USPS New Hires the Latest Threat for Stealing Checks?

- Post Office "Inside Jobs" are a concern

- New hires may be involved in activities like mail theft, fraud, and other criminal acts

- "As bad as you think it is, it’s much worse!”

It looks like the U.S. Postal Service is being infiltrated by "opportunistic" new hires who are not interested in delivering mail, but rather using their positions for nefarious purposes.

As noted on msn.com, the Inspector General of the U.S. Postal Service Office released a report in October that revealed employees “brought personal belongings onto the workroom floor,” such as bags or heavy coats, “which were used to conceal stolen mail and packages.”

The insider said the new hires are "not here to deliver mail" and are instead focused on exploiting the Postal Service for their own gain.

USPS New Hires the Newest Threat for Check Fraud?

The article suggests these new hires may be involved in activities like mail theft, fraud, and other criminal activities that undermine the core mission of the Postal Service.

“While most Postal Service employees work conscientiously to deliver the nation’s mail, there has been a small number who have stolen, delayed, or destroyed mail and packages,” the report said.

That small minority of employees swipes packages suspected to contain “credit cards, checks, cash, gift cards, narcotics, high value articles, and other sensitive items.”

Frank Albergo, president of the Postal Police Officers Association, pulled no punches, saying in a November interview with San Diego's KNSD, "As bad as you think it is, it’s much worse!”

“They only work for a few months at the Postal Service,” Albergo said. “They’re literally only getting the job so they can steal mail and quit! I mean, it’s amazing!”

“You have criminal organizations, gangs, that are actually recruiting people to get a job in the Postal Service, so they can rob mail and drain bank accounts,” he likewise warned.

Is This Really a New threat?

Mail theft is not a new phenomenon. However, most see it as an outsider threat. However, there have been several events in recent history that show "insider-crime" may be more prevalent:

- October 2024 – Former Houston USPS carrier indicted in $1 million mail theft, check fraud scheme

- September 2024 – Philadelphia mail handler accused of stealing 112 US Treasury checks while on the job

- July 2024 – New York: Five individuals, including two postal workers at JFK, charged with theft of government funds related to U.S. Treasury Checks – over 125 checks worth $4M

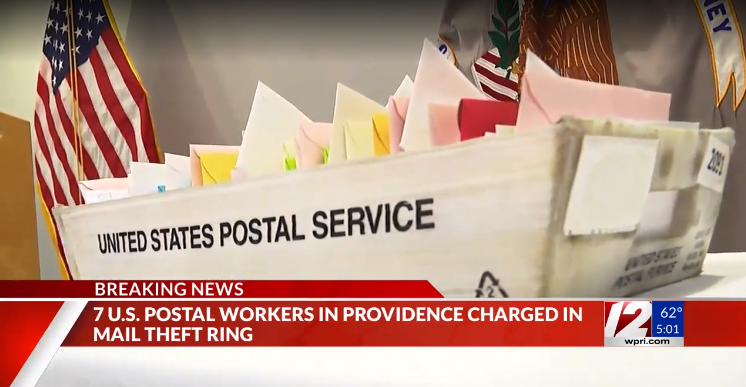

- May 2024 – Rhode Island: One Supervisor and six USPS employees arrested for stealing mail at USPS Distribution Center

- November 2023 – North Carolina: Postal worker among 3 charged in $24 million stolen check scheme

Additionally, in a recent audit of 84 postal facilities, 76 facilities across 25 states and the District of Columbia found untracked or unsecured arrow keys.

Protecting Consumers from Check Fraud

As we've noted recently, there are still a significant number of checks mailed via the USPS -- both personal checks and businesses. Many of these individuals and businesses are either unaware of the threat or believe this can't happen to them...until it does. This is where financial institutions need to communicate to their customers the dangers of mailing checks.

Financial institutions can further protect their customers by deploying a multitude of technologies that detect counterfeits, forgeries, and alterations before funds are lost. This includes -- perhaps most importantly -- image forensic AI to analyze images of checks. As stolen checks are altered (both washed or digitally altered) or counterfeited, images of the deposited checks are compared to previous cleared items to identify any issues with different aspects of the checks, including check stock, discrepancies in amounts, and writing styles (font and handwriting).

Until the USPS is provided funding to address stolen mail issues, criminals will continue to find new ways to get their hands on stolen checks. FIs cannot completely prevent this, but they can deploy the right technologies to protect their customers.