Ex-Industry Colleague, Now Actor, Meets ‘Bad Actor’ in Check Fraud Drama

- “B-movie level” fraud succeeds more than you think

- Banks are faced with risk-vs.-loss computation

- Even when resolved, the customer can feel let down by the bank

The negative impact of check fraud really hits home when it happens to you, a friend or relative. Unfortunately, as we see in the following drama, you don’t get the Hollywood ending if you’re unprepared.

A former colleague of ours, Eric Oliver, used to work for VSoft and Fiserv. He left for the greener pastures of the film trade some time ago, most recently appearing in the creepy short film, IN THE SHADOW.

Watch in a brightly lit room – it’s hair-raising…and packs a lot of into 8 suspenseful minutes — and perhaps a bit of a foreshadowing for the Olivers of what could happen in payments fraud.

What’s almost as creepy? Being victimized by a check fraudster — and then finding yourself without a great deal of help from your financial institution.

Fraud Case:

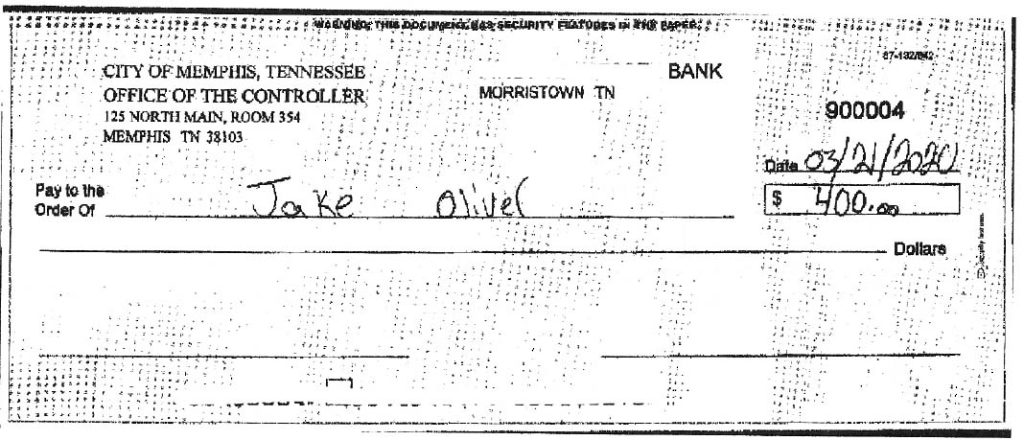

In Mr. Oliver’s case, his horror double-feature began when his son’s bank account was breached by a fraudster, who made several deposits consisting of obviously counterfeit checks. They suspect that the crime began when Mr. Oliver’s son lost his bankcard; however, it was immediately cancelled and replaced.

Also, the fraudulent checks were, even to the human eye at a quick glance, obviously fake — terrible special effects, as they say in Tinseltown. Unfortunately, many banks don’t activate field negotiability tests in their ATMs that would spot things like empty fields because it can give them a lot of false positives, creating a risk-vs.-cost issue.

Also, many ATMs are actually running “stand alone” recognition functions, which are pretty basic. Amount, MICR, maybe a little IQA — banks would rather take the item in and simply deal with the loss risk on a low dollar item rather then tick off the customer.

Too many banks are still lag in the deployment of self-learning and image analysis technologies to real-time deposit channels. — and that’s where the gaps for fraud exists.

Unfortunately, there are no second takes in the world of fraud!

So, the bank in question took the checks as valid deposits, and they remained in the unwitting victim’s account long enough for the fraudster to make withdrawals on the nonexistent funds (moving the funds to Zelle, in this case). That’s when the flick in the horror double-feature began: The Olivers were left on the hook for approximately $1400 while the gears of resolution ground in slow motion.

“On a personal level, I and my family have been insulted by the bank because they have inferred that my son may have perpetrated the fraud,” Mr, Oliver said. He also promised that they would take their business elsewhere once the curtain falls on this feature.

Conclusion:

The Oliver case study is a good example of how difficult it is for larger organizations to service customers in an accelerated fraud environment. 2018 data from ABA Deposit Account Fraud Survey showed that attempted fraud skyrocketed from 19.1B in 2016 to 25.1B in 2018. “We don’t know the current aggregate activity, but we may be in the midst of another major increase,” stated Joe Gregory, VP of Marketing at OrboGraph.

For the Olivers, let’s hope that the bank reimburses their son’s $1400 bucks and they are protected from future problems. For the industry, let’s look for ways to modernize your check processing to strengthen prevention measures!

This blog contains forward-looking statements. For more information, click here.