43% of FIs Report Increase in Fraud — Time to Fight Back with AI

- Scammers have easy access to sophisticated AI tech

- As a result, it's easier and easier for "the average scammer" to engage in sophisticated fraud

- The banking community is responding by deploying AI tools to combat this new wave of fraud

It's no secret that banks are dealing with increased fraud as scammers leverage advanced technologies like AI and synthetic identities more and more easily. As reported by PYMNTS.COM, AI is "both foe and friend in the eternal battle against fraud." AI makes sophisticated scams easy for the "average Joe," they report, and the result is significantly higher fraud costs for large banks.

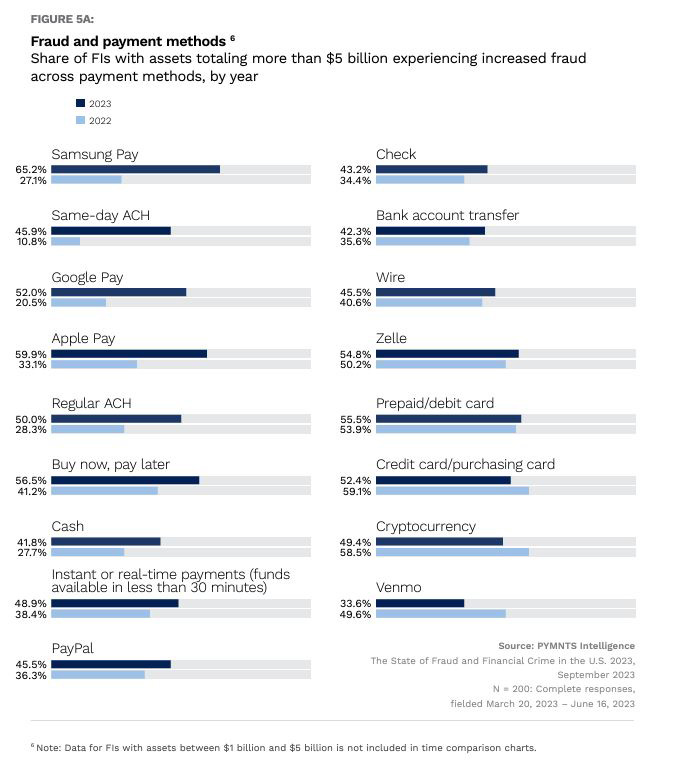

As joint research from PYMNTS Intelligence and Hawk AI revealed in the report “The State of Fraud and Financial Crime in the U.S.,” headed into the end of 2023, 43% of FIs have experienced increased fraud as compared to 2022. The average cost of fraud for FIs with assets of $5 billion or more also increased by 65%, from $2.3 million in 2022 to $3.8 million in 2023.

The joint report collected 200 responses from executives working with FIs with assets of at least $1 billion between March 29 and June 16 . Respondents were also part of our 2022 survey on fraud FIs experienced.

Check Fraud Increased from 2022 to 2023

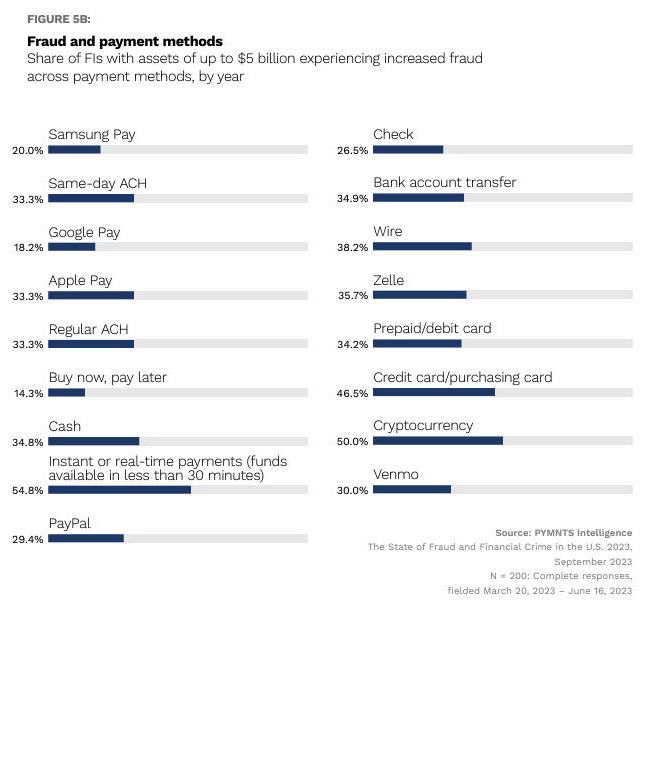

The joint report shows that checks experienced an increase in fraud. FIs with assets more than $5B saw an increase from 34.4% to 43.2%, while FIs with assets up to $5B saw an increase in 26.5%.

Source: The State of Fraud and Financial Crime in the U.S.

Click the images above to enlarge.

While check fraud typically is more manual, with fraudsters physically manipulating checks through washing or using software to alter the images/create counterfeits, fraudsters now utilize AI for their schemes.

AI enables criminals to combine disparate data sources online to create fake identities and impersonate people. Voice and image technologies further enhance these scams.

AI enables scammers to essentially cobble together identities — as customers, vendors, friends and family members through voice, text and collecting data online — to defraud banking clients and the FIs themselves. Images and audio only augment the scams, where a call or text can fake distress to lure victims into sending details or payments.

And, we noted in an earlier post, it is only a matter of time until fraudsters leverage generative AI to create digital counterfeits of images of checks.

Fighting Back with Artificial Intelligence

Artificial intelligence is the great equalizer in the fight against fraud. While fraudsters are leveraging AI to commit fraud, FIs are utilizing it to fight back.

"As the adage goes, one can fight fire with fire. Banks can use AI, too, to detect and thwart fraud, often in real time," PYMNTS.com notes.

Banks are fighting back by adopting AI and machine learning models to detect fraud in real-time and block bad actors. In fact, over half of large banks plan to invest in wider usage and deployment of these technologies.

PYMNTS Intelligence and Hawk AI found that advanced machine learning and AI technologies can help build robust defenses against schemes. These high-tech tools can identify anomalies in authorized user profiles and block bad actors before they even reach their targets. Fifty-six percent of FIs with more than $5 million in assets reported plans to initiate or increase their use of ML and AI to improve existing fraud solutions. That’s a jump from the 36% seen a year ago.

For check fraud detection, AI and machine learning technologies are already being deployed to fight back against fraudsters. FIs are leveraging image forensic AI to analyze the images of checks deposited for counterfeits, forgeries, and alterations. Combining this with behavioral analytics that analyzes transactions and behavior on accounts creates a strong defense against check fraud.