66% of Bank Execs Perceive Complexity in Integrating New Fraud Tech

Insurance Business America cites a recent report from Featurespace, a provider of enterprise financial crime prevention software. It observes that the financial sector is facing a significant conflict in that financial crimes – especially scams – are increasing, while at the same time laboring under the perception that any solution means added complexity and compliance headaches.

Specifically, the report -- entitled The State of Fraud and Financial Crime in the US -- said that while 62% of global financial institutions reported a year-over-year increase in fraud volumes, they remain hesitant to take action due to perceived regulatory and technological hurdles.

Carolyn Homberger, president of the Americas at Featurespace, notes that in many cases bank risk managers are not necessarily falling short. The report pointed out, rather, that they are "caught between a rock and hard place."

“Our report found that two out of three executives viewed the adoption of innovative solutions to improve fraud detection and anti-money laundering (AML) compliance as a high priority, but over one in three cited concerns about perceived complexity of integrating new technologies,” Homberger told Corporate Risk and Insurance. “Fifty-nine percent of those surveyed in our report said they were adopting a ‘wait and see’ approach until newer technologies are ‘widely accepted’ or ‘well developed.’ This points to an industry that is in a kind of deadlock when it comes to combating fraud and financial crime. This benefits no one as much as the criminal, and impacts no one as much as the consumer who sees their confidence, trust and choice diminished further with every attack.”

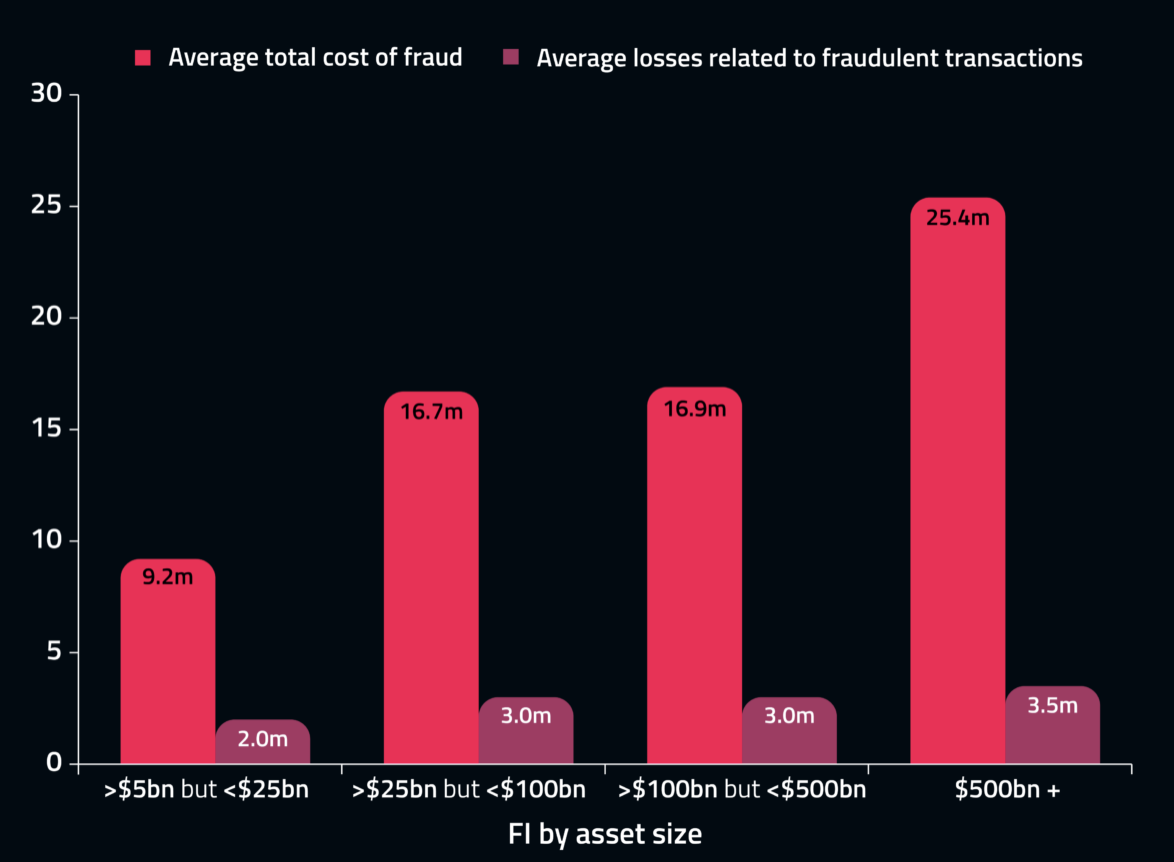

Smaller FIs Take Bigger Hit

While the study found increases in fraud across the industry, smaller FIs reported more damage:

- Smaller FIs, such as those between US$5 billion and US$25 billion in assets, are at larger risk of fraudulent transactions.

- Small banks and credit unions are often less equipped to counter or sustain increasingly sophisticated attacks.

- Almost three quarters (71%) of smaller institutions reported increased fraud rates.

Fraud growth outstripping customer growth

The rising volume of fraud attacks necessitates innovation to outsmart organized criminal networks.

Featurespace graphic

Smaller FIs felt the increase in the dollar cost of fraudulent transactions -- 68% of smaller FIs reported a bump upward. Larger FIs -- those with more than US$500 billion in assets -- had only 48% reporting an increase.

When you examine overall false positive rates, 48% of smaller FIs reported an increase, versus 39% for larger FIs.

Still, in spite of daunting risks, Homberger said that the study showed an industry in a deadlock when it comes to combating fraud and financial crime.

“The data – alongside our own experience – shows there’s an appetite for more innovative solutions able to address the ever-increasing challenges posed,” Homberger said. “Yet, it appears some institutions continue to wait before taking the leap and benefiting from the significantly reduced fraud losses promised to smart-thinking first movers.”

"We Know Technology is the Solution"

To combat modern fraud tactics effectively, Homberger emphasized the need for collaboration between leadership across various business sectors.

“Like any business, banks can be siloed organizations,” Homberger said. “Leaders across fraud prevention, AML, and data science must continue to collaborate to create long-term fraud prevention plans that are custom to each bank. There is no one-size-fits-all approach to fraud, and a diverse array of perspectives are needed in order to create an effective strategy.”

Also, currently accessible tech has to be adopted.

“We know that technology is the solution – financial institutions using AI and machine learning report the lowest levels of financial crimes, including fraud,” Homberger said. “For bank leaders, it’s now vital that they adopt technology that helps drive down fraud risks to create long-term, sustainable fraud prevention practices.”

Is integrating new technology complex? In most cases, yes. However, as noted by Homberger: "We know that technology is the solution."

That's why banks need to partner with a technology vendor that works directly with their teams to integrate and provide on-going support, and why banks are partnering with established technology partners like OrboGraph for check fraud.

Not only has OrboGraph developed and continuously improved its OrbNet Forensic AI technology for on-us and deposit check fraud, we also have a US-based Client Services and Account Management team that works hand-in-hand with banks to integrate the solution, tune the system for the targeted use cases of the bank, and assist in analyzing the results to ensure banks are identifying more fraud and reducing losses.