Check Payments Most Often Subjected to Fraud According to New 2025 AFP® Payments Fraud and Control Survey

- AFP released their 2025 AFP® Payments Fraud and Control Survey.

- Reported fraud was a single percentage point down from 2023

- FIs have invested more into fraud technologies, but there is still more work to be done

Earlier this week, AFP released the results of their 2025 AFP® Payments Fraud and Control Survey. This report is an important tool for FIs and the banking industry, as it displays the challenges that their customers are facing. The data is from 2024; the survey was conducted in January of this year and received responses from 521 corporate practitioners representing organizations of varying sizes and a broad range of industries.

According to AFP's press release, 79% of responding organizations report that they were victims of attempted or actual payments fraud activity in 2024 -- slightly down from 80% in 2023.

Which payment method was most impacted by fraud?

You guessed it: Checks.

Deeper Dive into Check Fraud

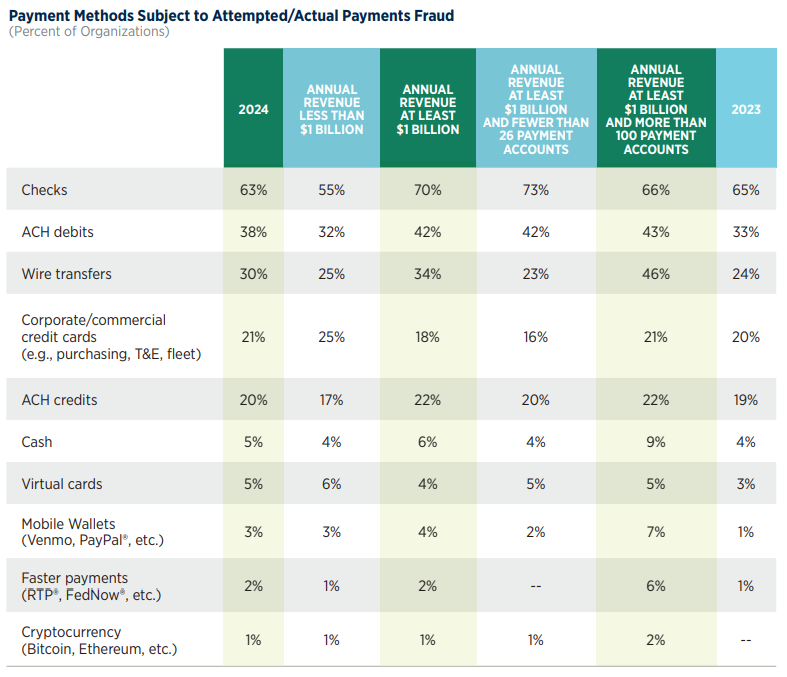

The survey revealed 63% of respondents reporting that their organizations faced check fraud in 2024 -- slightly down from 65% in 2023.

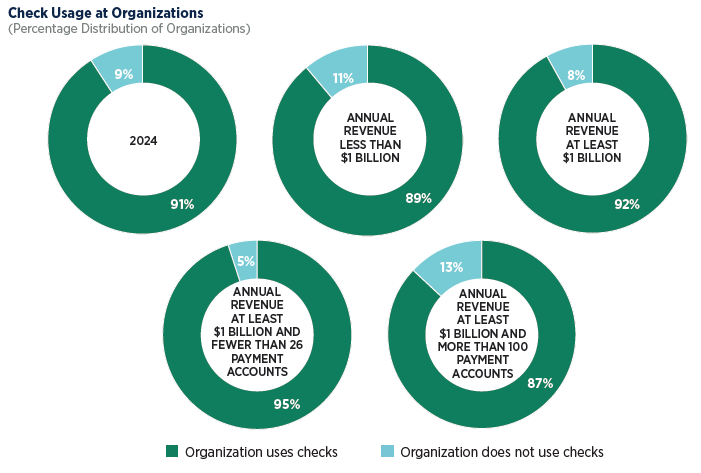

The fact that check fraud remains the most prevalent form of payments fraud is not surprising. Checks continue to be the payment method most often used by organizations. In this survey, 75% of respondents note that checks are being used at their organizations, with 34% reporting that over 25% of their payments are made via checks.

At the same time, checks continue to be a preferred payment method:

Checks continue to be a favored payment method at organizations -- and they are used extensively. Ninety-one percent of respondents report that their organizations are currently using checks. This figure is up from 75% in 2023.

Checks are the payment method most targeted and exploited by fraudsters, but heavy usage of check payments appears to be less clear to underwriters. The survey notes that some organizations might be misled into thinking checks are safer than digital payments, and there are leaders unfamiliar with the newest payment methods, back onto check payments to not disrupt accounts payable functions.

However, as we've previously reported, the answer might be much simpler: Behavior.

The Future of Checks and Check Fraud

As hard as mainstream media wants to push the notion that checks are dead, they remain a top payment choice for organizations and used extensively by a wide range of consumers.

The report notes that since 2020, levels of check fraud have remained between 63% to 66% consistently. This corresponds with findings from FinCEN, where check fraud SARs has remain consistent around 650,000 - 680,000.

With all this data, is this the new norm for check fraud?

While FIs have invested more into fraud technologies, there is still more work to be done. As noted in the past, there is NOT a single solution that can detect the majority of fraud. In order to better protect themselves -- and, in turn, their corporate clients -- FIs must continue to build up their fraud defenses, deploying a multi-layered technology approach to fight back against evolving fraudsters. This includes the latest innovations such as behavioral and transactional analytics, image forensic AI, rules engines, payee positive pay, consortium data, and dark web/Telegram monitoring.

Checks are here to stay, and FIs who continue to ignore or minimize this payment method will see the biggest losses.