ABA Banking Journal: Complementing Technologies to Combat Check Fraud in the Digital Age

- Digital payments are becoming more and more popular

- Even so, checks remain a mainstay for many consumers

- Fraudsters never stop evolving, and neither should anti-fraud technology.

As cited by an article at the ABA Banking Journal, the 2021 Association for Financial Professionals Payments Fraud and Control Survey indicates that checks remain the payment method most impacted by fraud activity at 66% -- even as banking moves toward digital.

More than three-quarters of organizations were targeted by Business Email Compromise (BEC) attacks, according to the “2021 AFP Payments Fraud and Control Survey Report.” BEC typically involves scammers sending emails that appear to be from a trusted source, such as the CEO or other managers, or vendors. The emails trick employees into revealing sensitive information or changing payment information.

“While treasury and finance leaders are very aware of how widespread this type of fraud has become, they are not able to obstruct it sufficiently. Fraudsters are successfully infiltrating payment activity at organizations by using email to do so. Their success in deceiving organizations encourages them to continue to use BEC,” the report concluded.

Fraudsters Leveraging Digital Channels and Social Media

During the pandemic mobile banking went up by 200 percent in new registration, leaving banks vulnerable to risk since fraudsters no longer had to show their faces at physical branches or ATMs.

This innovation offers the "bad guys" just as much convenience as it gives customers, and scammers have been taking advantage of the relative anonymity offered by these technologies in order to execute bolder and bigger transactions. This includes leveraging and embrace social media:

Another recent check fraud scheme financial institutions have been combatting is fraudsters leveraging unwitting accomplices via Instagram. These individuals are contacting Instagram users and paying them to use their accounts to commit the scam. Then, the fraudster utilizes these accounts to post photos of bank account statements with large balances and claims how easy it was to make money through a “currency exchange.” If the target agrees, the fraudster sends the target a check to deposit in their bank account. Once the check is deposited, the fraudster tells the target to withdraw money from the deposit account and send it via an online money transfer system or through cash. After a couple of days, the bank notifies the victim that the check was fraudulent, and the victim could be responsible for the check’s amount.

Technology to Combat Check Fraud

The article references three specific technologies that are key weapons against check fraud -- specifically in this digital age:

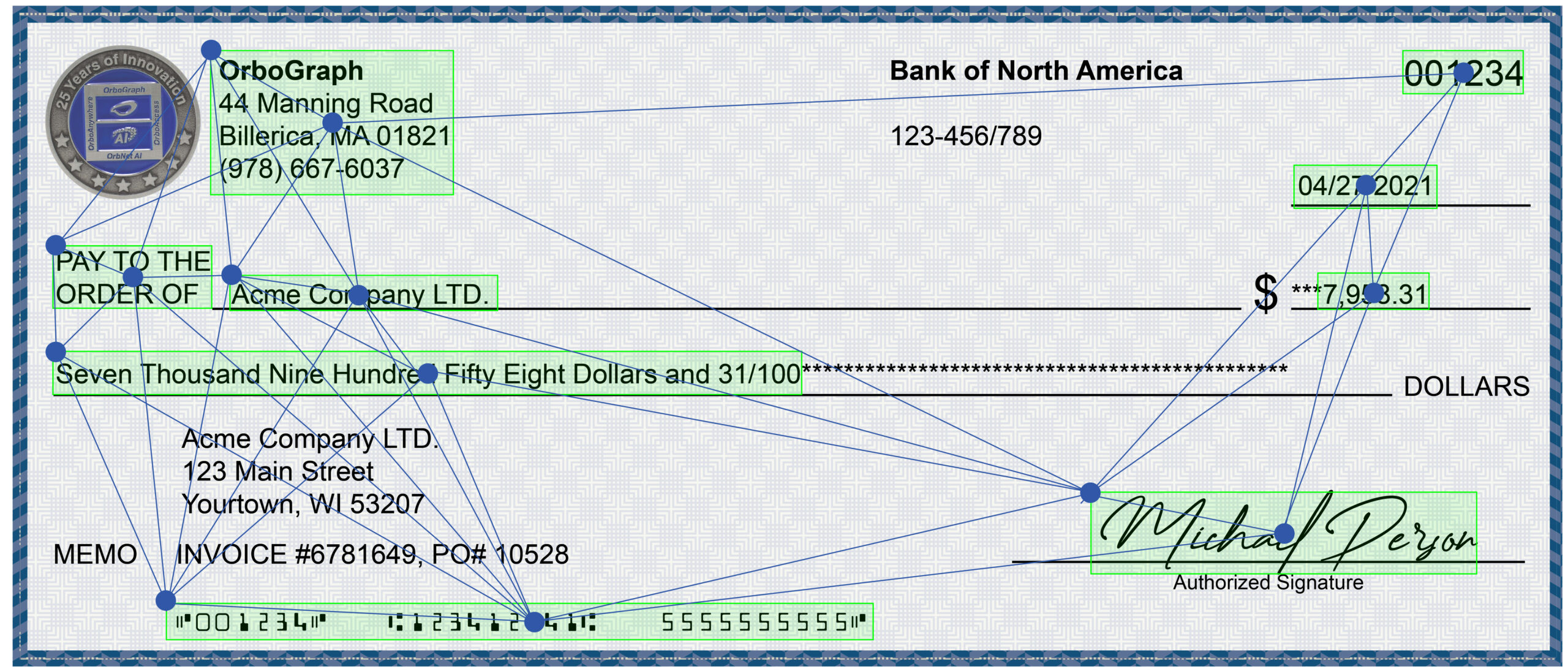

Transaction Analysis

Transaction analysis is the process of examining bank transactions to look for unusual and suspicious activity or other issues. This key component scrutinizes debits and credits contained in deposits and withdrawals to identify suspicious items such as out-of-range check numbers and check amounts and duplicate check numbers. It also applies tests at the account and entity level, measuring such things as account velocity, account volume, and deposits or withdrawals of unusual amounts.

Check Stock Validation

Check stock validation consists of analyzing presented check images against historical, referenced check images in order to authenticate the check stock. The solution helps institutions more effectively identify counterfeit in-clearing and over-the-counter checks with greater speed, accuracy and reliability than visual inspections. Check stock verification leverages technology to spot aberrations that cannot be detected by the human eye. It also reduces the number of manual verifications and decreases false positives through digital check image analysis. This process improves the check fraud detection process and alleviates the burden on your in-house anti-fraud team.

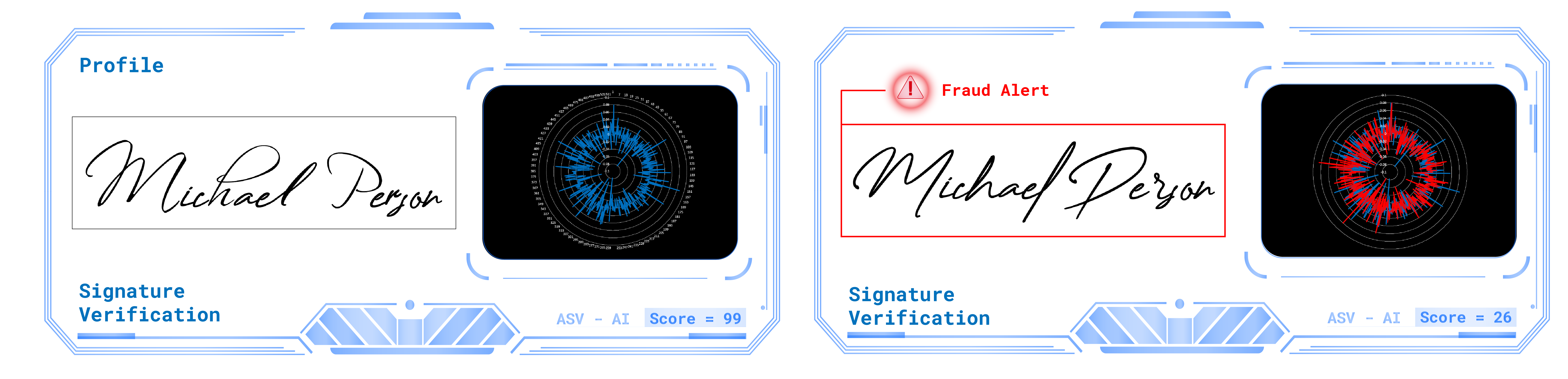

Signature Verification

This solution uses machine learning algorithms and sophisticated decision trees to provide a detailed analysis of check signatures. This results in efficient evaluation of suspect in-clearing and over-the-counter checks and increased confidence levels for acceptance and return decisions.

Signature verification compares digitized signatures to referenced images, manages multiple signatories on the same account and monitors items requiring dual signatures to validate check signatures on personal and business accounts. Focusing on dynamic aspects of the signing action, including signature fragments, handwriting trajectories, and geometric analytics helps produce confidence scoring based on these aspects when comparing newly presented check signatures with previously saved images to determine matching and nonmatching elements.

The ABA Banking Journal article aligns with the approach that many in the industry have begun to follow -- a solution combining multiple technologies that complement each other. Transaction analysis technologies analyze the transaction being processed by an account, while image-forensic AI is utilized for check stock validation and signature verification.

These technologies work in unison to provide banks and their customers the best protection against check fraud.