Ceto & Associates: Community Banks are at a Disadvantage in Fraud Detection

- Rising check fraud means banks and credit union must be vigilant

- The answer is better technology, but can small banks and credit unions compete?

- AI technology and deep learning lead to prevention rates approach 95%

Community banks and credit unions are at a disadvantage. Their lack of necessary internal resources and budget to upgrade their systems and integrate new technologies compared to big banks leads to gaps in fraud coverage, automation capabilities, and outdated systems. These gaps are perilous when almost all industry numbers indicate check fraud is on the rise. Meanwhile, the banking industry is more competitive than ever as new fintech companies like Chime, Brex, and Acorn hit targeted markets. Community banks and credit unions also perform much more manual work compared to these new fintech companies.

Take these examples:

- Community banks and credit unions lack the ability to deploy automation beyond simple manual image reviews of mobile and RDC deposits.

- The same is true for ATM deposits for those community banks and credit unions that have image-based ATMs. However, many of these institutions still rely on envelope deposits through the ATM channel.

- Without strong fraud mitigation software, community banks and credit unions struggle to reduce restrictions on mobile deposits, impacting their ability to compete head-to-head with larger banks.

Based on the above examples, many community bank and credit union leaders fear that a significant fraud loss could create catastrophic consequences for their institutions. Better technology can help act as an insurance policy to guard against potential risk.

Competing with the Banking Giants

Community banks and credit unions often feel overwhelmed by the technology capabilities of large banks who invest billions of dollars in technology every year. Fortunately, there are technology partners ready to assist. Jack Henry & Associates (JHA) and Finicity are teaming up to ease the adoption of open banking functionality for the non-giants who need to stay in the game. Additionally, Alogent recently introduced a modernized payments infrastructure called APG.

One advantage community banks and credit unions have over large banks is their strong relationships with customers/members – a point of differentiation that Forbes.com recommends they leverage. Over the past few years, there have been many breakthroughs in AI and machine learning technologies and deploying those technologies. Along with the breakthroughs, industry partners like OrboGraph are ready to assist community banks and credit unions.

How Emerging Technology Can Help Combat Fraud

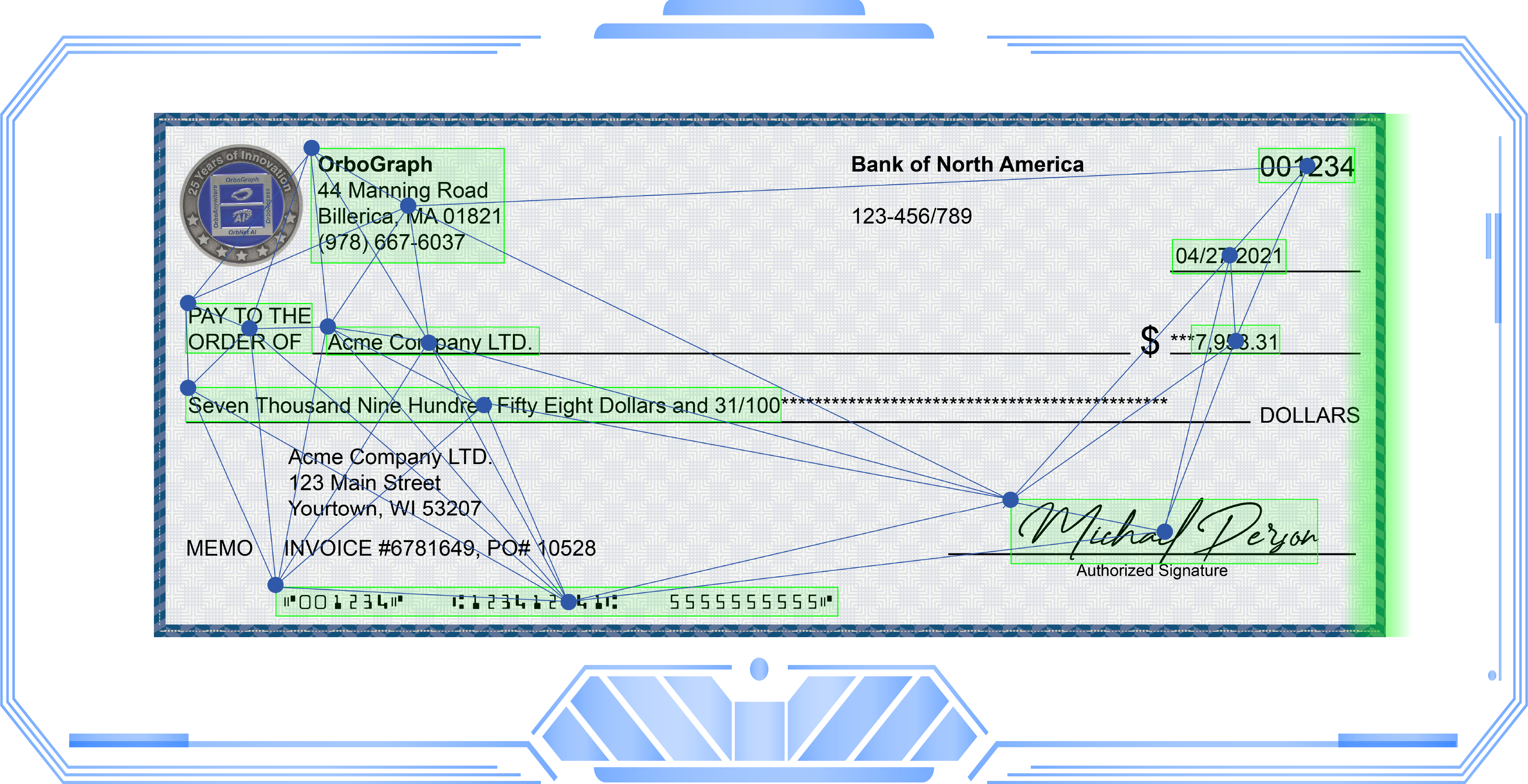

Community banks and credit unions should prioritize modernizing the payment channels that need it most. For example, checks, a primary cog in the digital payments ecosystem – according to Deluxe Corp. With the introduction of AI and deep learning technologies, we have seen unprecedented results – with automation rates exceeding 99% and accuracy rates over 99.5% translating to faster processing, fewer customer errors, and reduced costs.

The achievements of AI and deep learning also extend into check fraud. As we covered in the Modernizing Omnichannel Check Fraud Detection Blog, fraudsters continue to target checks as a primary payments channel to extract funds from banks and their customers. While the banking giants can write off losses, community banks and credit unions suffer more as the losses become a burden to the bottom line and hurt customer relationships. While a few community banks and credit unions are deploying some analytics-based technology, more is needed.

In a recent news release, OrboGraph announced its OrbNet Forensic AI technology – leading to prevention rates as high as 95%.

To put it into perspective:

Suppose a larger community bank or credit union has on-us fraud attempts of $10M per year in counterfeits, alterations, and forgeries; they could likely lose $2M to $3M resulting in a prevention rate of 70% to 80%. With AI technology and deep learning, prevention rates approach 95%, and losses plummet to $500K, resulting in loss mitigation of $2.5M annually. Community banks and credit unions cannot afford to ignore these implications.

Co-Author

John Mateker is the Vice President and practice manager for the Clear Point practice at Ceto and Associates, a leading community bank and credit union consulting firm. The Clear Point practice focuses on helping community banks and credit unions improve their operational processes providing opportunities for cost reduction through analysis and recommendations for retail and branch networks, commercial lending, loan operations, and other functions.