ACAMS: FIs Pivoting to New Tech as Fraudsters Overcome Traditional Check Fraud Detection Strategies

Recently, Fred Williams -- reporter and journalist for the Association of Certified Anti-Money Laundering Specialists (ACAMS) -- reached out to several check fraud experts, including OrboGraph's own Chief Strategy Officer, Joe Gregory.

For those not familiar with the association, ACAMS is a leading international membership organization dedicated to providing opportunities for anti-financial crime (AFC) education, best practices, and peer-to-peer networking to AFC professionals globally.

The article at moneylaundering.com examines the check fraud challenges financial institutions face and the technologies that they are now utilizing to fight back against the fraudsters.

Fraudsters Motivated by Profits -- And Checks Offer a Tempting Vehicle

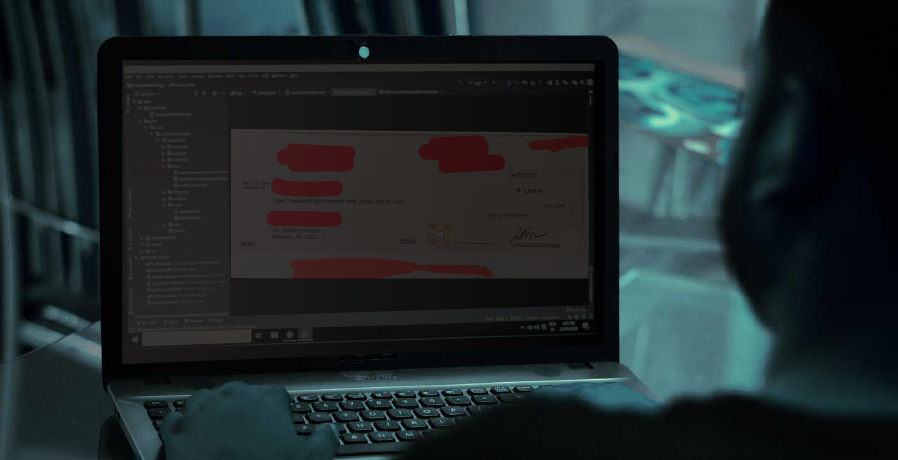

In the past we've covered the dark web and how it's become a marketplace for stolen checks. Mr. Williams notes that the value of a stolen check varies when sold on the dark web -- averaging around $650 per check. However, the a single check could be worth as much as $10,000 for fraudsters who purchase the stolen check and utilize methods like check-washing or digital tools to create counterfeits.

The activities of these criminals have drawn attention from a variety of government entities, including the USPS, law enforcement, and even Congress. However, there are times where the "profits" are too tempting for even "insiders."

The Post Office responded:

In July, federal prosecutors in North Carolina charged Jakia McMorris, a former mail carrier in Charlotte, with stealing $40,000 worth of checks in two months from mailboxes she allegedly unlocked with master keys she reported lost in September 2021.

McMorris and her co-conspirators allegedly used several accounts to deposit the checks in October and November of last year, then quickly withdrew the funds, converted some of them into money orders that they deposited into other accounts to obscure the financial trail.

As the Post Office takes steps to prevent these sorts of thefts, fraudsters simply make further adjustments and patiently "finesse" fraudulent accounts to appear more legitimate:

Counterfeiters and their associates appear to have adjusted to the new security protocols, Maimon said. For example, a larger share of “mule” accounts sold on the dark web have been “aged,” meaning set up two to three years prior to their acquisition.

Targeting "Lower-Tech"

John Calderon, chief compliance officer of Bison State Bank in Kansas City, Kansas, notes that "using a combination of tellers’ scrutiny and screening software, banks capture 75% to 85% of fraudulent checks that criminals seek to cash." While we can categorize this as the "majority," the remaining 15%-25% could add up to hundreds of thousands -- even millions -- in losses each year.

More -- and better -- tools need to be deployed, as noted by Joe Gregory:

Image validation technology analyzes previously cleared checks to validate signatures and the authenticity of “stock,” or paper, while also scanning for irregularities that may suggest an alteration.

“That’s a big piece of the equation because traditionally, a lot of the deposit channels were only doing a very simple validation of the item,” said Joseph Gregory, chief strategy officer at check processing and fraud detection technology maker OrboGraph in Burlington, Massachusetts.

Additionally, many fraudsters avoid tellers altogether, choose digital channels like mRDC and ATMs to deposit fraudulent checks. This is where financial institutions are pivoting from traditional technologies to the latest AI and deep learning technologies to combat check fraud.

Mr. Williams notes that banks are now utilizing "behavioral analytics to flag anomalous transactions, as well as 'negative lists' of suspected stolen or false identities drawn from the dark web and from accounts already linked to deposits of fraudulent instruments." Financial institutions are furthering their strategies by combining behavioral analytics with image forensic AI to analyze the check images for indicators of counterfeits, forgeries, and alterations.

Mr. Gregory provides a succinct observation for our readers:

Combining multiple complementary technologies enables financial institutions to analyze both transactional data of an account, while also interrogating the images of the physical check. This provides a strong combination that can achieve 95% detection rates. Financial institutions are taking things a step further by integrating data analytics to analyze trends and new dark web monitoring to proactively close accounts when stolen checks are found on the dark web.