Credit Unions: Ease of New Account Openings, Ease of Check Fraud?

- Check fraud is increasing at all financial institutions

- Credit unions are marketed on ease-of-use, making them more vulnerable

- There are steps that can be taken to combat fraud while maintaining credit union convenience

CU Management takes a look at how the increase in check fraud has specifically impacted credit unions. In an article by Al Pascual, SVP/Enterprise Solutions at TransUnion, we get a bit of background applicable to banks of all kinds:

It's not just how checks are deposited that is driving a resurgence in check fraud, but the ability of criminals to source a massive volume of real checks—many of which are tied to accounts with significant balances. Criminals are using various methods to steal real checks in transit through the Postal Service and re-sell them on the dark web. Sometimes, account statements accompany the check to show the amount of funds available, which increases the black-market value. Small businesses in particular have become valuable targets because their accounts are twice as valuable when compared to the average consumer’s.

The ability to target -- with some level of efficiency -- "worthwhile targets" is a major factor in attracting bad actors to check fraud.

Simplifying Access to Banking, Simplifying Avenues for Check Fraud

One of the vanguards of the credit union experience is that it "makes things simple" for its members. This is a definite brand advantage from which credit unions benefit, but it also increases security risks:

The final piece of the puzzle is that criminals have discovered it is far easier to establish “drop accounts” at a credit union or bank than attempting to pass them at a check cashing business. To stay in line with digital-first challengers, credit unions have worked hard to make the account-opening process simple. As a result, the identity verification standards for new accounts can be somewhat low. Scammers can use remote deposit once the drop account is open, making it more difficult to detect altered or forged checks. Criminals never have to leave home to pull off a scalable check fraud scheme.

So, the same "ease of use" benefits that credit union members enjoy -- and expect -- add layers of complexity to protecting member accounts. One solution would be to eliminate some of these "shortcuts" and conveniences, but that would be contrary to the credit union "brand."

Strategies for Check Fraud Detection

So, what can credit unions do to strengthen their anti-fraud capabilities without giving up the ease-of-use and convenience credit union members expect? Mr. Pascual suggests the following:

Mitigating Risks in Account Opening

As noted in the article, one of the major factors that enable check fraud is the ease in which fraudsters are able to open new accounts -- particularly online where it is nearly impossible to physically identify who is opening the account. There are methods to increase the security and verification of identities for account openings.

Credit unions can use low-cost, behind-the-scenes methods to gather risk signals during the account opening process. This information can determine, selectively, when more screening is warranted. This might include obtaining an identity risk score during the account opening process by leveraging a variety of low-cost data feeds that are predictive of potential future fraud, such as device and behavioral data. A credit union can then decide to ask for document verification or to engage in a manual review.

Cybercriminals look for low-hanging fruit. If they have to complete extra steps to open an account at your credit union, they’ll go elsewhere. The idea is to only create this friction when the need is demonstrated.

Mr. Pascual notes that credit unions need to review their current policies and technologies that are in use. This will help the credit union better focus on different methods, such as thresholds for account opening, to mitigate the risks from new accounts.

For new accounts, credit unions might consider imposing initial limits on remote deposits until trust has been established. For example, they might implement low remote deposit limits for new members at first that are raised over time with increased validation. These limits will most likely seem reasonable to the average new member but will be enough to discourage a criminal.

Deploying Technology to Mitigate Risk in Check Fraud

Finally, technology is key for credit unions to fight check fraud. It is impossible for humans to review every check transaction and deposit, so credit unions need to deploy technology to assist in monitoring and reviewing accounts.

When checks are written against an account at the credit union, there are straightforward steps a credit union can take to protect their member’s account. Because business accounts have been a popular target for check fraud, credit unions can promote automated positive pay tools to business members to match issued checks against those presented for payment. Analyzing transactions presented for payment within the historical context of the account can also reveal suspicious activity. These steps will often help prevent the funding of particularly large fake checks.

Finally, there is a quick and time-tested method for determining the risk inherent in any newly deposited check. Over the course of decades, third-party processors have built successful businesses around detecting bad checks. Integrating their check verification technology into the credit union’s check deposit process can filter out a meaningful volume of fraudulent activity.

Positive pay for business accounts is a strong tool to fight check fraud. However, credit unions need to be aware that not all positive pay solutions are alike, Most banks, in fact, have systems deployed where positive pay only matches serial number and amounts. Optical character recognition advancements and payee matching have revolutionized Positive Pay systems, allowing for a comprehensive and effective approach that matches the payee name to payee issue file source, building a strong deterrent to payee alterations.

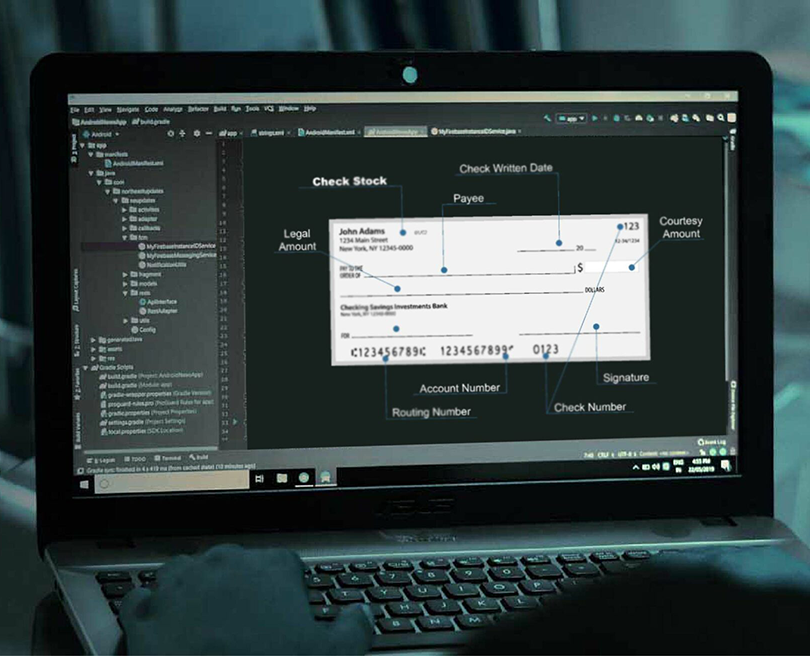

Furthermore, new technologies can validate additional fields like signature, date, and payor to provide a more robust fraud process, while implementing image forensic AI to interrogate the captured check images and detect alterations, forgeries, and counterfeits will increase check fraud detection and customer satisfaction.

Credit unions do not have the big budgets that large financial institutions typically possess, nor do they have the internal IT resources to develop these types of technologies internally. However, working with a fintech like OrboGraph can ease the technical and budgetary burden. The technologies are already developed, tested, and ready for use. And, with the use of APIs and other integration points, these technologies can be deployed for any deposit channel and feed directly into your current fraud review platform.