Dark Web: A Thriving Stolen Check Marketplace

- An active online marketplace exists for stolen checks

- Check thieves are provided an easy tool for remaining anonymous

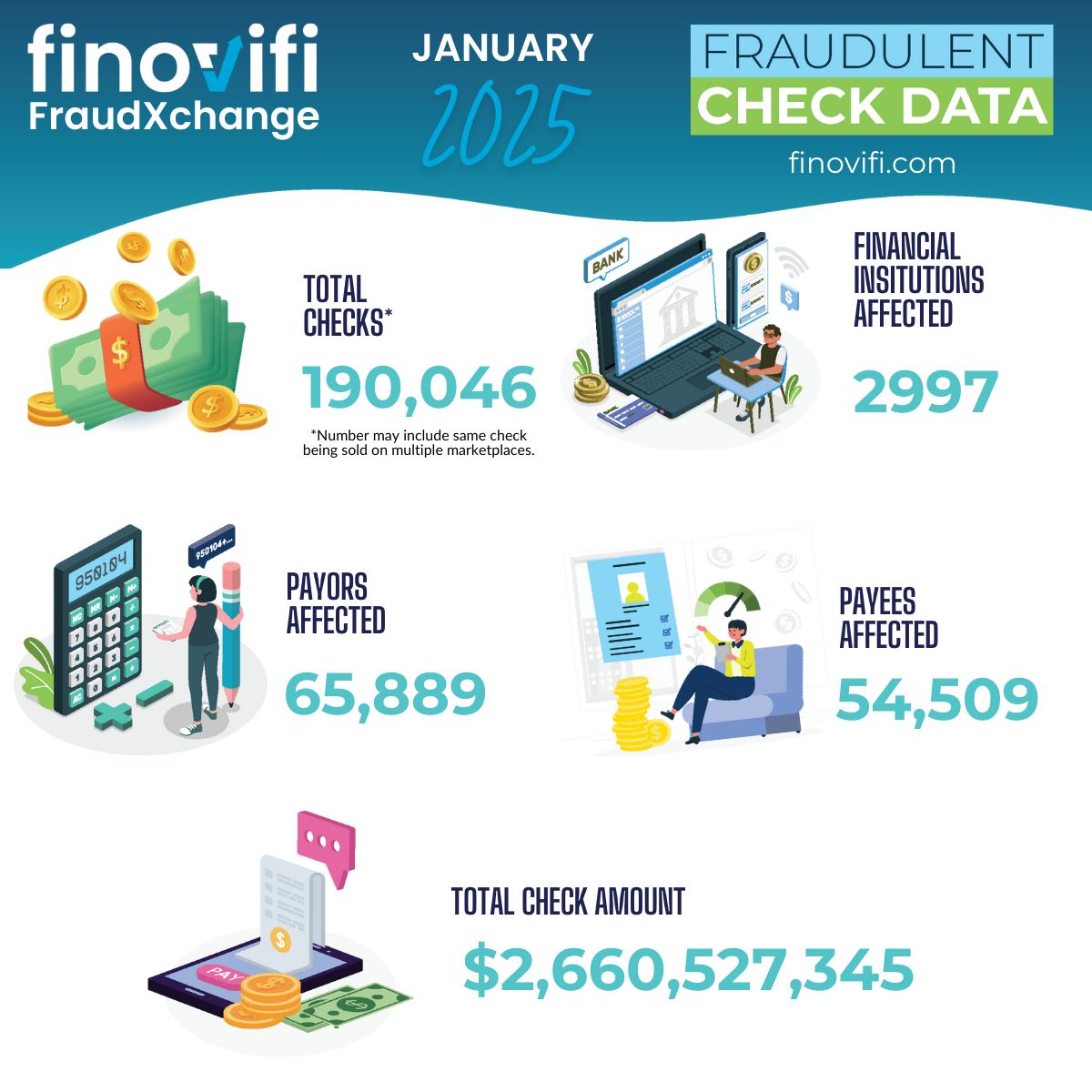

- A new graphic by Finovifi reveals alarming statistics

Earlier in the week we talked about protecting individuals and business from mail theft and check fraud. Equally important, however, is realizing where stolen checks end up.

Dark Web marketplaces – particularly Telegram -- are specialized online forums or “shops” that exist on networks that require anonymizing software to access. Since these marketplaces are not indexed by conventional search engines, buyers and sellers are shielded from immediate detection.

Transactions on these platforms are typically conducted using cryptocurrencies such as Bitcoin or Monero. The use of digital currencies and layered encryption protocols enhances the anonymity of users, making it more challenging for law enforcement agencies to trace financial flows back to individuals.

Underground Marketplace for Stolen Checks

Our friends at Finovifi (formerly ThreatAdvice) have published a new infographic detailing some alarming statistics:

While these statistics are highly disturbing, what many need to understand is that the dark web is much larger than most know.; a mere portion of the deep web -- the part of the internet that is unindexed by search engines like Google -- which makes up about 90-95% of the total internet according to ExpressVPN. The dark web itself holds about 7.5 petabytes of information, which is significantly more than the surface web, according to Anti-virus company Avast.

Within this context, what has been tracked by Finovifi is just a small portion of the actual stolen checks available for purchase.

Bottom Line

Simply put, it's vital to consider Dark Web monitoring as part of check fraud multilayer strategy. Fortunately, high-profile dark web marketplaces have been targeted by law enforcement over the years, leading to periodic shutdowns or seizures. However, new platforms routinely emerge to fill the void; many operators are adept at quickly migrating their operations to evade detection. This cat-and-mouse game contributes to the dynamic and resilient nature of these marketplaces.

Yet another reason that FIs need to add additional layers of technology for check fraud detection, including behavioral analytics, image forensic AI, and consortium data. Each technology plays a key role in check fraud detection, complementing one another to create a strong defense.