Check Fraud SARs Rise in 2024 to Near 2022 Record-Setting High

- Overall SARs reports have declined, but only slightly

- Check fraud SARs achieve near record-setting levels in 2024

- As we seeing the new norm for check fraud levels?

According to a recent report from the Thomson Reuters Institute, the total number of Suspicious Activity Reports (SARs) filed by U.S. financial institutions in 2024 declined slightly from the record-setting numbers seen in 2023, but nevertheless remained near all-time highs.

For the first time in a decade, the total number of SARs filings from financial institutions declined in 2024, down from a record number of filings in 2023 — but not by much.

The report estimates that the final 2024 SARs total will land somewhere between 4.5 and 4.6 million, roughly on par with the previous year's record. Official numbers are expected to be published in April/May of 2025.

Check Fraud SARs 2024

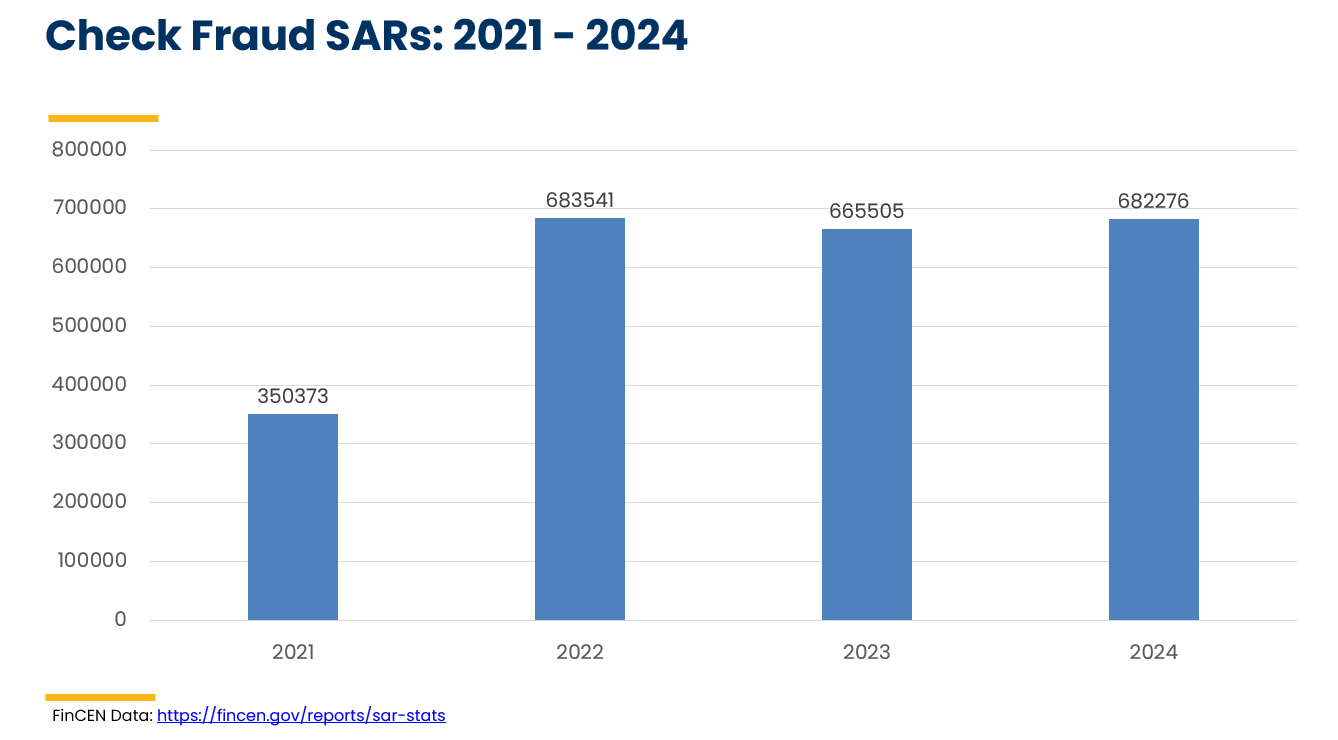

While the overall total number of SARs appears to have slightly declined in 2024, this is NOT the case for check fraud SARs. As many may remember, check fraud SARs exploded in 2022 to hit a record-setting high of 683,000, nearly doubling from 2021 levels (350,000). This led to a alert distributed by FinCEN to warn FIs to be vigilant for check fraud. In 2023, we saw a slight decline to 665,000 check fraud SARs filed.

Fast forward to 2024, it appears that the number of check fraud SARs are back to 2022 levels, with Thomas Reuters reporting that 682,276 being filed.

What to Expect in 2025

Over the past three years, we have seen check fraud SARs levels flatten, which begs the questions: Is this the new norm for check fraud? As noted by the article:

Given the consistently high incidence of fraud over the past few years, there is no reason to expect that 2025 will be much different.

While many financial institutions have taken the right steps in 2023 & 2024 to address the challenges of check fraud, many FIs are taking reactionary approaches vs. a proactive approach -- only investing in check fraud technologies when they get targeted and exploited by fraudsters.

Financial institutions of all sizes need to make the necessary investments NOW, not in the future. Technology like image forensic AI is available for deployment directly, or through their core providers and leading fraud platforms.