Data Verification

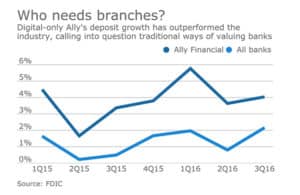

American Banker provides their view toward futuristic ideas with 10 Big Ideas for Banking in 2017. It’s a combo of both cool and crazy concepts; each of the 10 predictions/ideas link to a more comprehensive look at the topic in question (also in a fun slideshow format). “Redefine a bank’s worth for the digital age,” for example, links…

Read MoreWithin the first months of 2017, there will be a number of important market studies released related to check volumes via FED research, fraud losses (ABA Deposit Account paper), and retail banking (BAI). As OrboGraph looks to the future in check payment innovation, we believe the following trends will feed market innovations. Check volume declines…

Read MoreAndrew Davies, Vice President of Global Market Strategy, Financial Crime Risk Management at Fiserv, makes several great points about how quicker transactions – and the customer expectations attached to that speed – can be dangerous in terms of exposing fraud and theft opportunities. (Read it HERE.) Mr. Davies describes a “perfect storm of factors,” broadly consisting of: Greater demands…

Read MoreAll across the healthcare space, data analytics are providing exceptional results to the companies whose livelihoods depend upon accurate projection of future trends based on current divergent information inputs. Leveraging the cloud as a central information depository and distribution point has proved beneficial to Johnson & Johnson. A manufacturer of medical devices and bioinformatics, pharmaceutical, and consumer-health…

Read MoreBAI.org offers valuable insight into consumers’ adoption of digital interaction with their financial institutions via a document entitled “Digital Banking and Analytics: Enhancing Customer Experience and Efficiency.” The downloadable PDF provides great information about current and future use of digital interactive technology among bank customers, as well as a cogent overview of future expectations that the industry…

Read MoreThe folks at Crosscheck have put together a great overview of the life of a check – – starting at the tree (now that’s comprehensive) and advancing through the various legislative and technological steps that have kept checks speedy and relevant in the digital age. They also get into the nitty-gritty of check “construction” with…

Read MoreSteve McNair of FTP Consulting tells a great story about how a credit card processing company made a significant $$$ investment in system upgrades, which delivered “lower performance”. The customer blamed the solution provider — however, the system was running fine. Sound familiar? After nine months of working with the system, no one could identify the root cause of…

Read MoreIn light of last week’s crippling web outage, it’s ironic to note that the Federal Deposit Insurance Corporation has declared October Cybersecurity Awareness Month. The FFIEC hosted a webinar entitled Getting the Most Out of Your FS-ISAC Membership for financial institutions on October 31, 2016. Cybersecurity is, of course, crucial in the fraud prevention workflow, and last week’s outages…

Read MoreWe’re excited to see that, of the Top 5 Tech Innovations Your Bank Can’t Ignored, we can actually contribute significantly to three of them! Let’s call them the “Key 3”: Continue to embrace Check 21 Leverage electronic workflows Automated tellers Part of the shared theme of the Key 3 is that the branch bank is far from obsolete. Online…

Read MoreThe same report that finds 57% of organizations intend to use same-day ACH for last-minute payments also finds that business-to-business payments by paper check actually increased slightly from 2013, breaking the previous downward trend in check use. In fact, 86 percent have finally integrated their check payments systems with their accounting systems. There are still major…

Read More