Mainstream Media Continues Its Attack on Paper Checks

- Are checks really "dying"?

- Some large retailers have stopped taking personal checks

- Checks are still a useful tool, the article admits

A recent Fortune article got right to the point in its title: Paper checks are dying. Here’s what you should use instead.

Indeed, the article paints a bleak picture for the future of paper checks. According to the piece, personal checks are rapidly becoming obsolete as digital payment methods like debit cards, credit cards, and money transfer apps take over.

This downward trend is likely to continue, with major retailers such as Target discontinuing acceptance of personal checks as of 2024. Other big names like Aldi, Whole Foods, Old Navy, and Lululemon have followed suit, moving towards what industry experts are calling a “check zero” policy.

While it's true that check usage has declined in recent years, we’re not convinced the world is headed for a "check zero" future anytime soon. The article itself notes that there are still situations where paper checks remain necessary, such as for small businesses, large transactions, and individuals without bank accounts.

Scenarios for Writing Checks

The article is not, by any means, claiming checks are not still of use and benefit in the modern economy:

Despite the overall decline in use, there are still situations where paper checks might be necessary:

- Small businesses that don't accept credit cards or charge fees for card transactions

- Paying individuals who don't have bank accounts

- Large one-time transactions like donations or real estate deals

- Providing direct deposit information to a small employer, or ACH details to a small utility company

Additionally, the article cites a 2024 study showing that 46% of U.S. adults didn't write a single check in the previous year. That means over half the population is still using paper checks to some degree.

Fortune.com Provides Limited Perspective

Unfortunately, as many in mainstream media have done when declaring the death of checks, actual data was ignored. It's our duty to provide our readers with the facts:

- 43% of contractor payments are made by check, as well as for charitable donations, government fees, and rent

- 78% of renters are paying their landlords by check, according to JPMorgan

- 2 out of 10 tax refunds are paid by check, according to the IRS

This does not even account for business checks, which makes up the majority of check payments. In fact, 75% of organizations still use paper checks -- despite their high costs and inefficiencies -- according to PYMNTS.com research. Additionally, 70% of these organizations do not have plans to discontinue the use of checks over the next two years.

Furthermore, there are many industries dominated by paper checks, including healthcare reimbursements, the agriculture sector, and freight and logistics.

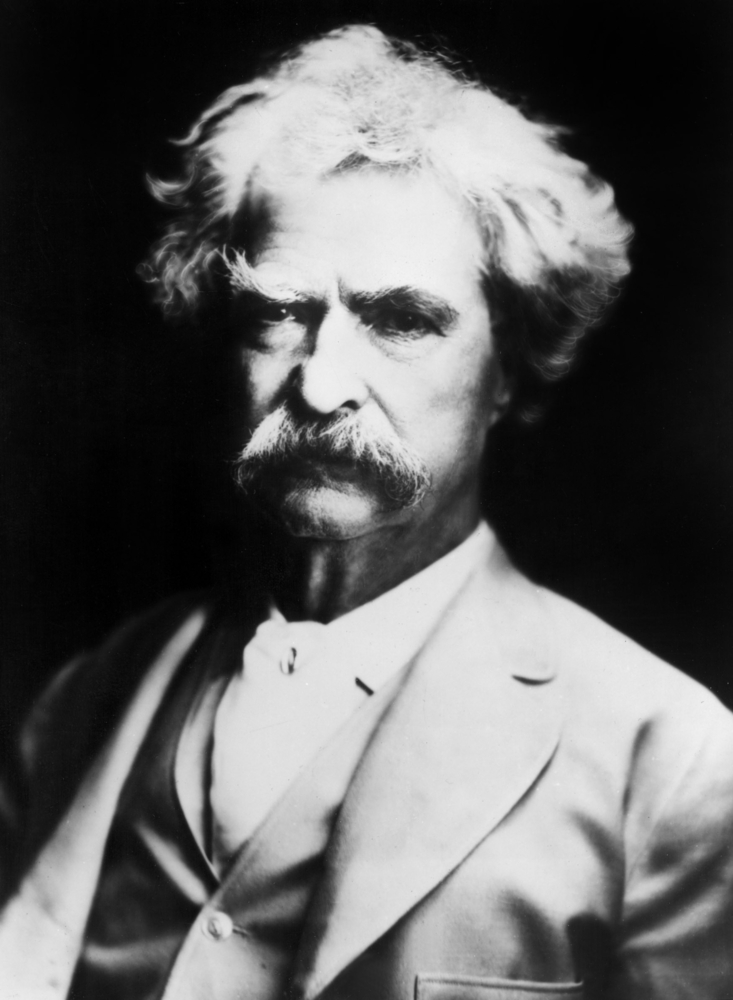

In other words -- to badly misquote Mark Twain -- reports of the check's demise are greatly exaggerated.

With all this in mind, financial institutions would do well to ignore the noise and focus on automating the check payment channel with new innovations such as artificial intelligence. Remember, the mistaken sentiment that "checks are dying" is a major reason why the industry is in its current predicament.