Warning Signs Not Enough to Detect Fraudulent Checks?

- There are 10 recommended warning signs that signal check fraud

- None of the warning signs require special equipment to detect

- Bank tellers, however, cannot be expected to get through the checklist on a busy day

Spotting a fraudulent check is not an easy task. Fraudsters have finely honed their craft, and even the most seasoned fraud investigator can miss a fraudulent check. Heck, even those who have taken our Check Fraud Detection Challenge have reached out with comments confessing incorrect assessments.

Nevertheless, it's still important for financial institutions to be aware of check fraud warning signs. A recent article on LinkedIn posted by Independent Correspondent Bankers' Bank provides their list of 10 Warning Signs of Check Fraud Every Community Banker Should Know:

- Inconsistent Check Numbers

- Altered Payee Names or Amounts

- Unusual Customer Behavior

- Poor-Quality Check Stock

- Mismatched Bank Information

- Excessively High Dollar Amounts

- Duplicate Transactions

- Unfamiliar Endorsements

- Suspicious Check Issuer

- Pressure to Expedite the Process

But, how can tellers or fraud analysts consistently watch for all these warning signs? Even FIs that process a small number of checks per day cannot dedicate a significant workforce to review all checks manually.

Manual Inspection vs Technology

While the list is thorough and provides a strong foundation for check fraud detection, it's a tall ask for the manual workforce to consistently watch for all the different warning signs.

When examining the list, it appears to be tailored to tellers accepting check deposits. Unfortunately, there are several issues with the list, particularly when it comes to visual inspection. While tellers may very well be able to detect issues like poor-quality stock and alterations from methods like check washing, or detect behavioral cues like nervousness or pressure to expedite, it's impossible for them to know the endorsement of a deposited check, spot an unfamiliar check issuer, duplicate transactions, and other factors.

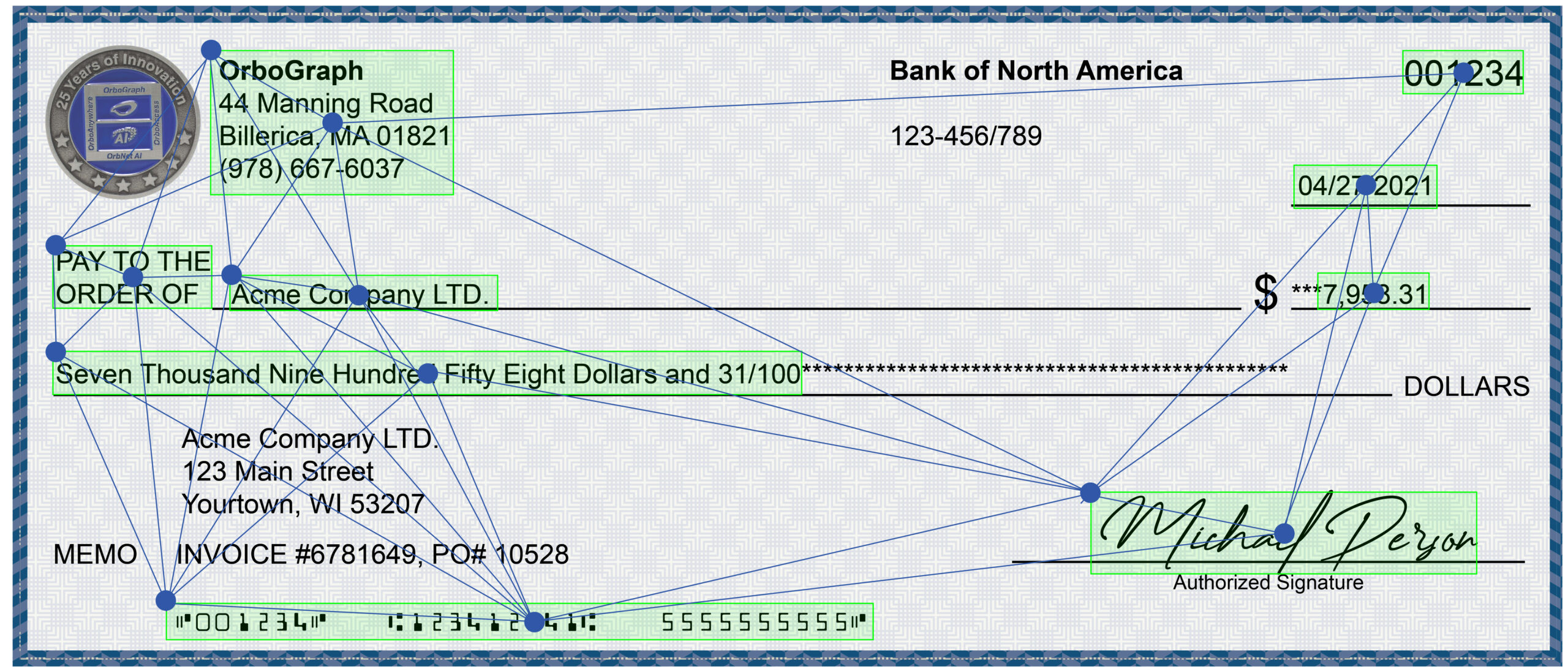

This is where technology is not only able to fill the gap, but free the teller from many of these tasks. Behavioral/transactional analytics use previous transactions to detect whether the deposit is suspicious; image forensic AI analyzes the image of the check to compare to previous deposits -- check stock, handwriting styles, and endorsements, and; consortium data assesses the risk of the deposit, detecting duplicate transactions and additional data from the paying bank account.

Simply put, FIs of all sizes who process checks need not put the burden of fraudulent check detection on their front-end staff. Deploying the right technologies will detect fraudulent checks before losses occur.