Technology has Turned Check Fraud Into a Business

- Fraud has grown from creating TENS of millions in losses to HUNDREDS of millions

- Fraudsters can sell their wares digitally

- Now there are even refunds made available by fraudsters selling to new criminals

Suparna Goswami, associate editor at the ISMG network, recently spoke to David Maimon, professor of criminal justice and criminology at Georgia State University, on FraudToday.io about check fraud.

Mr. Maimon pointed out one of the major hurdles facing banks today: They are not, as of now, able to share information with each other about fraudulent checks.

"Banks cannot really share information amongst each other with respect to stolen checks, the identity of individuals, and that is a big issue," says Maimon. He says the volume of fraudulent checks has increased dramatically over the past two years. "There is no depository where banks can go to figure out whether a check is stolen or not or whether an identity is stolen or not."

At the beginning of the pandemic, Mr. Maimon points out, we were looking at TENS of millions in losses due to check fraud, Now, it's HUNDREDS of millions. And that estimate, he says, is very conservative given the ease with which "new" fraudsters can get information and "fraud guides" from experienced thieves who profit from the information exchange.

It's a Business

Mr. Maimon explained that check fraud has evolved from simply "person selling stolen checks" to selling digital images of the checks -- a physical copy of a check takes days to be sent to the new fraudster, whereas a digital scan is instantaneous-- and even fraud tutorials, without any actual materials or checks included.

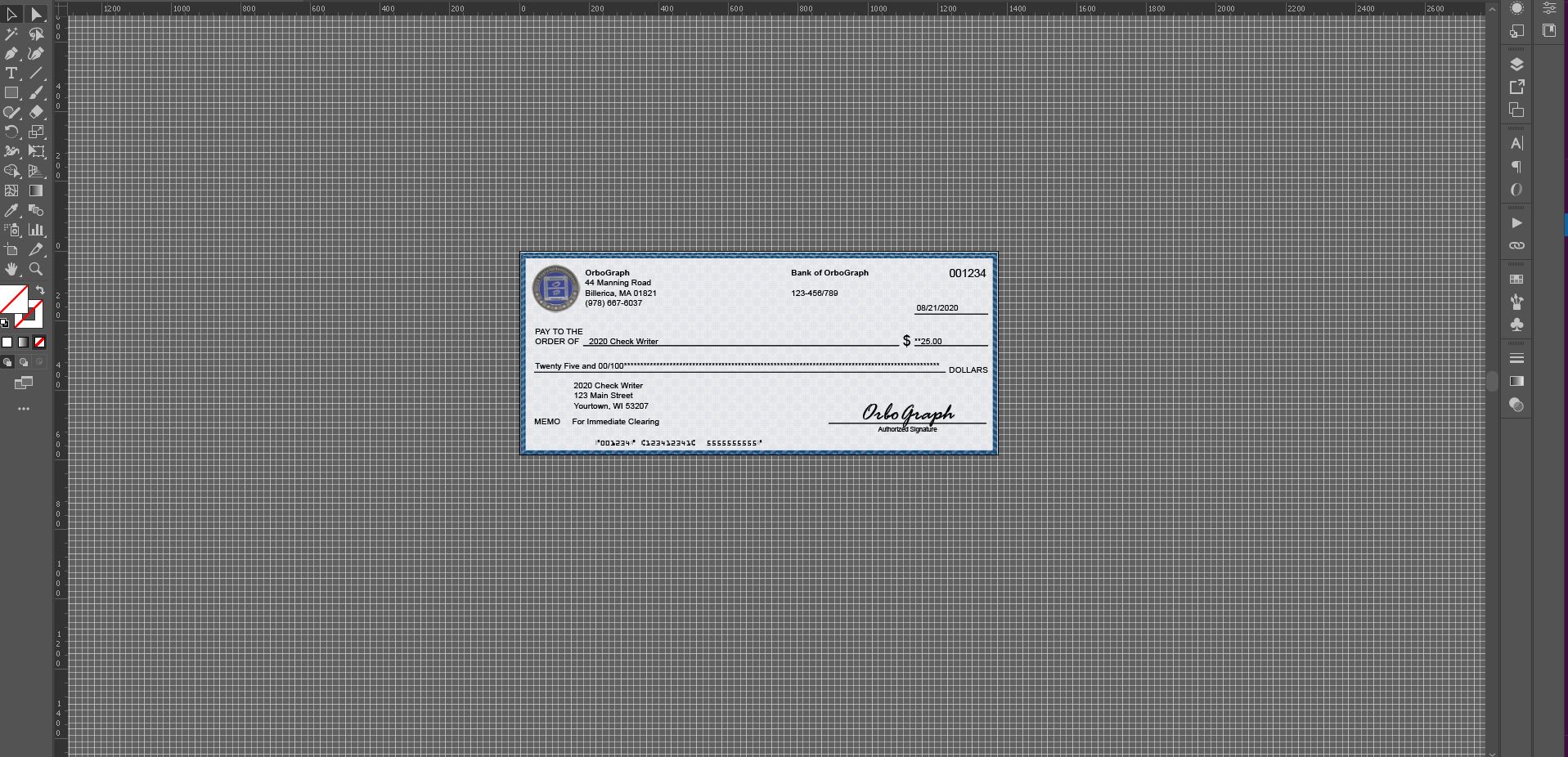

With the advancements in illustration and photo editing tools like Photoshop, fraudsters are able to create new counterfeit checks with stolen information or take a photo of a stolen check use simple software to create multiple checks. The checks are then printed through a standard desktop printer and deposited through mRDC, where a physical check is never received by the banks.

It's become such a business-like transaction, Mr. Maimon explains, that some fraudsters will actually refund your money if the stolen check and/or information they provide doesn't work.

Technology is Not There -- We Don't Agree

At the 8:29 mark of the video, Ms. Goswani brings up a previous discussion with Mr. Maimon, stating that "you had mentioned that banks are currently not equipped to spot fake checks. So what needs to change in 2023? What is the situation now and where do banks need to move?" Mr. Maimon's response focuses on technology, remarking that the technology is not out there yet.

This is where OrboGraph is in disagreement with Mr. Maimon. While we respect his opinion, we currently know the technology does exist. Behavioral analytics powered by AI and image forensic AI are both powerful tools that work together to identify 95% of targeted use cases of check fraud -- counterfeits, alterations, and forgeries.

The issue stems from internal resources -- whether the budgetary or internal fraud/risk team. Like any business, banks need to properly budget for a project to upgrade or integrate these technologies into their systems. Additionally, these systems are able to flag anomalous behaviors and flag suspicious items, but still require internal fraud teams to review the items. Early on in the training phase, these systems will need to learn what items are good and which are fraudulent. While there will be a large number of false positives, over time these will reduce as the systems continue to build profiles and learn.

No technology can currently spot 100% of fraud. We can take a look at credit card fraud: Big companies like Visa, Mastercard, and AMEX are not able to stop 100% of fraud with their vast resources and state-of-the-art technology, and neither will check fraud technologies.

However, with the number of check fraud attempt growing at an alarming rate, the ultimate goal is to mitigate risk, deter fraudsters by making it more difficult to succeed, and reduce losses.

Remember, technology has enabled fraudsters to turn check fraud into a business -- it is technology that will put them OUT of business.