Check Fraud Prevention

Despite the aggressive marketing attacks by many electronic payment platforms, even Bankrate advises readers to think twice before consigning their checkbooks to the nostalgia pile. Go to the link for details, but the five fundamental reasons paper checks are still important payment tools, according to Bankrate, are as follows: Many businesses shun plastic Ease of person-to-person…

Read MoreMobile check deposit rolled out almost five years ago, and at that time it was used mainly by tech-savvy leading-edge early adopters. The “mainstream” bank customer, however, felt intimidated by the tech, or was discouraged by the limits set on deposits. Undaunted, BBVA Compass aggressively addressed theses concerns over the past year. The bank increased its check amount limits,…

Read More“Until about five years ago, I used to carry my checkbook everywhere,” writes Lainie Petersen in the Money Crashers blog. “In fact, some of my purses even had a special compartment that provided easy access to my oft-used pad of checks. Nowadays, however, I leave my checkbook at home. In fact, I can’t remember the last time…

Read Morehttps://youtu.be/FnhBt0bo2m0 A French digital payment security company called Oberthur Technologies (OT) thinks it can pretty much eliminate credit card fraud with a new technology it calls Motion Code. What’s Motion Code? It’s basically a means of changing static CVVs to dynamic CVVs, changing every hour. If a bad guy gets your card, it would only be useful…

Read MoreLast month at the RDC Forum: Atlanta, an event hosted by RemoteDepositCapture.com, a new unified platform for processing check and ACH transactions was discussed by a Fed spokesman. It’s expected to make its debut at the central bank later this year. The changes are a modernization of the Fed’s own internal systems, and appears to hold…

Read MoreTo say the 2017 Orbograph Client Conference in Atlanta turned out to be a great event would be shameless self promotion, which we would never do. So speaking objectively, it all started with a must-see introduction movie trailer. Then, on the check and payments side, we recruited a number of the best companies and speakers in…

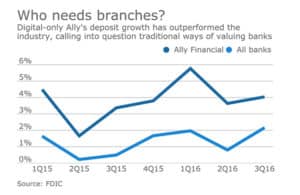

Read MoreAmerican Banker provides their view toward futuristic ideas with 10 Big Ideas for Banking in 2017. It’s a combo of both cool and crazy concepts; each of the 10 predictions/ideas link to a more comprehensive look at the topic in question (also in a fun slideshow format). “Redefine a bank’s worth for the digital age,” for example, links…

Read MoreGert Watkins just become the poster child of checks in an article about the reality of check writing. The Wall Street Journal article, posted by former colleague and friend Kathy Strasser, explored the dynamics behind why checks still exist and what the leading motivations are. Of course, when it comes to checks, technologists want to bash…

Read MoreWithin the first months of 2017, there will be a number of important market studies released related to check volumes via FED research, fraud losses (ABA Deposit Account paper), and retail banking (BAI). As OrboGraph looks to the future in check payment innovation, we believe the following trends will feed market innovations. Check volume declines…

Read MoreAndrew Davies, Vice President of Global Market Strategy, Financial Crime Risk Management at Fiserv, makes several great points about how quicker transactions – and the customer expectations attached to that speed – can be dangerous in terms of exposing fraud and theft opportunities. (Read it HERE.) Mr. Davies describes a “perfect storm of factors,” broadly consisting of: Greater demands…

Read More