Apple Vision Pro: The Vision of the Fraud Analyst of the Future?

- AI is entering many areas of daily life

- Apple is bringing immersive AI to the mainstream via their new Vision Pro

- Will fraud analysts of the near-future start wearing super-goggles?

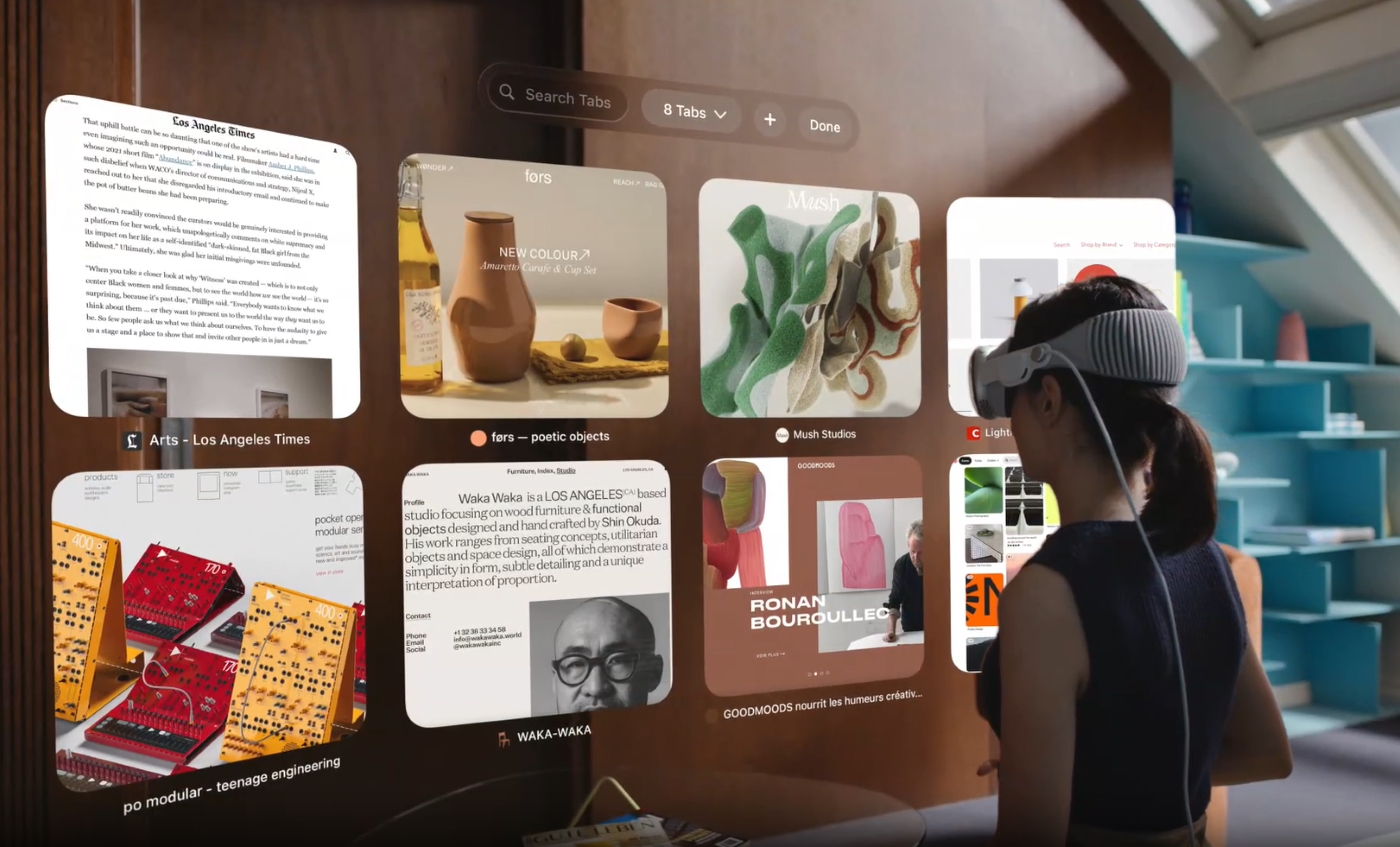

Apple recently introduced the Apple Vision Pro, a "mixed reality" headset -- currently priced at $3,500 -- that is designed to create an immersive, tech-interactive environment. Many are praising the latest innovation from Apple, as its UX provides a remarkable experience, crisp images, and flexibility/adaptability to the environment.

The company’s 30-minute demonstrations of the Vision Pro for select members of the media — and, more recently, developers and financial analysts — showcased the most polished parts of the operating system. But in-air typing and many user interface elements aren’t ready yet. And Apple still needs to finish adapting its core iPad apps for the new visionOS.

Source: TechRepublic

While the Apple Vision Pro is far from perfect, it still brings a realm of possibilities for both personal and business usages.

Immersive Environment: The Next Fraud Tool?

Ostensibly, the goal is to immerse the user into the data environment, where he or she can interact with data on an almost physical level. Equations to the left of me; wave-forms to the right...

Frank on Fraud is impressed by AI and Apple's Vision Pro, positing the possibility of this technology revolutionizing how fraud analysts operate and interact with data. Fear not -- he reassures us that the human element is still required for effective fraud fighting (and all that implies):

AI is great. But it is the fraud analyst – the human in the loop – who will make our future safe.

When Apple launched Vision Pro, I saw the future of being a fraud analyst. And it looks very much like a science fiction movie.

Minority Report to be exact.

And investigating a complex fraud will be completed with a dizzying array of fraud tech at our fingertips, made available to us simply through gestures.

I present to you, Fraud Analyst 2024. A master of spatial computing and rapid investigation.

Frank on Fraud describes a new world where, instead of staring at monitors and punching keyboard keys to track fraud culprits, simple verbal commands or hand motions will lead analysts to culprits. The technology is vital, but it needs human interaction to be of optimal effectiveness.

I tend to view AI as only a technology that will augment the human and not replace it.

As cool as ChatGPT is, the art of getting a good result with it is prompt engineering and being able to massage the result into something coherent and true.

The same is true with AI and fraud analysts.

AI will merely augment the fraud analyst, not replace them.

And the best fraud analyst will embrace AI, not reject it.

And the companies that achieve the best result will reject neither and use both.

Imagine you are a fraud analyst. You put on your headset and start your work day, swiping through the interface to find the fraud. For check fraud analysts, you swipe through the account information, review transaction data, and easily sift through previously cleared items to compare to new check image that has been flagged by image forensic AI as a counterfeit, forgery, or alteration. With a few motions of your hand, you zoom into the signature of the new check item and and compare it to the signatures on file and notice that there is a distinct difference, mark the item as fraud, and move onto the next.

Sounds pretty cool!

Different AI for Different Purposes

AI is a tool, not an overall solution. Leveraging AI for specific purposes is the key to being successful, particularly when it comes to fraud. While Apple Vision Pro creates an immersive working environment for a fraud analyst, it does not perform the analysis of data needed by the fraud analyst, nor does it have the ability to make decisions or recommendations for the fraud analyst.

Take check fraud, for instance. As we've noted in previous posts, to create an effective check fraud detection strategy, banks must leverage complementary technologies that monitor transactions for anomalous behaviors, data analytics to identify trends, and image forensic AI to analyze the images of checks. Typically, these results are then funneled into a fraud review platform that a fraud analysts can review.

Now, imagine if that platform is an interactive platform on the Apple Vision Pro! Fraud analysts are now moving from a static monitor screen to an immersive environment where they are able to interact with all the data and results. As far-fetched as it may seem right now, the technology is improving every day and could soon be a reality!