Check Image Quality

The San Diego Business Journal asked a group of banking leaders for their impressions of the digital revolution in banking, and received valuable insights regarding human interactions, response to pandemic-era restrictions, and fraud prevention. Even before the COVID-19 pandemic impacted the world economy in early 2020, the financial sector was developing and deploying digital tools…

Read MoreBAI examines the ongoing transformation of the branch experience: Long before the pandemic hit, many banks were well on their way to rethinking their branches to better accommodate customers’ increased use of digital channels. With the net closure of nearly 3,000 branches in the U.S. last year and a similar pace in the first half of 2022,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIt’s an open secret that the types of products and services corporate clients demand from their financial institutions (FIs) are shifting to digital banking solutions. This month PYMNTS Intelligence takes a look at recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking…

Read MoreA report on the Globes website gives us a look at restrictions on cash payments in Israel that have been in effect since January of 2019. The law limits the use of cash in any transaction worth more than NIS 11,000 with a business and more than NIS 50,000 in a transaction between private individuals.…

Read MoreCheck Fraud and Recognition Solutions Business Will Continue to Run Independently Billerica, MA, August 16, 2022 – OrboGraph, a premier supplier of check processing automation, fraud detection, and healthcare payment electronification, announced today that Revenue Management Solutions (RMS), a provider of automated healthcare payments reconciliation services has acquired OrboGraph. Thompson Street Capital Partners (TSCP), a private…

Read MoreAt The Financial Brand, Jim Marous, industry influencer and CEO of The Digital Banking Report, and BK Kalra, Global Head of Banking and Capital Markets at Genpact, offer their four essentials for success in the digital banking space. One point they make early is that, while COVID certainly accelerated adoption, the digital banking revolution was on its way, pandemic or…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

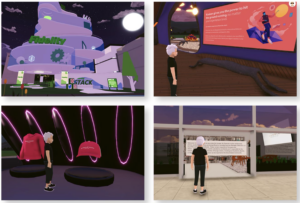

Read MoreBrace yourself: It’s time for banks to begin planning their move to the Metaverse. Or Web3. Or Web 3.0. Or whatever they’re calling it today. If you’re not exactly sure what the Metaverse is, rest assured that you are not alone…but that hasn’t stopped banks from eagerly diving in. The Financial Brand had Mike Abbott,…

Read MoreA post at Alogent starts with a very clear — and, by now, familiar — proclamation: The stigma around the use of checks was even the focus of an SNL sketch, where they joked about the amount of data needed before it could be tendered. What those script writers didn’t realize was the value and…

Read More