Remote Deposit Capture

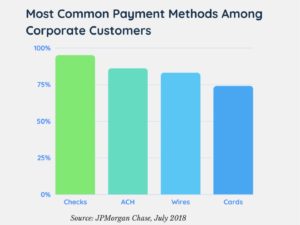

A survey released last week by JPMorgan Chase revealed that, while a majority of U.S. business leaders (owners, managers, and executives) prefer using digital banking, less than half of them have plans to increase their use of online banking products and services! The reason? Cybersecurity concerns! While checks are certainly not immune from fraud and hacking,…

Read MoreThe National Check Fraud Center has a no-nonsense, word-dense list of 20 UCC Provisions Every Banker Should Know. Go “check” out that link – – looks pretty daunting, doesn’t it? Author Mary Beth Guard manages to keep it light, though, even in some of the longer explanations: Section 4-209: Are you familiar with the encoding warranty? A…

Read MoreAccording to Thomas Skala, chief executive officer and president of telecommunications and payments company Genie Gateway, a mitigated risk of chargebacks makes checks the best path for high-risk sellers. High-risk sellers can include, for example, product repair companies if a customer is unhappy with a repair result; or the travel industry, in which buyers can chargeback travel…

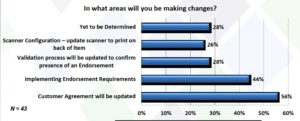

Read MoreWe’re continuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, via a presentation by Paul A. Carrubba, Partner at Adams and Reese LLP, and John Leekley, Founder & CEO, RemoteDepositCapture.com, entitled “Best Practices for July 2018 Reg CC Changes.” After Paul Carrubba’s overview of Reg CC Amendments that…

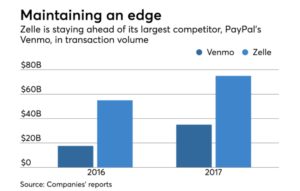

Read MoreSmall banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

Read MoreLet’s be frank: paper checks present a challenge to anyone in the accounts payable space. But let’s be equally realistic: checks continue to make up about half of the supplier payments volume. B2B payments disruptors now have a choice when designing and deploying technology: Will they use that tech to make paper checks less friction-filled, or entice…

Read MoreThere is a trend in the wind, according to AmericanBanker.com: Over the past few days, midsize banks — such as Comerica, Commerce Bancshares and M&T Bank — have reported notable declines in total deposits, with M&T, in particular, reporting a 6% drop from a year earlier. Executives have offered a number of reasons why, saying…

Read MoreA newly released report reveals that cloud computing advances are a driving force for large enterprises — including, of course, those in the health care and retail banking segments — to modernize their application platforms in spite of large investments they may have made previously in legacy systems. Large enterprises have dedicated in-house IT resources,…

Read MoreRemoteDepositCapture.com creates one featured poll question per month on RDC-related topics. If you’re at all interested in check processing [who wouldn’t be, right?], then we invite you to visit their site and register your input. While you’re there, it’s well worth signing up for their newsletter so you can get poll results regularly. This month’s featured…

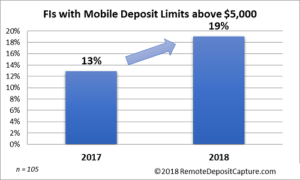

Read MoreA RemoteDepositCapture.com poll reveals that the limits banks and credit unions place on the size of consumer checks eligible for depositing via mobile RDC are rising steadily. In fact, the past year has seen the number of financial institutions with standard per-item deposit limits above $5,000 for consumer mobile deposit customers growing by nearly 50%, according to the…

Read More