U.S. Consumers’ Use of Personal Checks: Evidence from a Diary Survey

- Business and government still rely on checks to a greater degree than individuals

- While fraud is prevalent across all payment channels, checks remain the biggest target

- Evolving tech is making check fraud prevention more effective in spite of its status as a "big target"

From the Federal Reserve Bank of Atlanta comes an informative overview of check usage entitled U.S. Consumers’ Use of Personal Checks: Evidence from a Diary Survey. The authors look at 1,600 individual transactions to gain an understanding of what check payments are currently used for—by dollar value, and by payee—and who uses checks (in terms of demographics and income).

The study, it should be noted, covers the 2017-2018 time period. The data are taken from the 2017 and 2018 Diaries of Consumer Payment Choice (DCPC), a collaboration of the Federal Reserve Banks of Atlanta, Boston, and San Francisco (Cash Product Office).

Report Highlights

- Most paper checks are written by businesses and government—60 percent of checks by volume in 2015, according to the 2018 Federal Reserve Payments Study (FRS 2018).

- In 2009, U.S. consumers age 18 and older made 13 percent of their payments with checks; in 2018, 5 percent.

- In 2009, 87 percent of consumers reported using a paper check at least once during the year. In 2018, 61 percent of consumers reported using a paper check at least once.

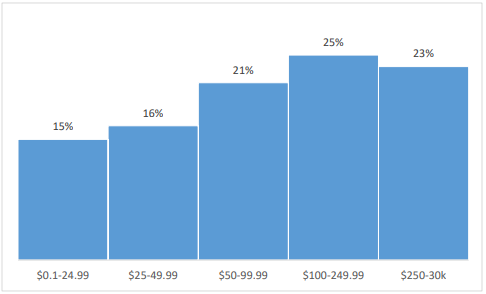

- The median dollar value of checks written in the two years was $100. Three-quarters of checks are for less than $250.

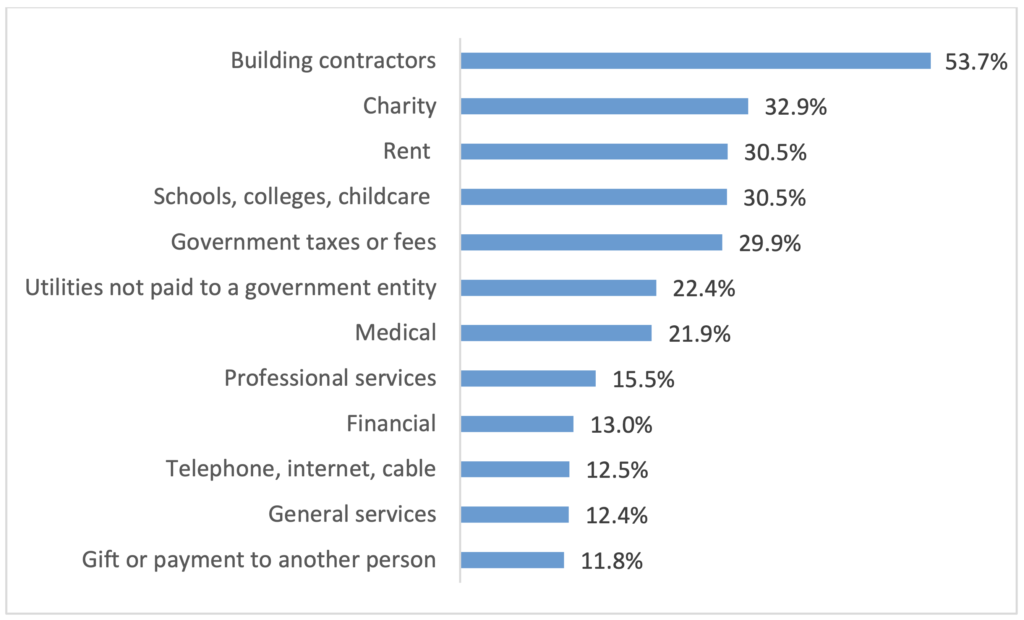

In the figure below, the report breaks down the share of check payments by payee type, displaying that the majority of checks written to businesses, charities, services, and utilities:

The study also found that, compared to transactions using other payment instruments, checks had a relatively high average dollar value, around $300, compared to $84 for all the rest of the transactions.

Check Fraud Targets: Who is Writing Checks?

As we discussed in a blog post at OrboNation regarding the demographics of personal check use, the 2018 Federal Reserve Payments Study (FRS 2018) reveals that most paper checks are written by businesses and government—60 percent of checks by volume in 2015.

The recently published ABA Fraud Study found that, in 2018, check fraud accounted for 47 percent -- or $1.3 billion -- of industry deposit account fraud losses. The study goes on to note that, of that number, 63 percent of check fraud is on consumer accounts.

This is one of the reasons that advances in machine learning and image analysis -- as explored in the webinar we produced with NICE Actimize and featured in last week's blog -- are more and more vital to financial institutions as they seek the safest and most secure transactions path for their members.

Different tests and validations include:

- 80-90% successful matching of payee to account holder name

- Signature verification comparison to previously cleared checks and two signature presence verification for business checks

- Amount verification comparison to previously cleared checks to payees

- Check stock validation to detect anomalies on the image of the checks

As the fraud threat escalates, it's comforting to know that tools are currently available -- and steadily improving -- for banks to combat fraudsters, mitigate risk, and reduce fraud losses.