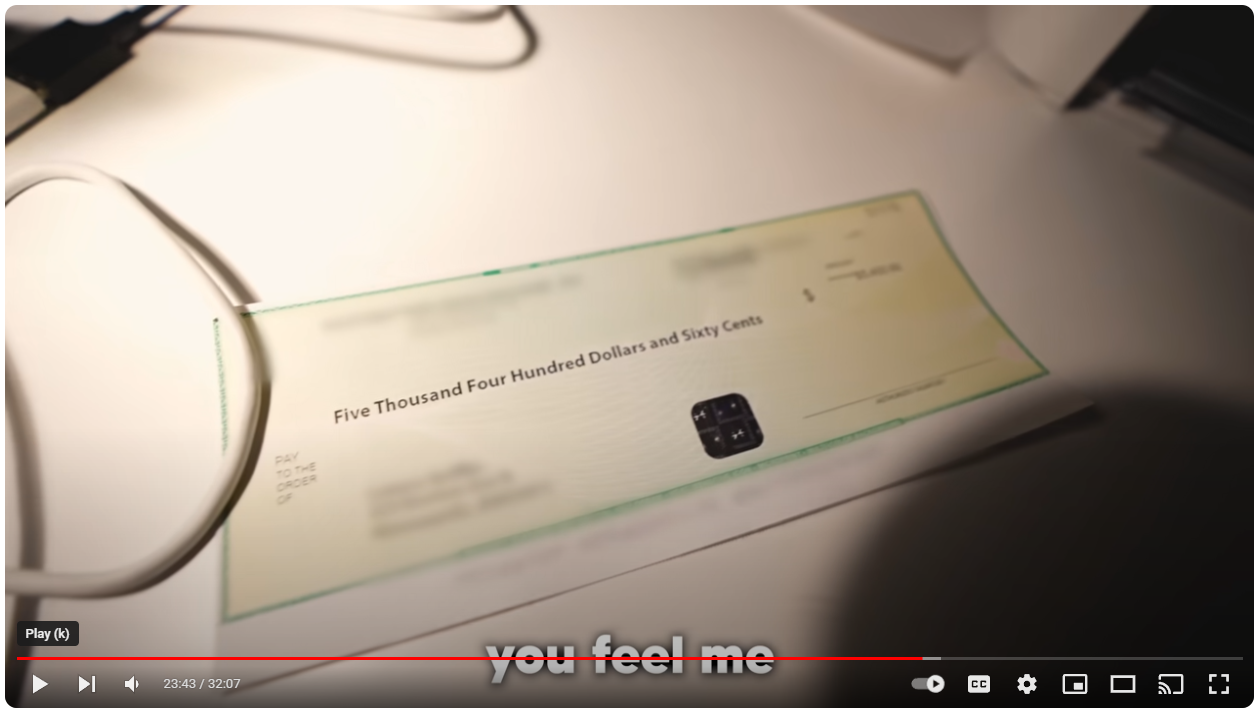

At one point they discuss counterfeiting (not forging, as noted by Tommy G.) the check, which involves specialty paper they can easily get and requires no more than a regular, $500 printer. Not exactly a formidable challenge. At the 23:45 time mark, they even show an example of a counterfeited check.

And, of course, "mules" are commonly deployed:

What normally happens isn't that the person who's doing the fraud is the one cashing it.... usually they get some unsuspecting person -- "oh I can make you a lot of money" -- and so they write the check to that person, so there's a middle guy in between and it's usually the person that's unsuspecting, not thinking that it's a fraudulent check and all of a sudden they go to the bank and they try to get the cash -- and sometimes it works sometimes it doesn't.

As discussed here frequently, violent attacks aimed at mail carriers are mentioned. Postal workers carry checks, so they are targets. Still, punishment for check fraud varies, but FinCrime is "less serious" than other crimes like drug trafficking and outright robbery.

Fighting Back: The Importance of Technology

For the bank of first deposit (BoFD): if this is brought to teller, they should note the large bold font of the legal amount fields. This is uncommon for business checks. Additionally, with new deposit fraud analyzers leveraging consortium data, the items can be flagged for hold when compared to previous transactional data.

While scammers show quite a lot of confidence -- some would say arrogance -- the key to stopping scammers and fraudsters is technology. When we examine the check displayed by the fraudster, even through the blurred areas we can see some issues.

For the paying bank, there are several key image forensic AI analyzers that would flag this item. First, Writer Verification (WV-AI) would detect the difference between the fonts of the legal field compared to previous cleared checks in the account. Furthermore, we do not see a signature, and if the scammer attempts to forge it, the Automated Signature Verification (ASV-AI) will be able to detect that there is a difference. Also, we cannot forget that since it is business check, Payee Positive Pay would be able to flag these items as the payee and check serial number would not match the issuer file.

While this is just one example, these tactics are not uncommon. However, all banks need to deploy a multi-layered technological approach to fighting check fraud, combining tech like transactional analysis/behavioral analysis, image forensic AI, consortium data, dark web monitoring, and positive pay to ensure that fraudsters are unsuccessful.