Check Clearing Fees Marginally Rise in 2025 FED Payment Services

- The Federal Reserve's has announced '25 pricing for payment service

- Check pricing fees will rise marginally at approximately 10% across different services

- Checks will continue to play a major role in both volume and revenue

In the ever-changing world of banking and finance, the Federal Reserve's recent announcement of 2025 pricing for payment services highlights the importance of staying ahead of the curve. These actions were taken in accordance with the Monetary Control Act of 1980, which requires that, over the long run, fees for Federal Reserve priced services be established based on all direct and indirect costs, including the PSAF.

By law, the Fed must establish fees to recover the costs, including imputed costs, of providing payment services over the long run, according to a statement. The Fed expects to recover 104.1% of actual and imputed expenses in 2025, including the return on equity that would have been earned if a private-sector firm provided the services. The Fed banks estimate that the price changes for 2025 will result in a 2.8% average price increase for established, mature services.

This update will take effect on January 1, 2025.

Comparison Between Checks and Other Payment Channels

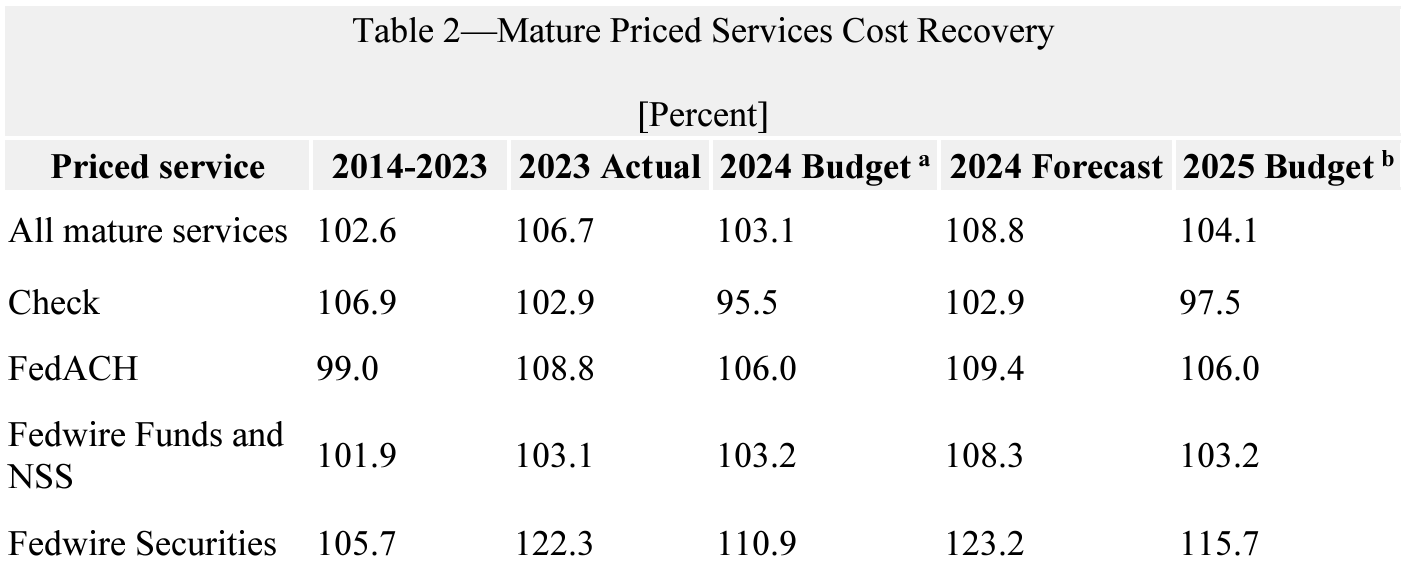

In the official document, the FED provides an overview of cost recovery budgets, forecasts, and performance for the 10 year period from 2014 to 2023, 2023 actual, 2024 budget, 2024 forecast, and 2025 budget by mature priced service.

2025 Projected Performance — The Reserve Banks project a mature priced services cost recovery rate of 104.1 percent in 2025, with a net gain of $31.9 million and targeted ROE of $10.8 million. The Reserve Banks project that each of the individual mature service lines will achieve full cost recovery in 2025 except for Check Services. Check Services are expected to under recover primarily because of anticipated volume declines. The Reserve Banks’ primary risks to current projections are unanticipated volume and revenue reductions and the potential for cost overruns from new and ongoing improvement initiatives.

When reviewing the updated fees, the FED notes that checks pricing fees will rise marginally at approximately 10% across the different services. In comparison, the majority of fees for FedACH, FedWire Funds and NSS, and Fedwire Securities are rising anywhere from 6% to 11%.

Interestingly, the FED estimates total revenues for 2025 at $531.7M. We can see tha -- even though checks are seeing a slow decline in volume -- the FED is forecasting revenues of $107.1M, or about 20.1% of total revenue. This is a significant portion of the total revenue for 2025.

After examining the new pricing fee structure from the FED, we can see that checks will continue to play a major role in both volume and revenue -- effectively putting to rest the sentiment that "checks are dead."

As we look to the future of checks, financial institutions will need to continue investments in the payment channel to create operational efficiencies, while also increasing check fraud capabilities. While the FED continues to push adoption of new payment rails like its FedNOW service, consumers and businesses continue their affinity for the nostalgic payment channel.