VALID Systems Bold Prediction: Est. $35B Check Fraud Losses in 2025

- Check fraud losses continue to accumulate

- There are solid recommendations available to fight fraud

- Effective tools can be leveraged for protection

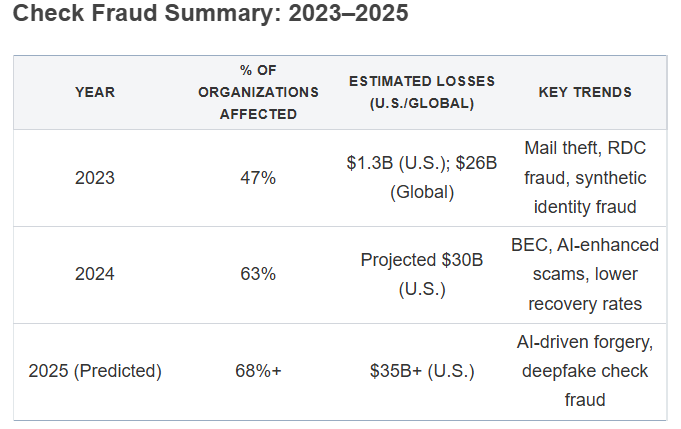

As we near the end of 2025, many are wondering what the total losses will be from check fraud. While concrete numbers are not available, our friends at VALID Systems made a shocking prediction: $35B+ in estimated check fraud losses in the US for 2025.

Source: VALID Systems

While this is just a prediction, it's far from outlandish; many financial institutions are still struggling with the challenges of both On-Us and Deposit check fraud.

Recommendations for Tackling New Check Fraud Challenges

Fraudsters and their tactics are not static. While tried-and-true methods such as check washing still remain part of the fraudster repertoire, VALID Systems provides us with some evolving tactics now being utilized by fraudsters. They include:

- Leveraging social media and other messaging networks to share tactics and schemes

- Advanced AI-based handwriting generation tools to replicate logos, holograms, and even mimic handwriting/signatures

- Leveraging insiders to gain insights or commit check fraud

To tackle the challenges, VALID Systems provides a list of recommended tools to utilize in a multi-layered technologies approach for check fraud:

1. Deploy AI-based image analysis

2. Use Positive Pay across all check types

3. Enable real-time alerts and monitoring

4. Offer guaranteed-funds products

5. Leverage behavioral analytics and consortium intelligence

As we've noted, a multi-layered technology approach is the most effective strategy for tackling both On-Us and Deposit Fraud. Each layer provides addition defense and enables banks to analyze and scrutinize each check several times -- ensuring that if a fraudulent item passes by one layer, it will be flagged by a different technology in another layer.

As we near the end of 2025 and prepare for what is to come in '26, financial institutions can rest assured that the tools necessary to curb the rising trend of check fraud are readily available to them.