Check Cooking Lab: Low Investment, High Return

- "Check cooking" is on the rise

- Florida's Attorney General has issued a warning

- Initial investment for deposit fraud is surprisingly low

Florida's Attorney General, Ashley Moody, recently issued a warning about a digital check manipulation or "check cooking" scheme where fraudsters alter stolen checks to change the payee and payment amount.

The warning comes in the wake of an investigation in which the Cyber Fraud Enforcement Unit, led by Attorney General Moody, assisted law enforcement in apprehending a Tampa man involved in manipulating checks. The fraudster in question managed to steal over $50,000 from victims before being caught and now faces 30 years in prison.

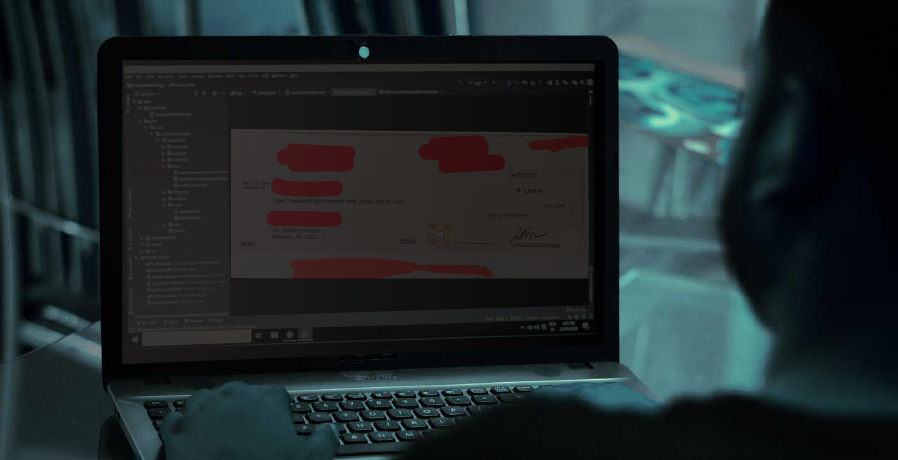

Check cooking is a fairly simple process. A fraudster obtains information from stolen checks and adds that to digital check stock templates found easily online; or, adds it to physical check stock ordered from legitimate vendors. This enables a fraudster to create numerous counterfeit checks in minutes.

Low Investment; High Return

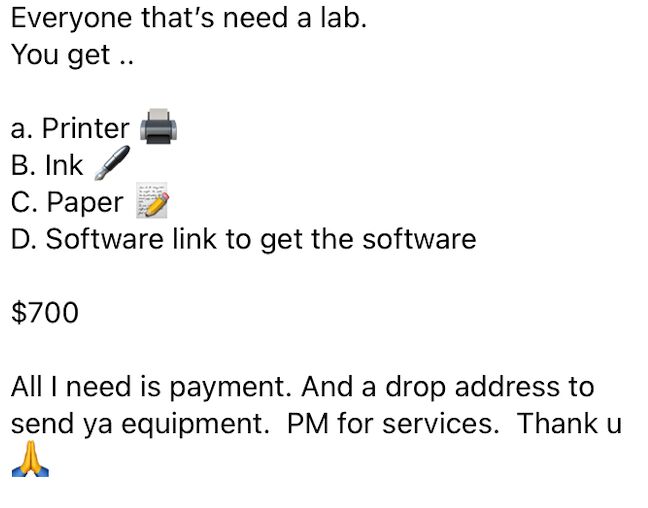

As TD Bank Cybercrime Research & Analysis Leader and Curator of Fraudsterglossary.com Eric Huber will tell you, "There is a whole ecosystem on Telegram for new fraudsters to get training, equipment, and all the stolen checks they need to get started in deposit fraud."

In fact, he posted on his LinkedIn page a sample online offer from Telegram:

A $700 investment -- plus access to "training," if needed -- and you're on your way.

However, according to a video posted on LinkedIn, former fraudster turned #FraudFighter Alexander Hall details that it can get as cheap as $300!

Flaws with Check Cooking

Check cooking is indeed a cheap investment from which fraudsters can gain thousands, if not millions of dollars. However, the flaw within check cooking may lie with the fraudsters themselves.

The software to duplicate check stock is readily available, and, if the fraudster is meticulous enough, they can create a near identical check. However, this is rarely the case. Most in the check fraud industry categorize counterfeits checks as either "skilled" or "unskilled." As the names suggest, skilled counterfeits are nearly identical to the correct check stock; unskilled, however, is not (see example 1 and example 5 in our Check Fraud Detection Challenge). What we are seeing across the country is that many fraudsters are opting to take a standard template check stock and add stolen information, like the account and routing numbers and payor.

The end product resembles a standard check, but it does not match the standard check stock for the account. In order for financial institutions to detect this type a fraud, they need to deploy image forensic AI to analyze the incoming checks and compare them to previous cleared checks. This is the most effective path to identifying counterfeit or "cooked" checks.