77% of Businesses Using Positive Pay Report Fewer Check Fraud Attempts or Losses

- A new report by NPG reveals check fraud rising even as check usage declines

- NPG's survey reveals that 80% of FIs offer Positive Pay

- FIs have not adopted Positive Pay mainly due to lack of awareness or perceived risk

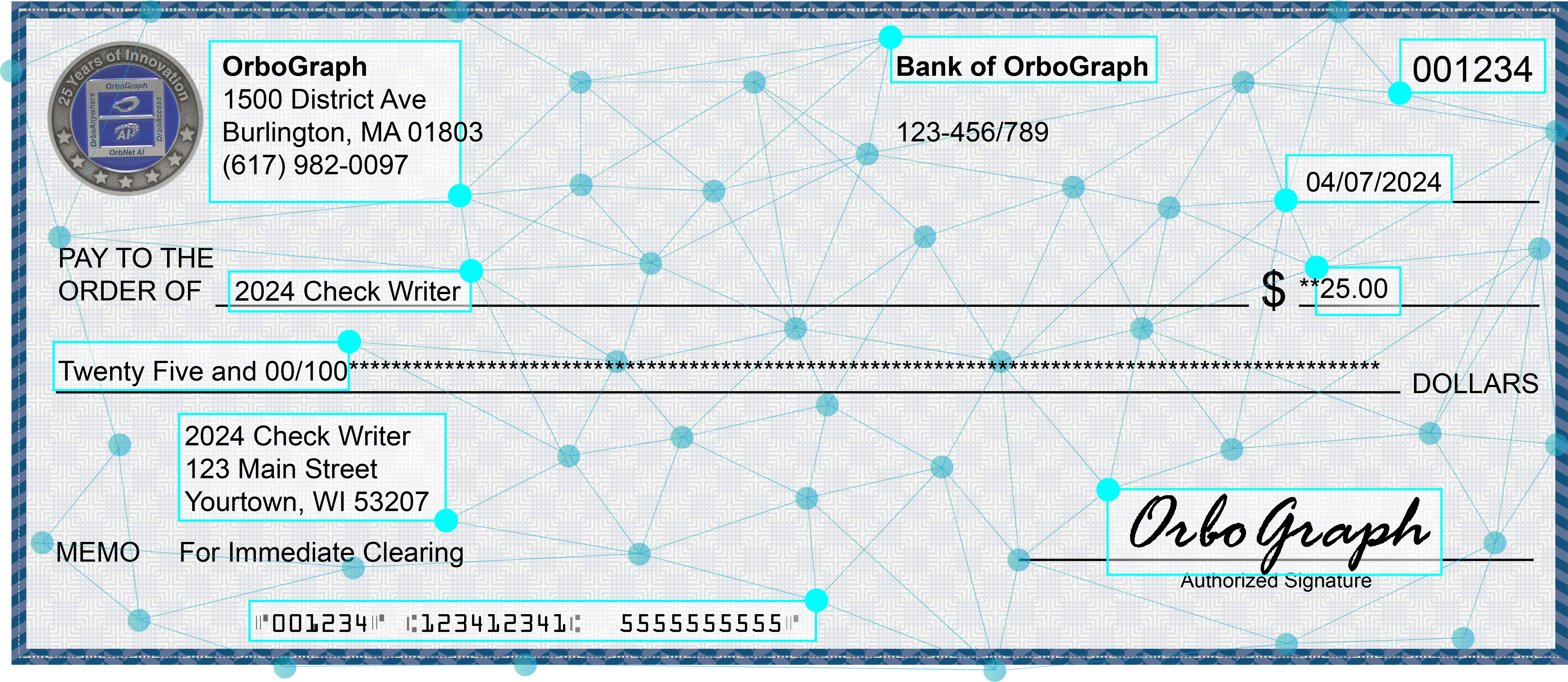

Within the arsenal for financial institutions to fight check fraud, Positive Pay undoubtedly plays a key role. While not a new technology, it's an effective tool that compares data extracted from the fields of the check with the "issuer file" provided by the corporate client. Any discrepancies are flagged and the corporate client is able to confirm any issues with the payment -- enabling the FI to reject the check payment from the bank of first deposit.

This technology is a popular offering, and, as noted in the recent "Positive Pay Market Survey Findings and Recommendations" report by NEACH Payments Group (NPG) , 80% of FIs offer Positive Pay.

However, 20% of FIs do not offer this service, citing cost/resource constraints and lack of client demand as primary reasons.

Diving deeper into the report, we can see why positive pay is such an effective tool.

Key Findings from the Report

The report shows positive results for FIs who offer positive pay, and the corporate clients that utilize the technology.

For those using Positive Pay:

- 53% of FIs have seen a measurable reduction in fraud, particularly with counterfeit and altered checks

- 77% of businesses report a significant decline in check fraud attempts or losses

- 79% reduction in counterfeit checks

- 74% decline in altered checks

- 90% of businesses with access to Positive Pay have signed up for the service

While there are tangible benefits from utilizing Positive Pay, why don't all financial institutions offer it? And, why would corporate clients not take advantage of the offering to better protect themselves?

As noted earlier, while 80% of the FIs surveyed offered Positive Pay, 20% do not. Here are the top 5 reasons:

- 68% cite cost and resource constraints

- 50% cite lack of client/member demand

- 18% cite client/member pushback

- 14% cite concerns on implementation or integration

- 9% cite other priorities

Maybe most alarming, 10% of businesses have not engaged with Positive Pay, mainly due to a lack of awareness or perceived risk -- signaling a lack of communication between the FI and their corporate customer.

Fortunately, FIs can proactively address some of those concerns. With 71% of FIs charging for the service, FIs concerned about expenses can plan to recoup some of their costs. In addition, new, more automated fraud solutions make Positive Pay a less manual process and offer a more seamless integration for FIs, simplifying operational requirements and addressing those issues.

Recommendations for FIs

The report recommends that FIs should:

- Require or encourage the use of Positive Pay among business clients

- Consider extending Positive Pay to other payment methods like ACH

- Conduct comprehensive risk assessments

OrboGraph would additionally recommend "supercharging" Positive Pay systems to include the following capabilities to strengthen check fraud detection:

Payee Positive Pay: Advancements in optical character recognition and payee matching have revolutionized Positive Pay systems, allowing a comprehensive approach that matches the payee name to payee issue file source, building a strong deterrent to payee alterations.

Field Validation: New technologies enable FIs and their corporate clients to validate additional fields like signature, date, and payor to provide a more robust fraud detection process.

Consortium Data: Positive Pay systems are receiving a boost from consortium data. As noted in a previous article, technology vendors like AFS are able to take the extracted data and compare it to their consortium data to provide extra protection from check fraud.

Dark Web Monitoring: Many stolen checks end up on the dark web or other channels like Telegram. Deploying a dark web monitoring solution scours these channels to detect compromised checks or accounts -- putting FIs in a proactive position as they fight check fraud.

But, are these legitimate reasons for not offering Positive Pay? As noted by NPG:

While offering Positive Pay is essential in the fight against check fraud, FIs need to invest in the latest technologies that can further reduce check fraud attempts and losses from the “77%” provided by Positive Pay. With the industry standard of 95% check fraud detection rate, Positive Pay cannot achieve this alone (particularly since it is only available for corporate clients) without layering it with other check fraud detection technologies like image forensic AI. Remember, no single technology can detect the majority of check fraud alone.