Data Verification

Here’s a terrific podcast interview via BAI Banking Strategies that you should listen to during your commute. In it, Andres Wolberg-Stok, Citi FinTech’s global head of policy, talks about best practices and approaches to incorporating financial tech – FinTech – in financial organizations. An important point Wolberg-Stok makes early in the conversation is the fact that,…

Read MoreWe’ve heard stories of card skimmers at outdoor ATM machines and even gas pumps ripping off consumers’ card information, but, admit it – – you always trusted card machines that are inside of retail establishments just a bit more, right? Watch this clip and marvel at the fact that this caper is pulled off in…

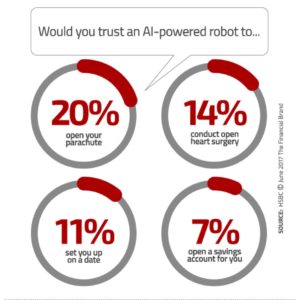

Read MoreArtificial Intelligence, chatbots and robo-advisors are coming. Here’s an interesting example of how perceptions can yield crazy statistical results. A “Trust in Technology” report published by HSBC found that consumers are leery of allowing chatbots and robo-advisors to help them open a savings account or provide mortgage advice – – but they would trust them more for heart surgery! In an article…

Read MorePymnts.com reports that electronic payments are rising, according to a Viewpost study. Small and large businesses are recognizing the advantages of electronic payments. But, for all the rah-rah about electronic payments seeping into the consciousness of American businesses, there are no victory dances quite yet: Every single one of the business owners surveyed by Viewpost…

Read MoreAJC.com recently reported the story of a group of fraudsters who used Instagram ads to solicit bank information for unsuspecting victims, who were robbed of substantial funds before the crime was discovered. During a scheme lasting at least 17 months, the FBI said, the trio posted advertisements on Instagram and other social media sites offering “fast…

Read MoreDespite the aggressive marketing attacks by many electronic payment platforms, even Bankrate advises readers to think twice before consigning their checkbooks to the nostalgia pile. Go to the link for details, but the five fundamental reasons paper checks are still important payment tools, according to Bankrate, are as follows: Many businesses shun plastic Ease of person-to-person…

Read MoreMobile check deposit rolled out almost five years ago, and at that time it was used mainly by tech-savvy leading-edge early adopters. The “mainstream” bank customer, however, felt intimidated by the tech, or was discouraged by the limits set on deposits. Undaunted, BBVA Compass aggressively addressed theses concerns over the past year. The bank increased its check amount limits,…

Read More“Until about five years ago, I used to carry my checkbook everywhere,” writes Lainie Petersen in the Money Crashers blog. “In fact, some of my purses even had a special compartment that provided easy access to my oft-used pad of checks. Nowadays, however, I leave my checkbook at home. In fact, I can’t remember the last time…

Read Morehttps://youtu.be/FnhBt0bo2m0 A French digital payment security company called Oberthur Technologies (OT) thinks it can pretty much eliminate credit card fraud with a new technology it calls Motion Code. What’s Motion Code? It’s basically a means of changing static CVVs to dynamic CVVs, changing every hour. If a bad guy gets your card, it would only be useful…

Read MoreLast month at the RDC Forum: Atlanta, an event hosted by RemoteDepositCapture.com, a new unified platform for processing check and ACH transactions was discussed by a Fed spokesman. It’s expected to make its debut at the central bank later this year. The changes are a modernization of the Fed’s own internal systems, and appears to hold…

Read More