Modernizing Omnichannel Check Fraud Detection

Check fraud is discussed on The Payments Podium Some of the “specialized skills” need for check fraud are identified Many financial institutions struggle with rules and regulations that determine liability As has been made clear in this space many times previously, even in today’s increasingly digital world checks remain a surprisingly relevant – and vulnerable…

Read MoreIn spite of its effectiveness, Positive Pay is not yet adopted universally Adoption of Positive Pay is expected to increase over the next two years Positive Pay is an essential tool for check fraud detection, but cannot detect the majority of check fraud alone Positive Pay is an essential tool for check fraud detection. In…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreAre consumers impressed with anti-fraud protections? A high percentage of customers are pleased with their banks Consumers reported losing more than $12.5 billion to fraud in 2024 One facet of fraud that gets overlooked is the consumer satisfaction factor. Anytime fraud is not detected, there is a victim — whether it’s an individual or a…

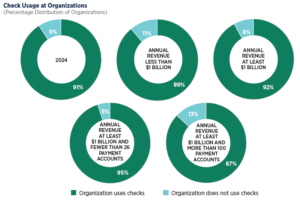

Read MoreAFP released their 2025 AFP® Payments Fraud and Control Survey. Reported fraud was a single percentage point down from 2023 FIs have invested more into fraud technologies, but there is still more work to be done Earlier this week, AFP released the results of their 2025 AFP® Payments Fraud and Control Survey. This report is an important…

Read MoreFraud is set to become even more challenging Advanced tech allows fraudsters to “flood the zone” Fraud prevention must be viewed as an investment, not just a cost center The fraud landscape is set to become even more challenging for banks and credit unions in 2025, according to Jim Houlihan, partner and principal consultant at…

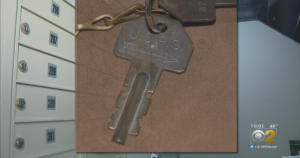

Read More143 arrow keys were reported missing from Sacramento post offices Mail theft and robberies are becoming a major issue USPS efforts to improve security seem ineffective Last year, we examined a USPS audit where, out of 84 postal facilities inspected, 76 facilities across 25 states and the District of Columbia found untracked or unsecured arrow…

Read MoreChecks and debit cards are leading fraud tools Checks, payee forgery & check washing led the pack in fraud Leveraging multi-technologies to address check fraud is key Earlier this month, the Federal Reserve published its findings from the Annual Federal Reserve Financial Services (FRFS) Financial Institution Risk Officer Survey (2024). The most prominent payments for…

Read MoreThe elderly are most vulnerable to fraud Even family members and caregivers attempt fraud Older consumers are the biggest users of checks, making them a target What makes the elderly our most vulnerable population when it comes to fraud? Is it because they are the least technologically savvy? Are they more trusting than other age…

Read MoreReverse Positive Pay for Personal Checking Accounts — Strong Fraud Mitigation or Shifting Liability?

Reverse Positive Pay adds fraud protection but may burden customers Banks should offer, not require, Reverse Positive Pay Reverse Positive Pay alone is not enough – banks need multi-layered fraud detection as well Over the past few months, we’ve explored the efficacy of Positive Pay systems, noting that “77% of Businesses Using Positive Pay Report…

Read More