Accessing Tutorials to Commit Check Fraud – One Click Away?

- Not to be confused with "money laundering"

- Techniques for check washing are offered on YouTube

- Checks benefit from physical security features

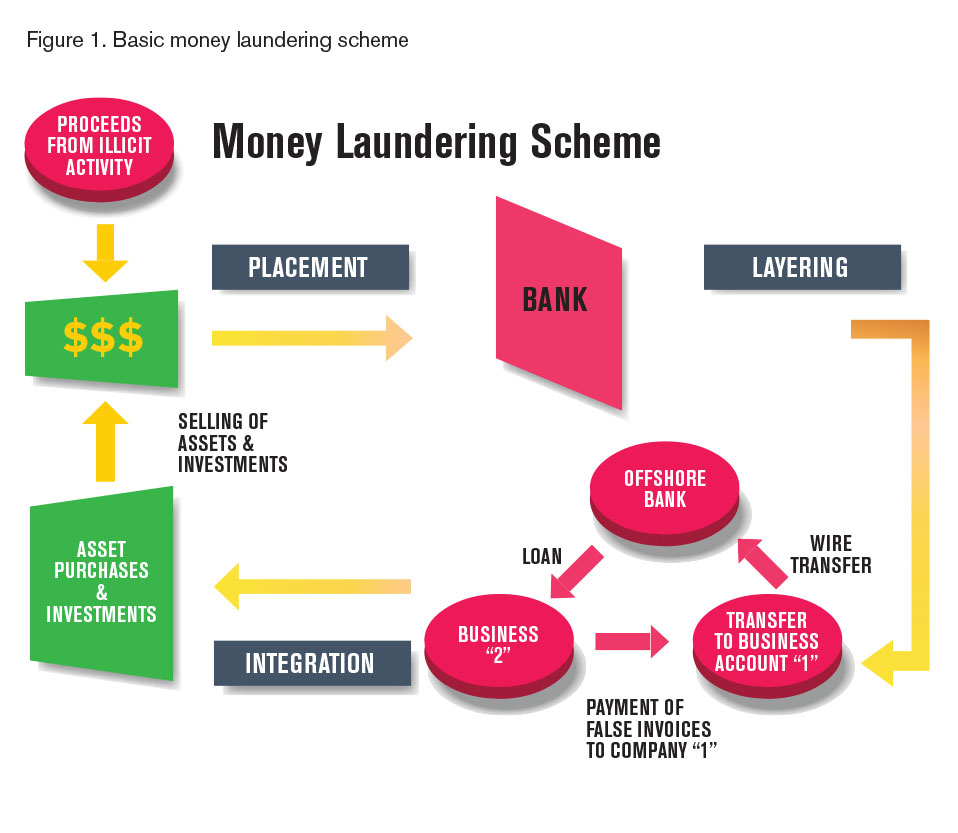

While explanations of money laundering can be complex and require charts and graphs to comprehend how the schemes work, check washing is much more basic and easy to understand.

As most in the banking as aware, check washing means you procure a check or checks by whatever means necessary, remove the amount and "pay to" information (the "washing"), and alter it to serve your own nefarious purposes. No chart needed. Not even a printer.

While you would expect fraudsters to learn the "tricks of the trade" from other fraudsters, or possibly keeping their techniques secret, the internet makes it very easy for fraudsters -- new and old -- to access tutorials with relative ease.

ACAMS Today Chart

(Click to enlarge)

"For Educational Purposes Only"

It turns out that there are lo-fi YouTube videos available to show "hobbyists" exactly how to remove ink from checks "for entertainment purposes only." Here's just one example:

"For entertainment purposes only..."

While the disclaimer may be a way to keep a fairly sketchy how-to videos on YouTube, this is just one of many different how-to guides and videos that can be easily accesses through a Google search. And these techniques are still being used today.

The restaurant owner, who asked that his name and the name of his business not be published, said he wrote checks to contractors for $90 and $350 and mailed them in one of the mailboxes in front of the post office at Main Street and Center Street.

Later, he discovered that the checks had been rewritten to different recipients and for drastically higher amounts — $8,500 in one case and $7,200 in another case.

Solutions For this Simple Scam

While the scam above is nothing new, it still causing issues for banks and their customers. The ease with which scammers can access tutorials to commit fraud and obtain supplies for check washing -- as detailed in the video above -- makes it more important than ever to invest in high security checks that contain fraud-busting features such as security holograms and thermochromatic ink that disappears when heat is applied. Even makers of pens like Uni-ball promote check security features.

In addition, banks need to continue to integrate technologies that can detect these "washed checks" and protect customers. Depending on the fields that are being altered, a positive pay system that uses image-analysis to extract the payee name from the image of a check and compares to approved lists will flag the check before it hits your customer's account.

Additionally, image-analysis deploying artificial intelligence and machine learning technologies extracts the data from the amount fields (CAR/LAR) for comparison, as well as setting amount thresholds for review, providing customers with the protection needed against the fraudsters.