MICR: Do We Need Magnetic Ink Anymore?

- Magnetic Ink Character Recognition traditionally required scanners to read MICR code

- Today many checks are not printed with the magnetic ink needed for MICR

- What are the implications of phasing out MICR?

The Troy Group is a technology and security solutions company specializing in secure check and document printing. In a recent post entitled The Importance of MICR Check Printing in 2025, they note that MICR (Magnetic Ink Character Recognition) has long been the standard for check processing, with scanners relying on the magnetic properties of the ink to read the critical account and routing numbers.

This allowed for automated, high-speed processing of checks through specialized MICR scanners...at least when the specifications are correct.

As noted by Digital Check:

The first thing that’s important to understand is that MICR – which stands for Magnetic Ink Character Recognition – is a very black-and-white technology. If the check is printed within industry-standard specifications, the scanner on average reads the MICR line correctly with up to 99.998 percent accuracy. If the MICR printing is outside of spec, then all bets are off. Almost all MICR reading “errors” mean there is a problem with the MICR printing on the check, not with the scanner itself.

While MICR was the standard only a few decades ago, the landscape has shifted as more checks are printed without magnetic ink.

MICR vs OCR & AI Recognition

The traditional MICR reading process can only be applied when a physical check is present and scanned by a specialized scanner. However, a large portion of checks are now deposited via ATM and mRDC where the physical check is never received by the financial institution to scan. Rather, FIs leverage technologies like optical character recognition (OCR) and, most recently, advanced AI software to interpret the MICR data.

OCR is less reliable and accurate than the magnetic ink-based approach -- typically achieving a 80-85% read rate. There are many factors that affect the read rates, including image quality, low quality scanners, etc. Still, this technology enables banks to accept checks through all deposit channels.

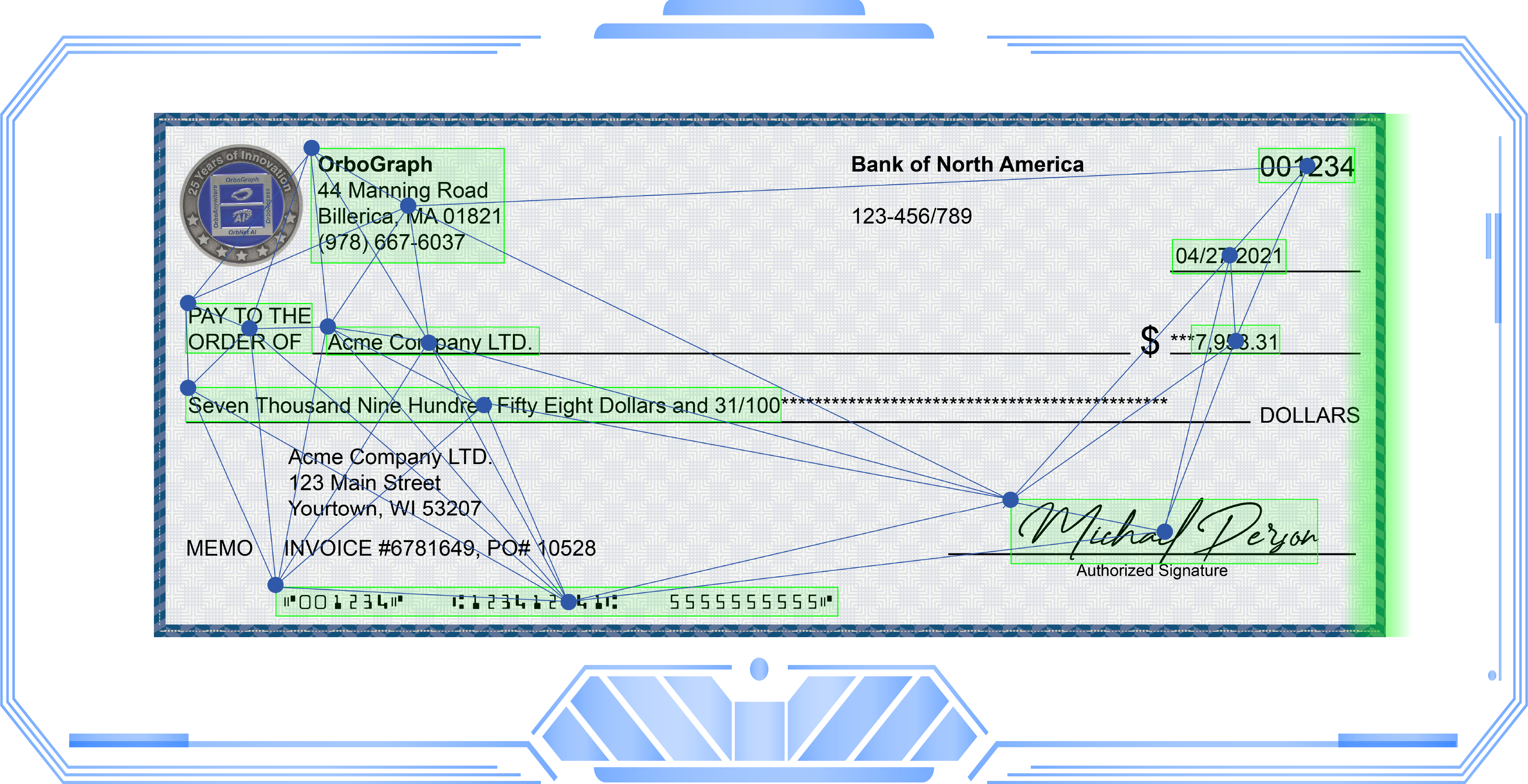

However, AI-based check recognition like OrbNet AI is not the same as OCR. OCR relies on algorithms and legacy technology to read and extract data from the images of checks. AI-based check recognition models have been trained with millions of check images, enabling over 99.9% read rates and accuracy rates of 99.5% on all fields of the check, including the MICR line (with or without magnetic ink needed).

More importantly, this technology leverages models for field detection, allowing location of the MICR line and accurate reading vs. returning an "error" because the MICR line is not meeting the specification noted by Digital Check.

Does the Industry Need Magnetic Ink?

The Troy Group notes industries that still rely on check payments:

The auto industry uses checks to buy cars from customers. Insurance companies use checks to approve claims. Governments and payroll departments also use checks. The checks used by all of these industries require MICR toner, a correctly positioned MICR line, and MICR fonts.

And, as noted by Rosetta Technologies, Reg CC still requires magnetic ink:

Regulation CC section 229.2(u)(4) states: "non-cash item" means an item that would otherwise be a check, except that it has not been preprinted or post encoded in magnetic ink with the routing number of the Paying Bank.

Checks and Substitute Checks (IRDs) are legally required to include a magnetic code line in order to be treated as a "cash item" for processing in the U.S. Payment System.

However, industry experts note that specialized scanners for reading the magnetic ink are no longer a necessity -- many banks will accept checks without the specialized ink, and new AI-technologies can accurately read the MICR line AND other fields to further automate check processing.

What is your opinion?