75% of Organizations Still Use Paper Checks According to New PYMNTS Report

- Digital payment solutions are becoming more and more popular

- However, many people and businesses still rely on checks

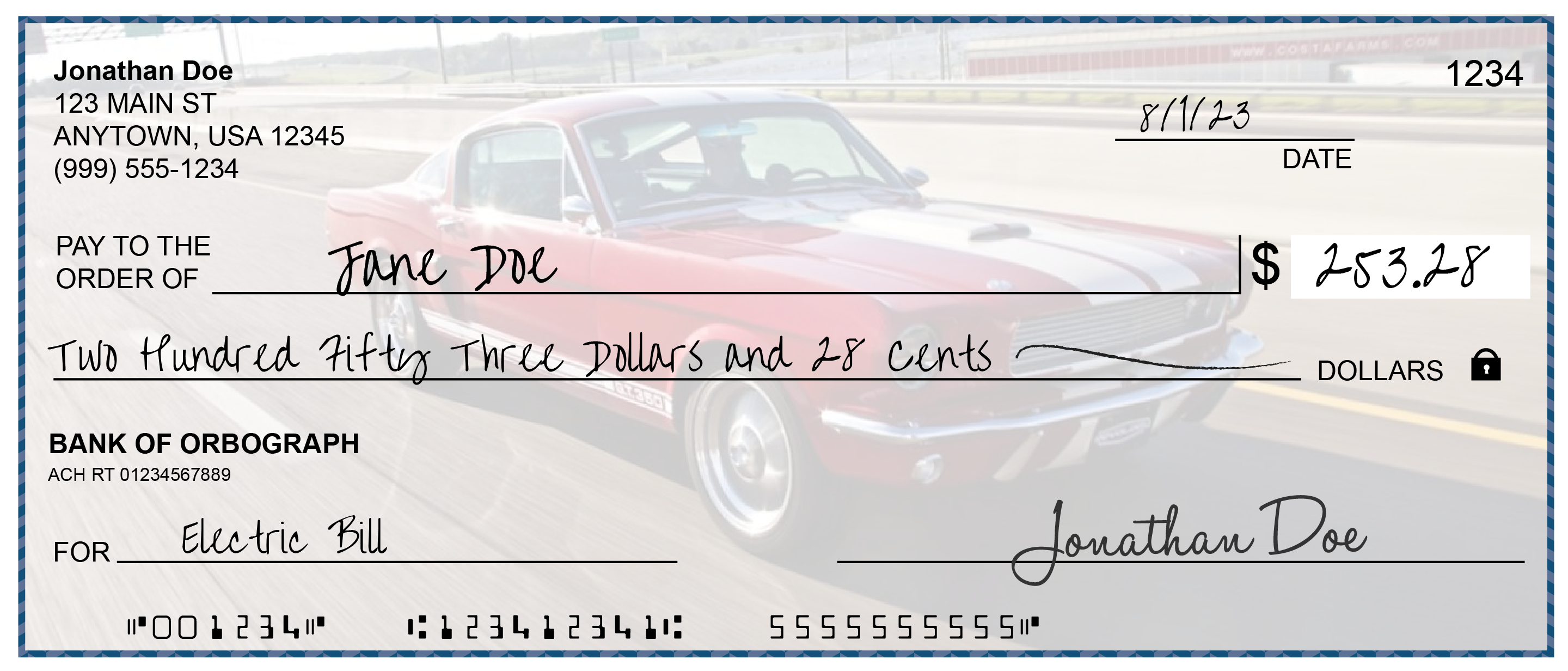

- Streamlining payment processes in that environment benefit from OrboGraph tools

The industry narrative that "the check is dead" has lost a lot of steam. While checks have seen slight declines year-over-year, the US has not ecperienced the mass adoption of digital payments that were supposed to deliver the "knock-out blow" to check payments.

In fact, OrboGraph has seen financial institutions (FI) change their tune, investing heavily in the payment channel. FIs are updating their legacy systems to deploy AI and machine learning technologies that automate the process.

There are various very good reasons for businesses to continue the use of checks.

Why Businesses Choose Checks over Digital Payments

PYMNTS reports that, despite growing adoption of digital solutions, many businesses still continue to choose paper checks as their preferred method of B2B payment. In fact, according to PYMNTS' "Getting Paid: Digital Payments for Improving Cash Flow and Customer Experience,” 75% of organizations still use paper checks, despite their high costs and inefficiencies. This is a slight decline from a 2022 report from PYMNTS that noted "81% of businesses still pay other firms via paper checks, making it the most common B2B payment method, even amid companies’ digitization efforts."

There are many benefits of adopting digital payments for businesses, including the reduction in days sales outstanding (DSO), building strong relationships, and operational efficiencies. Additionally, the article notes that digital payments offer lower costs per transaction. This has lead firms to adopt -- or intend to adopt -- digital payments, as "83% of firms said adopting fully electronic payment processing is essential."

However, despite these benefits, checks continue to thrive in B2B payments for several reasons:

- Established payment that requires no procedural changes

- Both sides of transaction must utilize other payment channels, whereas check payments are universal

- "Float time" helps SMBs manage their accounts

- Paper trail for all payments

- Credit card payments come with 3-5% fee

Financial Institution's Role in B2B Payments

The role of FIs is clear: enable their consumers and business account to send and receive funds through as many payments channels as possible.

FIs cannot force a business to stop accepting or using a certain payment. While they can recommend different payment channels and present their various perceived benefits, ultimately it is up to the business to utilize the payment channel of their preference.

Banks have taken note of this; instead of resisting, they are taking the steps to update their legacy core platform to leverage technologies to streamline payment channels like checks to reduce the inefficiencies and costs.

While no one can be certain what's ahead for checks, it's clear that they will continue to be a major payment channel now and into the near future..