Alloy Research: 60% of Respondents Report Fraud Growth in 2024

- Alloy's 2025 State of Fraud Benchmark Report has been released

- Organized Fraud Rings are growing

- 99% of respondents report AI is part of their fraud defense

Alloy, an identity risk management platform for financial companies -- recently published its 2025 State of Fraud Benchmark Report, revealing meaningful losses for financial organizations in 2024.

Last year, we took a deep dive into Alloy's 2024 report, noting:

The direct cost of fraud is significant. 57% of respondents indicated that their organization lost over $500K (EUR/USD) in direct fraud losses over the past twelve months. Over one-quarter of respondents lost over $1 million in direct fraud losses over the past 12 months.

In terms of check fraud, 22% of respondents in the US are concerned with check fraud.

Sara Seguin, Principal Advisor of Fraud & Identity Risk notes:

Expect check fraud to remain a relevant problem in 2024 along with in-branch fraud. This is a consistent theme we are experiencing now that will continue. During 2024, I predict banks will expand the use of their fraud tools to include omni-channel strategies that require more stringent identity checks during in-branch onboarding and transactions beyond just reviewing an ID.

Fraud Data for 2024

The 2025 report surveyed 486 industry leader at organizations including financial institutions and fintechs.

Some takeaways from Alloy's new report:

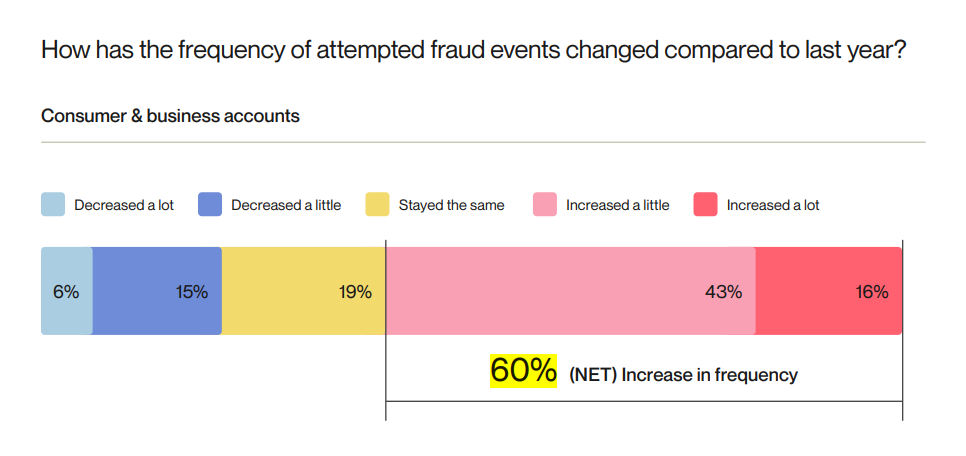

- 60% of financial institutions and fintechs said fraud grew across consumer and business accounts in the last year.

- 31% of organizations faced total fraud losses exceeding $1M.

- Fraud rings account for a whopping 71% of fraud, as reported by decisions-makers.

Alloy Graphic - Click to enlarge

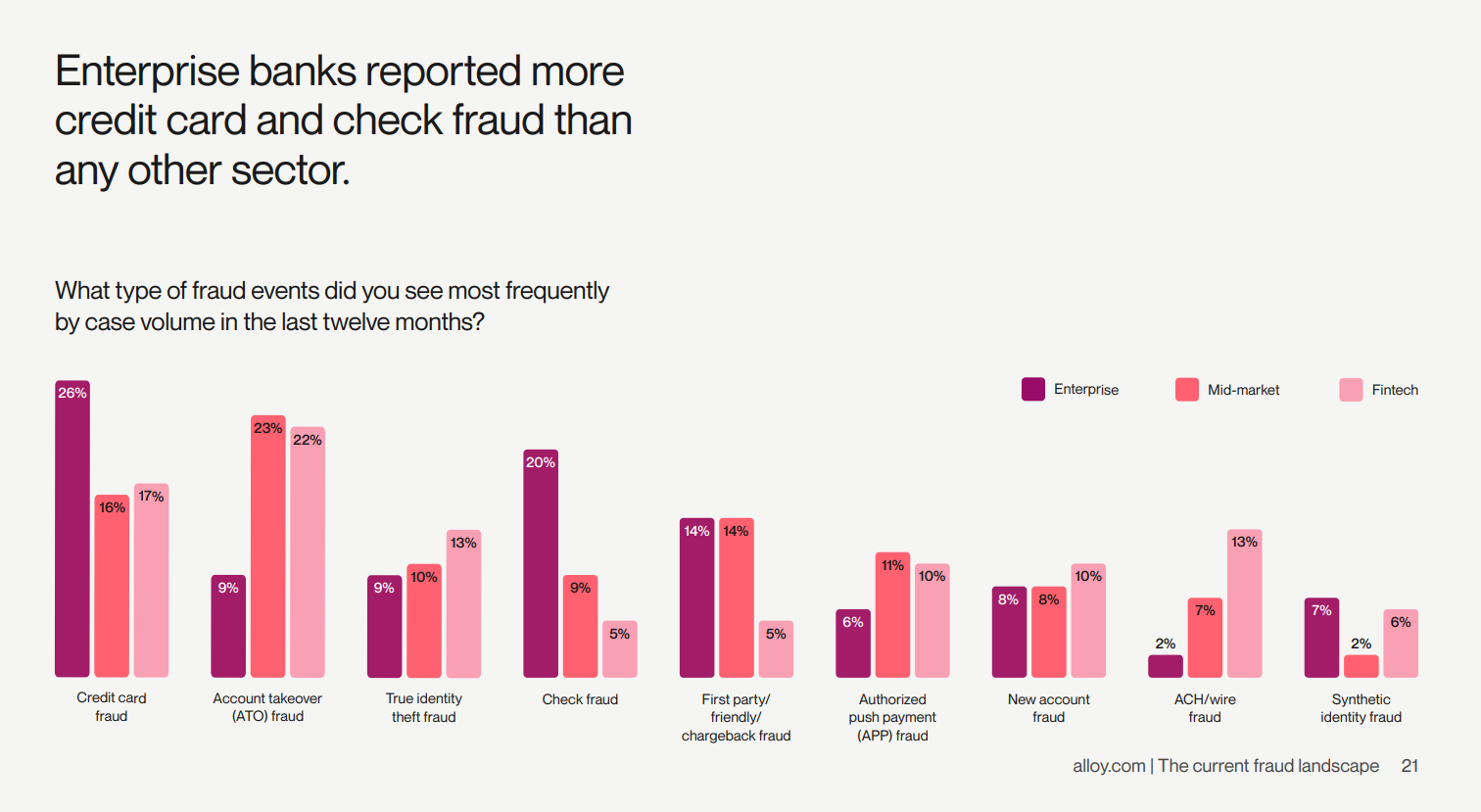

For check fraud specifically, the report notes that "20% of enterprise banks rank check fraud as their most common fraud type" vs the concern level from 2023.

Additionally, the report notes:

- 11% of response report check fraud as the most frequent fraud event in the past 12 months

- Enterprise banks reported experiencing the most check fraud events at 20%

Alloy Graphic - Click to enlarge

Investment in Fraud Technology

Financial organizations are not standing still; they are responding with fraud-fighting investments:

- 93% of respondents said that their organization is making ongoing investments in fraud prevention in 2025.

- 62% have increased investments in fraud prevention.

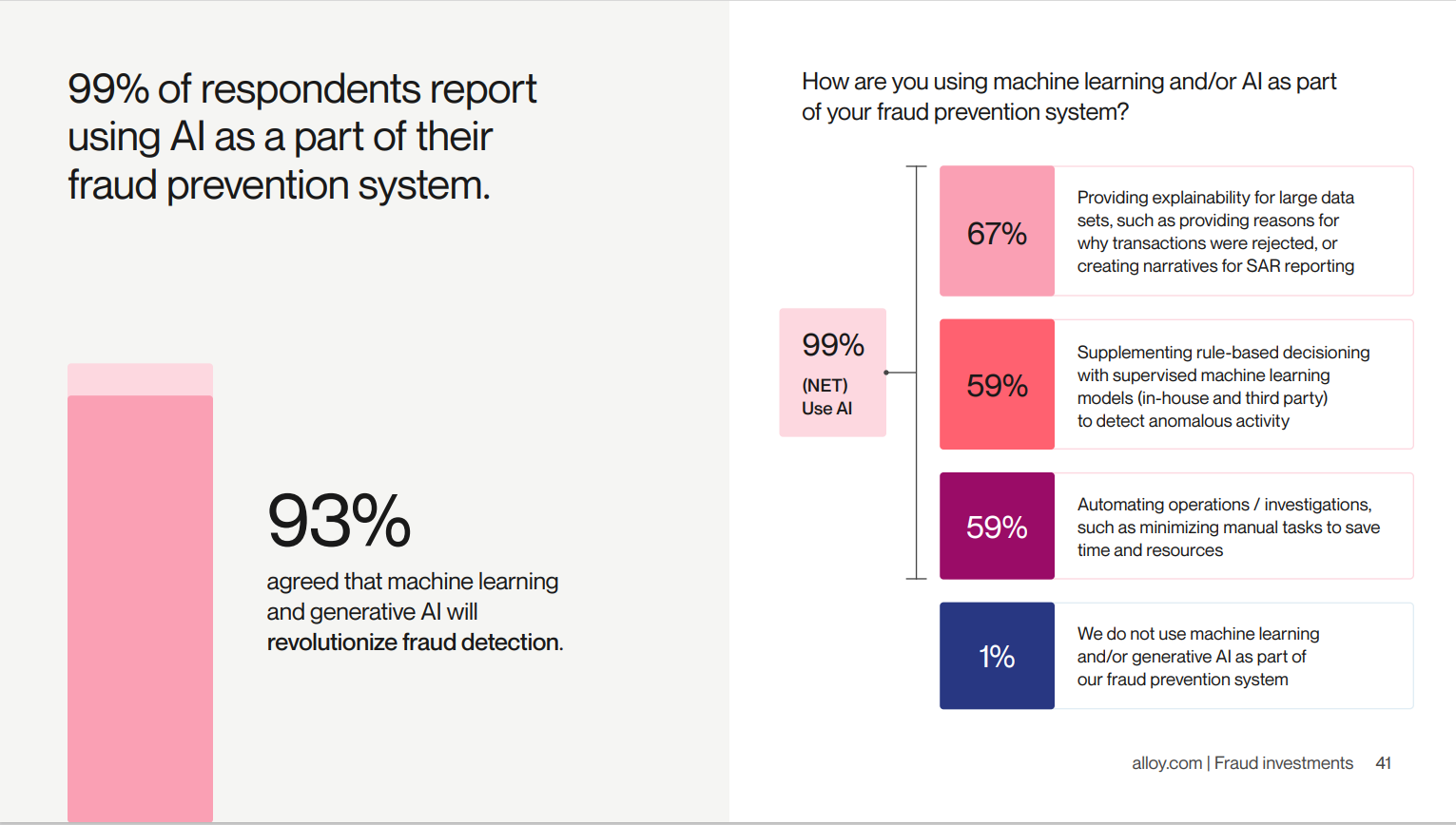

- 99% of respondents report using AI as a part of their fraud prevention system.

Alloy Graphic - Click to enlarge

This also includes check fraud detection, where financial organizations are deploying sophisticated technologies like Anywhere Fraud with OrbNet Forensic AI. In order to detect a majority of counterfeits, forgeries, and alterations, financial organizations cannot rely on transactional data alone. Image Forensic AI represents the evolution of its image analysis predecessor, leveraging AI technologies for specific analyzers including check stock validation (CSV-AI), automated signature verification (ASV-AI), Writer Verification (WV-AI), and alteration detection (AD-AI). These analyzers interrogate check images to spot any indicators of check fraud, detecting over 95% of fraudulent checks.

Fraudsters continue to deploy technologies to pursue advantages; financial organizations, of course, must do the same.