Establishing “Drop Accounts”: More Than Opening an Account

- Drop accounts are becoming a fraud "staple tool"

- These accounts are easy to open

- Fraudsters are advised to be patient and "age" the account for maximum effectiveness

Many in the banking industry as are aware of one tool that is crucial to a fraudster: drop accounts. For those who are not as familiar, this is an account that fraudsters will utilize to deposit -- or drop -- fraudulent checks to steal funds from businesses and consumers. While there are many variations of drop accounts, typically there are two distinct ways that drop accounts are established.

The first method is where a fraudster will convince a person to allow him or her access to their account to deposit checks in exchange for cash. Fraudsters will exploit acquaintances on social media, or advertise drop accounts on channels like Telegram -- or even YouTube.

The second method involves a fraudster digitally opening an account at a financial institution that does not have strong identification verification. As we've explored previously, the pandemic has made it easier and easier to open drop accounts. In order to keep up with digital-first challenges, credit unions and banks made it a priority to simplify the account-opening process. Consequently, identity verification standards for new accounts can be lower than the previous norm, and scammers can access remote deposit once the new drop account is open.

One major key for drop accounts is that simply opening an account isn't enough. The account needs to be open and legitimate transactions need to occur for a period of time -- anywhere between one month to a year.

David Maimon, Head of Fraud Insights at SentiLink | Professor at Georgia State University | Fraud Intelligence, heads up a team studying this very phenomena.

Growing Trend of Drop Accounts

As noted by Dr. Maimon on LinkedIn:

As part of the Evidence-Based Cybersecurity Research Group's efforts to comprehend the methods employed by fraudsters utilizing drop bank accounts, we gather ATM deposit receipts shared by these individuals within the online underground ecosystem to showcase their achievements. Our dataset comprises receipts from a sample of 80 underground markets involved in acquisition. The first image represents a recent example among the numerous ATM receipts we compile. On average, we collect over 150 receipts per month.

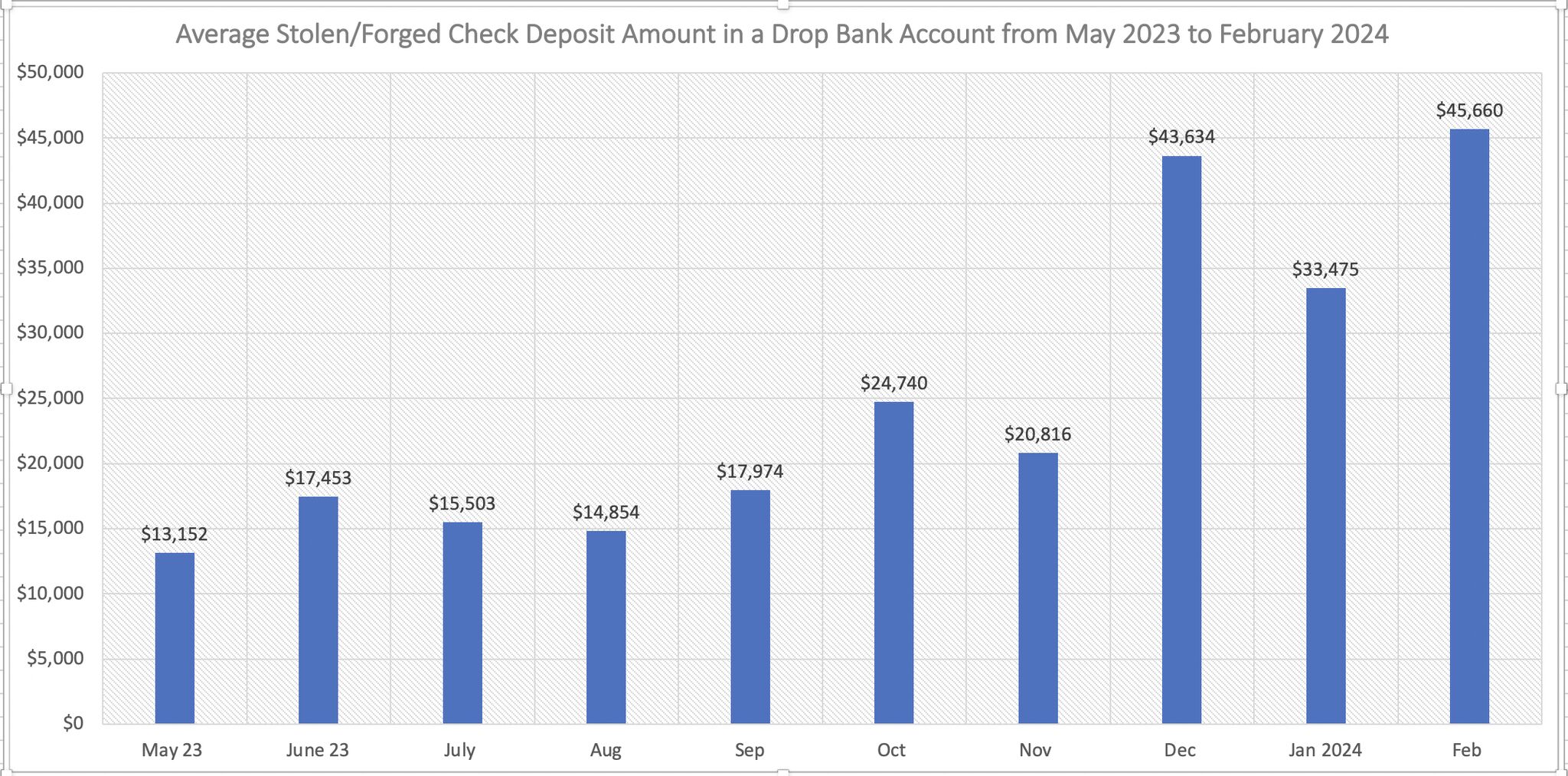

As you can see from the graph, fraudsters will go to great lengths to establish these accounts, making them more valuable to fraudsters as they are more successful in depositing fraudulent checks.

This trend underscores the heightened aggressiveness of check fraudsters in utilizing these accounts and depositing checks with substantial balances.

This trend shows how important is is for financial institutions to monitor all accounts and their activities. This can be done utilizing a combination of transactional/behavioral analytics to review the account activities, image forensic AI to analyze the images of the deposited checks, and consortium data for banks to identify accounts that are frequently being utilized for depositing fraudulent checks. By deploying these technologies, financial institutions can not only detect fraudulent checks being deposited, but identify the accounts being utilized and freezing or closing them -- making it more difficult for fraudsters to be successful.