Mobile Banking

While I was at Money20/20, there was a session called “B2B Payments: Investment is Heating Up & Paper Checks are Under Fire!” The session included 5 industry payment experts who were primarily taking pro-check positions. One of the startling observations which I heard was that they had little empirical evidence substantiating a significant business case…

Read MoreIt’s advertised as “The World’s Largest Payments & Financial Services Innovation Event,” and it’s taking place right now (October 22-25) in Las Vegas – – the 2017 Money20/20 event expects 11,000+ attendees, including more than 1,700 CEOs and Presidents, from 4,500 companies and 85 countries. Their agenda is comprehensive and includes themes like PAYMENTS, BANKING, COMMERCE, SECURITY,…

Read MoreWith all of the tech we count on that uses actual experiential learning to better read handwriting on a variety of payment types — including checks, for instance — we probably should have seen this coming. Last September the white coats at Google added something called the Google Neural Machine Translation system (GNMT) to their translation tool.…

Read MoreHere’s a terrific podcast interview via BAI Banking Strategies that you should listen to during your commute. In it, Andres Wolberg-Stok, Citi FinTech’s global head of policy, talks about best practices and approaches to incorporating financial tech – FinTech – in financial organizations. An important point Wolberg-Stok makes early in the conversation is the fact that,…

Read MoreWe’ve heard stories of card skimmers at outdoor ATM machines and even gas pumps ripping off consumers’ card information, but, admit it – – you always trusted card machines that are inside of retail establishments just a bit more, right? Watch this clip and marvel at the fact that this caper is pulled off in…

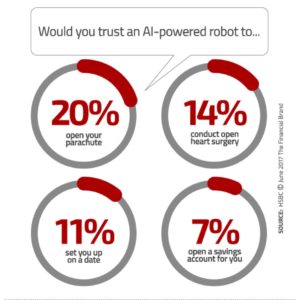

Read MoreArtificial Intelligence, chatbots and robo-advisors are coming. Here’s an interesting example of how perceptions can yield crazy statistical results. A “Trust in Technology” report published by HSBC found that consumers are leery of allowing chatbots and robo-advisors to help them open a savings account or provide mortgage advice – – but they would trust them more for heart surgery! In an article…

Read MorePymnts.com reports that electronic payments are rising, according to a Viewpost study. Small and large businesses are recognizing the advantages of electronic payments. But, for all the rah-rah about electronic payments seeping into the consciousness of American businesses, there are no victory dances quite yet: Every single one of the business owners surveyed by Viewpost…

Read MoreBillerica, MA, June 7, 2017 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation solutions in healthcare revenue cycle management (RCM), as well as recognition solutions, image validation and check fraud detection for the U.S. check processing market, recently presented its OrbyAwards for excellence and inducted eight recipients to the OrboGraph Hall of Fame…

Read MoreThe American Banker podcast is a pleasant way to spend your commute. Their latest segment features a conversation from our business partners FIS, Doug Brown, senior vice president. He examines a recent survey that shows 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. “Business owners gravitate toward things that make…

Read More“Until about five years ago, I used to carry my checkbook everywhere,” writes Lainie Petersen in the Money Crashers blog. “In fact, some of my purses even had a special compartment that provided easy access to my oft-used pad of checks. Nowadays, however, I leave my checkbook at home. In fact, I can’t remember the last time…

Read More