IntraFi Q2 2024 Bank Survey: 62% Support Shifting Liability for Check Fraud to BoFD

- Check fraud rates continue to climb

- Delays in repayment for bad checks are becoming common

- A majority of financial institutions want liability shifted to BOFD

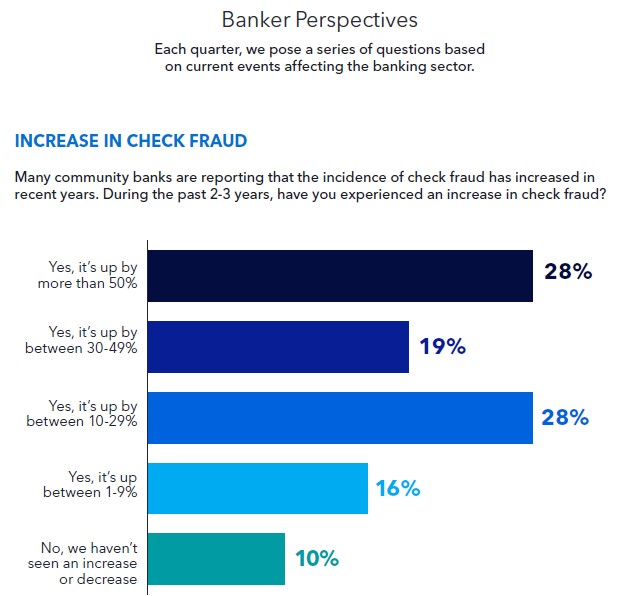

The recently released IntraFi Executive Business Outlook Service report makes it clear that check fraud has significantly increased, with 90% of community bankers reporting higher levels of fraudulent check-writing. Furthermore, 28% of community bankers noted an increase of over 50% in fraudulent check writing over the last three years.

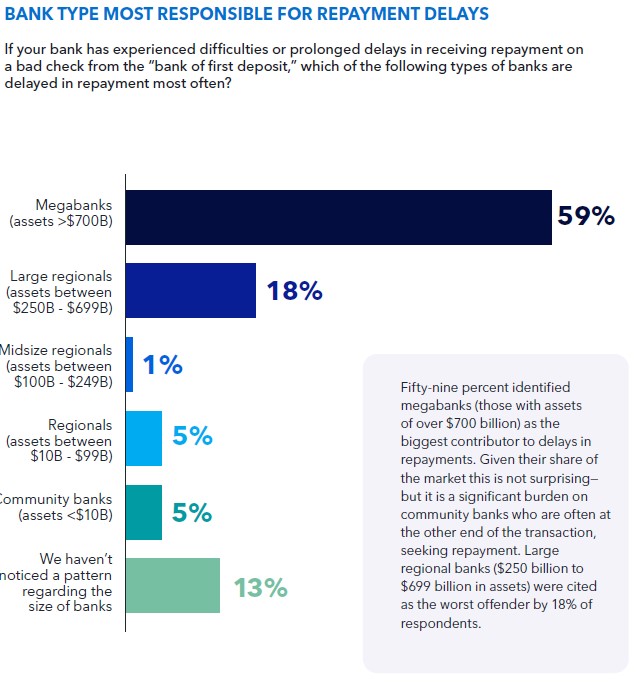

One major issue that has arose is the issues with repayments -- specifically when larger banks prolong the process of returning funds from fake deposited checks. Megabanks (those with assets over $700 billion) are identified as the primary source of delays in repayment on bad checks, with 59% of respondents pointing to them. Large regional banks (those with assets between $250 billion to $699 billion) were cited by 18% of respondents as contributing to repayment delays

Community Banks Looking Towards the Government?

A majority – 62% of respondents to IntraFi’s survery – say that policymakers should address check fraud by shifting liability for the fraud to the BOFD, or “bank of first deposit.”

During our most recent Check Fraud Roundtable in May 2024, Steve Cree -- VP, ECCHO Rules, Compliance and Engagement -- provided attendees with clarity on the rules and regulations for fraudulent check returns.

There are several regulations that govern the return of a check item, including UCC 4-301 that notes "if a payor bank settles for a demand item before midnight of the banking day of recept, it may revoke and recover the settlement if, before its midnight deadline, it (1) returns the item or (2) returns an image of the item in accordance with an agreement with the party to which it is returning the image."

What arises is the timing issue, as the "paying bank may not return an item for any reason after the deadline under the UCC or Reg CC; it becomes accountable for the amount of the item."

If a BoFD misses these time frames, they are now liable.

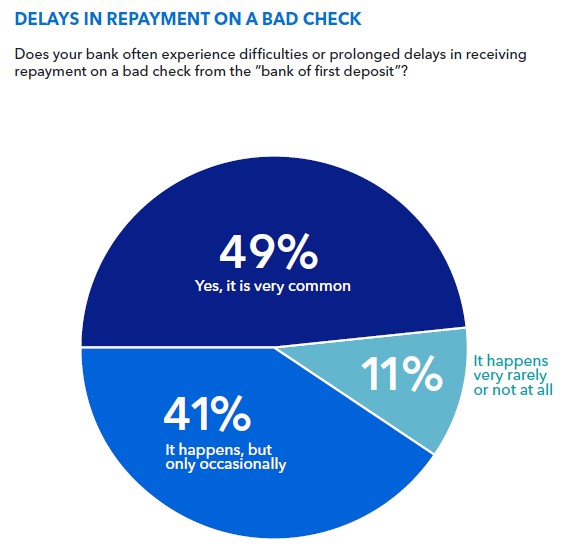

Another prominent issue is common delays in repayment on bad checks – in fact, 90% of bankers report experiencing difficulties or prolonged delays in receiving repayment. 49% of respondents noted that payment delays are a common issue, while 41% said it happens occasionally.

How Policymakers Should Approach Check Fraud Issues

According to the survey, bankers are looking for policymakers to take the following actions:

- Shift liability for check fraud to the “bank of first deposit” (62%)

- Law enforcement should better target check fraud as an issue (49%)

- Congress should authorize appropriations to hire more postal police officers (14%)

And, while we have seen some government officials take action, things have been slow to develop. This means that banks -- both the BoFD and the paying banks -- need to be proactive in deploying innovative technologies like AI and machine learning for on-us and deposit fraud detection.

For on-us fraud detection, a multi-layered strategy deploying machine transactional analysis, image forensic AI, rules engine and a review platform provides a strong defense against check fraud.

For deposit fraud, data is king. It is recommended that banks deploy a combination of transactional analysis, behavioral analysis on the account, a rules engine, consortium data, image forensic AI, and a account monitoring a review platform.

We agree that policymakers need to step up. However, relying too much on them to enact more rules and regulations, while hoping other financial institutions will change their procedures for repayment is fools gold. Defense -- aka check fraud detection -- is the only way for banks to secure themselves and their customers.