The Payments Podium Podcast: “Specialization” in Check Fraud Rings

- Check fraud is discussed on The Payments Podium

- Some of the "specialized skills" need for check fraud are identified

- Many financial institutions struggle with rules and regulations that determine liability

As has been made clear in this space many times previously, even in today’s increasingly digital world checks remain a surprisingly relevant — and vulnerable — payment instrument. As highlighted on The Payments Podium by Payments Professor Kevin Olson and guest Steve Cree from ECCHO, check fraud is not just alive -- it's thriving.

During a fascinating 30-minute discussion, they cover the following topics:

- The rise of specialized fraud operations

- How mail theft fuels check fraud

- Who is liable in fraud cases?

- Why education is key for businesses and banks

- How Rule 9 helps combat counterfeit checks

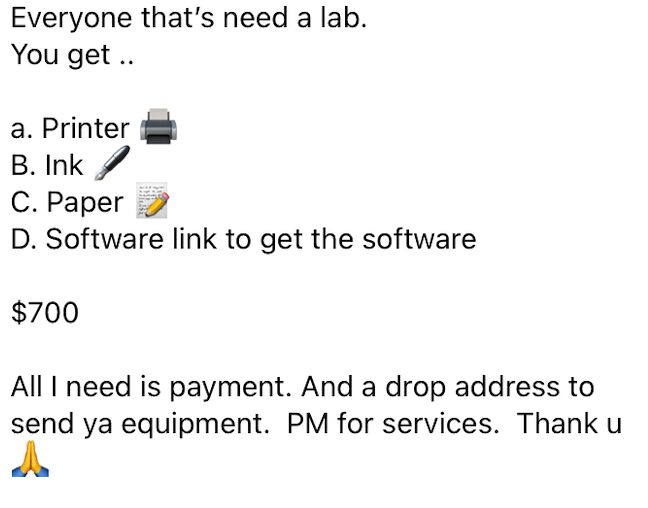

The conversation mentions that today’s check fraud often starts with a simple but devastating act: mail theft -- a subject we have covered extensively in our blog. Criminals steal checks from mailboxes using pilfered U.S. Postal Service master keys, then either alter the stolen checks or use easy-to-attain technology to create convincing counterfeits. With inexpensive software and printers, fraudsters can quickly mass-produce fraudulent checks, often selling them in bulk on the dark web — with a guarantee, no less!

Check Fraud Involves "Specialized" Skills

What’s even more alarming, note Mr. Olson and Mr. Cree, is the rise of specialization. Fraud rings have evolved into sophisticated networks where different groups steal, alter, print, and deposit checks — almost like an efficient and illicit assembly line. Some even "age" new bank accounts with legitimate-looking activity before using them for fraud, making detection harder for banks.

We see specialization in check fraud, with almost a mass production of check fraud.

As the methods become more sophisticated, financial institutions must stay vigilant and implement robust fraud detection solutions to protect their customers and their own bottom line.

(Source: Eric Huber)

FIs Struggle with Liability

Mr. Olson and Mr. Cree also touch upon the fact that the issue that many financial institutions struggle with the rules and regulations that determine accountability. While the liability for check fraud often falls on the paying bank, it will vary depending on whether the fraud involved alterations or counterfeits.

Fortunately, there are solutions available to help financial institutions. One such solution is Rule 9, established by the Electronic Check Clearing House Organization (ECCHO, which is available to ECCHO member banks only) to provide a warranty against counterfeit or forged checks. By leveraging this rule, banks can recoup funds lost to fraudulent checks, reducing their exposure and incentivizing them to invest in robust fraud detection capabilities.

The industry is starting to put more importance on education for their staff -- as more individuals are receiving different certifications, from fraud specific to Nation Check Professional certifications. Combining this expertise with technologies like image forensic AI are both important ingredients in an FI's overall check fraud detection strategy.