ABA Journal: Integrated Anti-Fraud Approach Critical for 2024 Success

- Check fraud doubled in 2022

- Counterfeit checks are easy to create

- Checks are still widely used, giving fraudsters a big target

ABA Risk and Compliance takes a look at check fraud, a persistent challenge for banks with reported cases doubling in 2022.

The article highlights the three primary fraud techniques at work today:

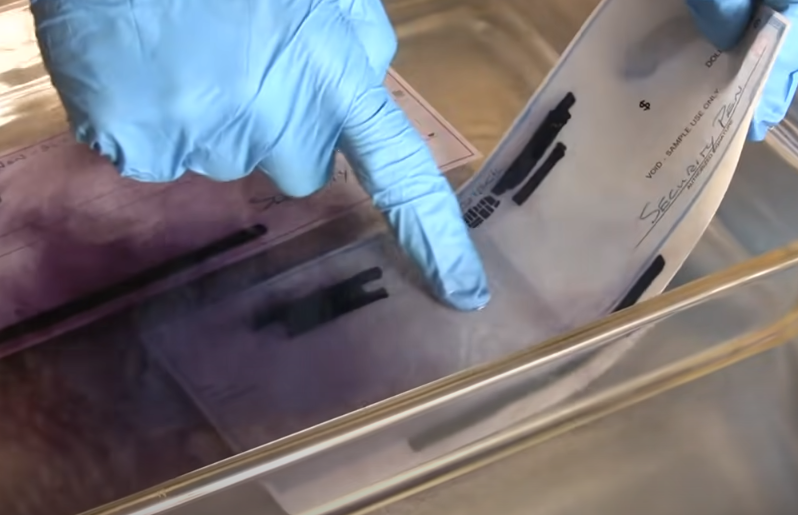

- Counterfeit checks require an increased level of skill. The availability of check stock and online services, easily downloadable computer programs, and account information on the dark market add to the prevalence of this type.

- Altered or ”washed” checks are currently the most commonly reported fraudulent checks and involve altering the payee name or amount or both. The attributing factor is the increased focus by organized criminal groups stealing U.S. mail and monetizing through a well-orchestrated attack.

- Forged endorsements normally involve stolen checks by less sophisticated criminal(s) looking for quick money to steal and perhaps feed a habit or addiction.

Checks Are Still a Widely Used Financial Tool

None of this is really a problem because checks are going away, right? The answer is a resounding no:

Checks are not going away anytime soon, if ever. Americans still trust checks to make charitable donations, pay bills, obtain services and buy goods — especially if the amount of the purchase exceeds the payor’s debit or credit limit. Some smaller businesses prefer payment by check to avoid card network and processing fees. Even with the increased migration to online/mobile banking, accelerated during the COVID era, a recent study signifies that checks still play a significant role in the U.S. payment ecosystem. The Atlanta Federal Reserve, pulling statistics from the Bank for International Settlements (reporting of 20 countries, highlighted the global migration away from checks to different forms of non-cash payments, while showing that the U.S. lagged on innovative payments and had “by far the highest per capita use of checks per year in 2021 — 30 checks.”

With such "ripe pickings" available, fraudsters, the article points out, are becoming "creative creatures" who adapt their tactics to societal behaviors.

Now, using street level “mules” or “walkers” along with the latest social media applications, like Telegram, they are attacking at scale with high rewards with little risk of being caught and prosecuted.

Who's to Blame?

The article also attempts to assess where the "blame" should fall for the rise in check fraud, but it's not so easy to narrow it down:

The U.S. Postal Service for not protecting the mailed checks that get stolen and then “washed” or altered? Law enforcement for not arresting the “walkers,” “washers,” robbers, and counterfeiters and putting them in jail? Or the banks? Indeed, Congress asked the American Bankers Association earlier in the year why customers are not being protected better from “washed” and other fraudulent checks. There’s no agreed upon answer. However, each party plays a role in slowing this fraud down.

Organized criminal groups are behind many fraud schemes as well, stealing checks from mailboxes and altering or depositing them. When speaking with law enforcement, they note that many organized crime groups or gangs have moved away from typical crimes -- such as distributing illegal substances -- to stealing mail/checks. Why, you may ask? Simple -- it's easier, requires less effort, and the penalties for check fraud are lighter than those from other crimes.

Is There a Solution?

ABA agrees that banks need integrated anti-fraud strategies across departments to better detect fraud. Information sharing with other banks and law enforcement is critical to connect the dots on organized fraud rings. Banks should educate employees and customers on fraud trends and defenses like positive pay services.

An integrated anti-fraud approach inside banks is also critical and should be the goal. The banks’ different deposit points tend to feed into different processes within the bank. This allows banks to have a more complete picture of check fraud and also to identify and share information about the newest check fraud strategies and practices.

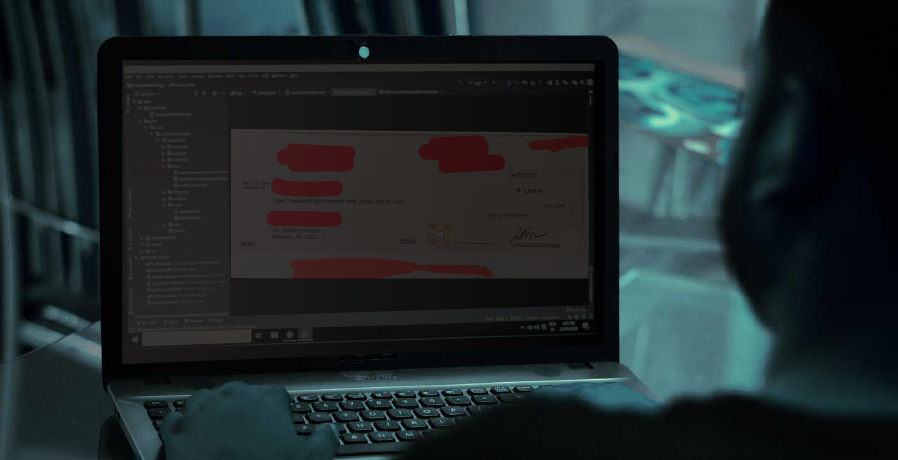

An integrated anti-fraud approach inside banks is critical and should be the goal. The banks’ different deposit points tend to feed into different processes within the bank. Enabling the different technologies -- like behavioral analytics to monitor accounts, image forensic AI to analyze the images of check deposits, consortium data to verify and validate check payments and account data, and dark web monitoring to ensure your customer data and checks are safe -- allows banks to have a more complete picture of check fraud and also to identify and share information about the newest check fraud strategies and practices.