FinCEN Reports $688M in Check Fraud Linked to Mail Theft – What Financial Institutions Need to Know

- Check Fraud and the rise in Mail Theft are directly correlated

- FinCEN Analysis shows $688M in check related SARs reported in a six month period following their alert (February to August 2023)

- Image forensic AI is key to identifying counterfeits, alterations, and forgeries

The correlation between the increase in mail theft and rising check fraud is undeniable. Check fraud has been trending upwards since the EMV chip appeared; mail-theft and stolen checks have helped push check fraud attempts and losses to new levels. While many were surprised by the trend, OrboGraph -- a leader in check fraud detection -- saw preliminary indicators and was an early adopter of AI and machine learning technologies to help financial institutions in the fight against fraud.

Recently, FinCEN published its analysis of check fraud-related mail theft via press release. However, the numbers reported are deceiving.

Diving Deep into the Check Fraud/Mail Theft Data

According to the FinCEN Press Release, financial institutions reported over $688 million in suspicious activity related to mail theft-based check fraud in the six months following FinCEN's 2023 alert on the issue.

The Number of Financial Institutions

What needs to be understood is that $688 million is just a portion of the problem. Within their Financial Trend Analysis, Mail Theft-Related Check Fraud: Threat Pattern & Trend Information, February to August 2023, FinCEN notes:

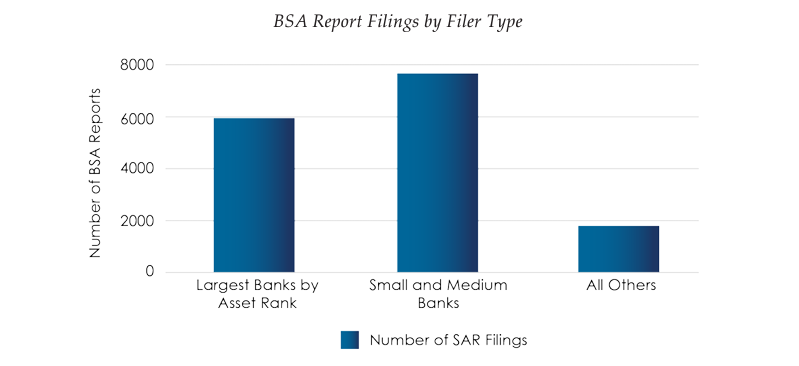

- 15,417 BSA reports related to mail theft-related check fraud during the 6-month period.

- 635 Banks filed 13,618 of the total mail theft-related check fraud BSA reports (88%) -- 31 banks that filed more than 100 BSA reports during the review period.

- 165 Credit unions filed 882 BSA reports.

- 32 Securities/futures firms filed 885 BSA reports.

Source: Financial Trend Analysis, Mail Theft-Related Check Fraud: Threat Pattern & Trend Information, February to August 2023

With only 635 banks and 165 credit unions reporting mail-theft related check fraud -- weighed against 4,500+ banks in the US and 4,600+ credit unions -- this equates to 8-9% of financial institutions.

We cannot surmise the full extent of check fraud/mail theft with basic arithmetic (dividing $688M by 0.92). Mail-theft-related activity is regional, and a vast majority of the country may not be experiencing the mail theft issue (yet). However, we need to understand that these findings are based on a small portion of the actual amount of check fraud/mail theft that occurring.

Types of Check Fraud Reported

The report from FinCEN breaks down check fraud methodology to three major categories:

- 44% of stolen checks were altered and deposited

- 26% were used as templates for counterfeit checks

- 20% were fraudulently signed and deposited

In comparison, Comerica recently posted an infographic with a much different breakdown:

- Counterfeit: 60%

- Alteration: 25%

- Endorsement (forgery): 1.5%

The discrepancy shows that each financial institution will encounter different methods dependent on region and the fraudsters.

However, whether counterfeit, forgery, or alteration, the only effective way to detect fraud is via analysis of check images, targeting check stock, print/handwriting styles, and discrepancies in signatures.

To see a demonstration of image forensic AI, click the link below.