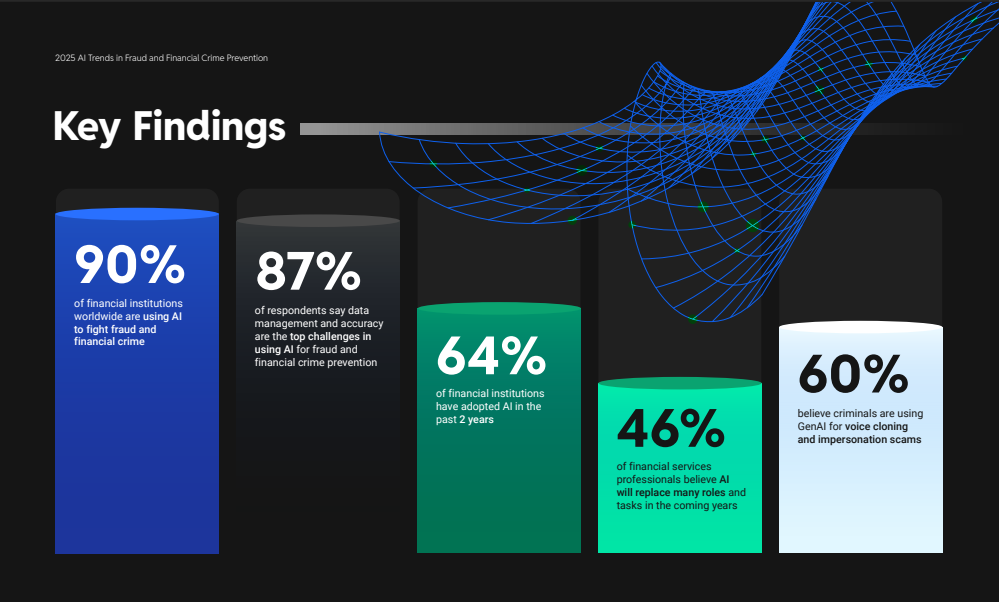

Feedzai Report: 90% of FIs use AI to Fight Fraud and Financial Crime

- A new report states that 60% of fraudsters are using GenAI in scams

- Fighting fire with fire, an overwhelming majority of FIs use AI

- AI has presented measurable benefits

We've all heard the buzz around AI and its potential for fighting fraud -- including check fraud. Well, FIs have put it into action.

According to the Feedzai's 2025 AI Trends in Fraud and Financial Crime Prevention, "90% of financial institutions worldwide are using AI to fight fraud and financial crime."

Artificial intelligence has emerged as the ultimate secret weapon against fraud and financial crime. AI isn’t just a buzzword. According to our global survey of 562 industry professionals, nine in ten banks now rely on AI to detect fraud, with two-thirds integrating these solutions just in the past two years.

So, how are FIs deploying AI to fight fraud? Let's dive deeper into the report.

Widespread Adoption of AI in Financial Institutions

When thinking of "fraud," those in banking industry know it's a broad term encompassing a multitude of approaches. The report breaks it down into different categories, pointing out which categories FIs are utilizing AI for:

- Transaction Fraud: 39%

- Scam Detection: 50%

- Customer Banking: 29%

- AML Transaction Monitoring: 30%

- Identify Verification: 30%

For North American FIs, 46% of AI is deployed for scam detection, 44% for transaction fraud, and 37% for identity verification. When examining these categories, each are major facets of check fraud detection. Scams often involve checks (i.e. overpayment, employment, etc.), fraudulent transactions, and also drop and mule accounts.

Tangible Benefits of AI for Fraud Detection

Results. That's what matters most -- and AI appears to be delivering. The report notes that 64% of FIs have been using AI for fraud prevention for two years or less. And, those FIs are seeing significant results:

- 39% of FIs saw 40-60% reduction in fraud losses

- 43% of FIs saw 40-60% improvement in efficiency

- 34% of FIs saw 40-60% reduction in false positives

And it appears that FIs are fighting fire with fire against fraudsters. The report notes that 60% of fraudsters are using GenAI for cloning scams. In response, a whopping 96% of banks use GenAI for fraud prevention!

AI in Check Fraud Detection

Readers of our blog understand the importance of AI, and how it's useful in many facets of fraud prevention, including:

- Image Forensics

- Behavioral Analytics

- Transactional Analytics

- Profiling and Threshold

- Identity Verification

- Rules Engines

- Dark Web Monitoring

AI technology for check fraud detection is a major reason why banks are seeing a 95% detection rate -- as the models are trained for specific purposes; everything from account opening to analyzing the images of checks being written or deposited.

With the industry shifting and embracing AI, it's no longer simply a "nice-to-have" -- it's a necessity.