A Classic Check Fraud Scheme Targeting… Millennials?

Can you stop it?

- Yes, they are mostly originated in Nigeria

- The FTC notes that scams have increased steadily over the last three years

- The Lesson: Don’t spend deposited funds from unknown entities until one to two weeks have passed

While instant payment channels grow and multiply by the day, fraudsters remain interested in check fraud as a “reliable” form of illegal income.

Let’s look at the classic Fake Check fraud scheme, which has not lost popularity in spite of the growth of other payment channels.

The CBS This Morning segment illustrates how easy it is to convince people that they now “have” money that they, in fact, really do not. A counterfeit check appears as a “pending deposit.” This is enough to make a large number of people believe that actually have the money in their account.

So, they send you a check for a large amount of money; that’s the fund out of which you will pay the comparatively small expenses attached to the project. If you get a check for $6545 and deposit it into your account, why shouldn’t you send a measly $1200 to the promotion company via wire to cover shipping or “installation”?

The investigation also reveals that, yes, many of the more sophisticated scams originate in Nigeria. Hard to believe, isn’t it — fraudsters from Nigeria making money off of victims in the US? Notice that we didn’t necessarily say “innocent victims,” because many willfully participate thinking that they will gain financially from a shady series of transactions.

Targets

And this is not a scam designed to take in the elderly. A look at complaints from 2015 to 2017 shows that ages 20-29 represent the “sweet spot” for the scammers.

Age Number of Complaints 13 -17 583 18-19 1578 20-29 8977 30-39 7449 40-49 6724 50-59 7703 60-69 5783 70-79 2506 80+ 1087 - SOURCE Consumer Sentinel, 2015-2017

Why is this a prime demographic? It may be because many of the schemes play upon “influencer” status that is popular in the 20-39 age group. A target is offered money to market a product via their social media accounts (or even on their car, as seen in the CBS This Morning clip), and a well-known brand-name company whose name appears right in the email and right on the eventual check will compensate them.

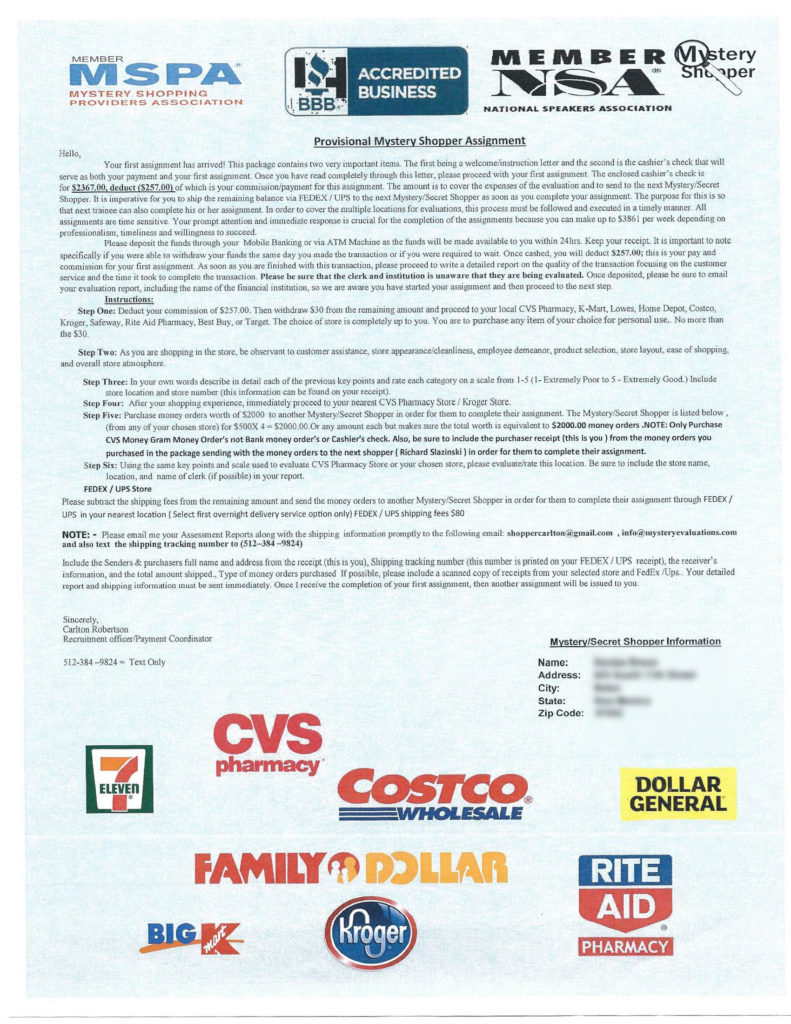

Another popular theme is the “mystery shopper,” and the mission is often to visit the local CVS to buy four $500 MoneyGram money orders and ship them by FEDEX. Of course, you’re using a small amount of the money “paid” to you in that check the scammers sent you.

However, because the bank will eventually learn from the paying bank that the check is counterfeit, the consumer will be on the hook for covering the funds that left the DDA account.

Or, as the Better Business Bureau warns on their website:

Scammers are often successful because consumers don’t realize:

Crediting a bank account does not mean the cashed check is valid.

Federal banking rules require that when someone deposits a check into an account, the bank must make the funds available right away – within a day or two. Even when a check is credited to an account, it does not mean the check is good. A week or so later, if the check bounces, the bank will want the money back. Consumers, not the fraudsters, will be on the hook for the funds.

Cashier’s checks and postal money orders can be forged.

A cashier’s check is a check guaranteed by a bank, drawn on the bank’s own funds and signed by a cashier. If a person deposits a cashier’s check, the person’s bank must credit the account by the next day. The same holds true for postal money orders. Scammers use cashier’s checks and postal money orders because many people don’t realize they can be forged.

In the above cases, banks may not be on the hook for losses. So, why should they care? Because it’s good risk mitigation practices, and money laundering could be right around the corner. Strengthening the defenses against check fraud is good for the consumer, the small business, and the corporate account.

Solutions

Each fraud use case has different environmental considerations. In the case of a counterfeit as defined above, there is transaction history which can be used, along with negative image matching (using image analysis), that can identify these fraudulent transit checks. Money Order and Cashier Check profiles can be used to check for specific fraudulent attributes on these items as well as Treasury Checks. To the human eye, these items can be identified. Using image analysis with self-learning is a way to “visually inspect” these sorts of items for fraudulent attributes.

Spotting anomalies in a timely manner saves an enormous amount of trouble for the consumer and the bank, and will likely make this avenue a much less desirable target for the “fraud underground.”

To schedule a short fraud use case discussion or learn more about Anywhere Fraud, contact joe.gregory@orbograph.com.