Why Prediction of Precipitation is a Lot Like Check Fraud Detection

Many parts of the U.S. have been on the blunt end of some "interesting" weather of late. Whether it's flooding rains, high winds, or excessive heat, it's been important to be "weather aware."

Effective weather prediction -- the kind that helps you postpone that camping trip when storms are ahead, or make sure the snowblower is operable when a blizzard is forecast -- is the result of analyzing patterns, utilizing historical data, and applying advanced technology to anticipate future occurrences. When these tools are used effectively, fewer short- and long-term "weather surprises" confront us.

Which Way the Wind Blows

As it turns out, check fraud detection has a lot in common with weather prediction. In fact, both meteorologists and check fraud prevention systems rely on four primary tools:

- Data Collection:

- Check Fraud: Transaction analytics collect data from financial transactions and image forensics gather visual data from checks to identify anomalies and patterns indicative of fraud.

- Weather Prediction: Meteorologists collect data from various sources, including satellites, weather stations, and sensors, to monitor atmospheric conditions.

- Pattern Recognition:

- Check Fraud: Algorithms analyze transaction and image data to detect unusual patterns that may signify fraudulent activity.

- Weather Prediction: Predictive models use historical weather data to recognize patterns that help forecast future weather conditions.

- Technology and Algorithms:

- Check Fraud: Advanced technologies, such as machine learning and artificial intelligence, are used to improve the accuracy of fraud detection by analyzing large datasets and identifying subtle indicators of fraud.

- Weather Prediction: Sophisticated models and algorithms, often leveraging AI, process vast amounts of weather data to predict future weather with greater precision.

- Predictive Analytics:

- Check Fraud: Predictive analytics anticipate potential fraud before it occurs, allowing for preemptive measures.

- Weather Prediction: Predictive analytics forecast weather patterns, enabling people and organizations to prepare for upcoming weather events.

From Predictions to Reality

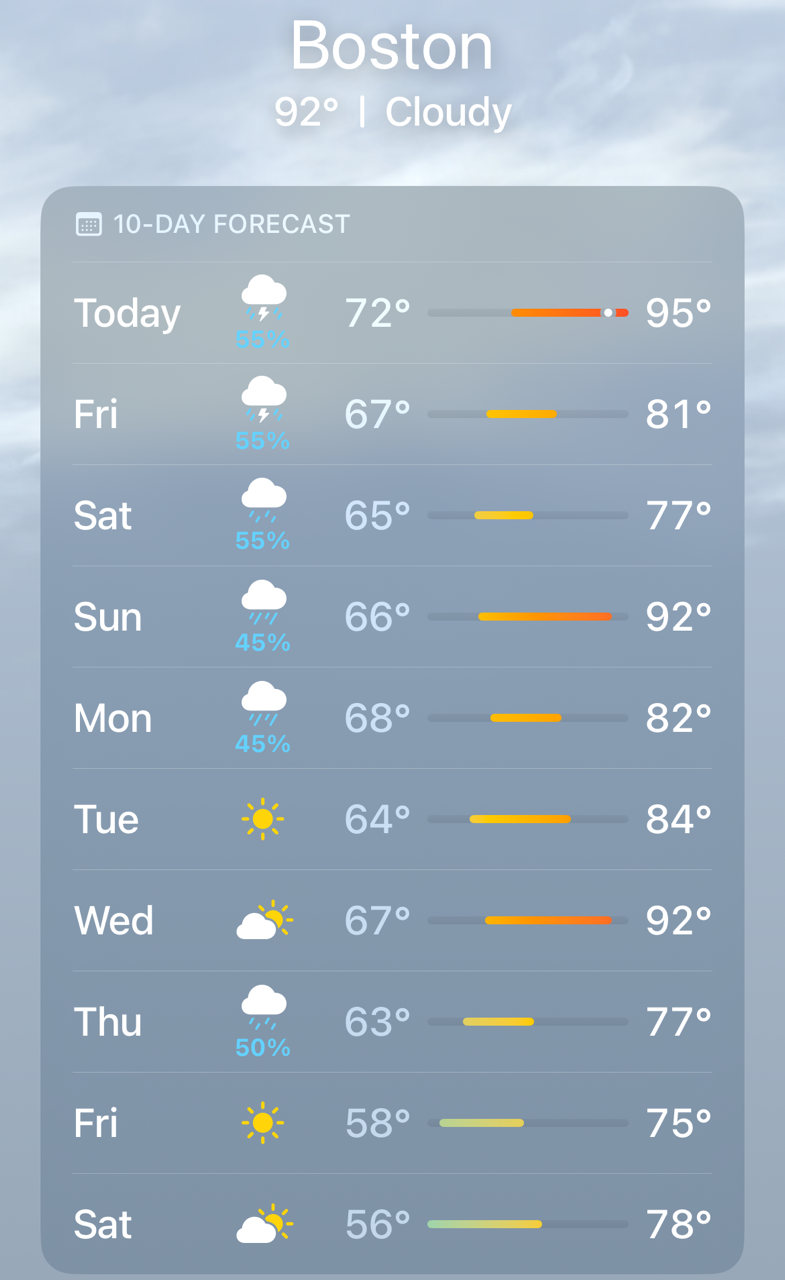

As we noted above, specific data points enable a prediction for both the fraud reviewer and meteorologist. In the case of meteorology, we can see several of these predictions displayed for the end-consumer, such as the chance of precipitation. As you can see from the picture from Boston, MA -- OrboGraph's home office location -- precipitation changes vary by percentage in the next few days..

Detecting check fraud is similar, as AI and ML technologies perform numerous analyzations to provide reviewers an overall risk score for a check. This is done by analyzing both the image of the incoming item and the transactional metadata and providing the overall risk score.

However, for fraud reviewers, the individual analysis typically has more weight in the overall risk score. For instance, if a check stock has minor differences in the locations of certain fields, or if the typical font used for the check is different (i.e. Arial vs Times Roman), this will not only produce a high risk score for that particular analysis (in many cases, systems will use a 0-100 scale, with a lower score to be higher fraud probability), but also boost the overall risk score significantly so a fraud professional can review the transaction and item.

There is an old saying that goes something like "meteorology is the only professional where people get paid to be wrong." Unlike meteorology or predicting weather, check fraud detection systems are highly accurate -- achieving an over 95% detection rate.

As Summer kicks off and we see more variable weather and precipitation, fraud reviewers can rest easy in their AC-cooled offices knowing that their check fraud detection systems will effectively nab fraudulent items.

Source: The Weather Channel App