ACFE and SAS Release Anti-Fraud Technology Benchmarking Report 2022

- Use of AI and machine learning expected to escalate against fraud

- A majority of organizations plan to increase their anti-fraud tech budgets

- The pandemic has certainly been a factor

The Association of Certified Fraud Examiners and SAS released their Anti-Fraud Technology Benchmarking Report 2022 -- a report exploring how organizations are using anti-fraud technologies and which ones they plan to adopt.

The fight against fraud can feel like a battle to stay one step ahead of the fraud perpetrators, especially as the fraud risks that organizations face today are more dynamic and persistent than ever. Thankfully, anti-fraud professionals have a full suite of technologies they can deploy to combat these threats. From traditional data analytics to emerging options such as robotic process automation and computer vision analysis, anti-fraud technology plays a key role in many organizations’ fraud programs.

A 20-question survey -- distributed in October 2021 to 80,011 ACFE members -- asked members to provide information about their organizations’ use of various technologies as part of their anti-fraud initiatives. Survey responses -- 884 total -- were collected anonymously.

Key Findings from the Report

The report highlights specific technologies that organizations are deploying or plan on deploying in the next few years, including:

- Artificial intelligence

- Exception reporting and anomaly detection

- Data analytics

- Biometrics

- Blockchain

When examining the key findings, we see several technologies that are particularly effective for check fraud. As noted in the report, "more than half of the respondents currently use exception reporting and anomaly detection, as well as automated monitoring of red flags and business analysis as part of their anti-fraud programs." This is expected to grow to to more than two thirds in the next two years.

This type of technology is currently present in check fraud detection, where we see transactional-analytics and image-forensic AI systems blacklisting accounts and detecting anomalous behavior for accounts and payments.

Source: Anti-Fraud Technology Benchmarking Report 2022

Also, 99% of organizations say that the increased volume of transactions reviewed and the improved timeliness of anomaly detection are beneficial outcomes of their anti-fraud analytics programs.

When examining the deployment of artificial intelligence and machine learning for fraud detection, we see a concerted investment from these organizations.

According to the report:

- The use of artificial intelligence and machine learning in anti-fraud programs is expected to more than double over the next two years

- More than 40% of organizations expect to add computer vision analysis, robotics, or blockchain/distributed ledger technology to their anti-fraud technology toolkit in the future

Source: Anti-Fraud Technology Benchmarking Report 2022

In particular, computer vision analysis -- a field of AI that trains computers to capture and interpret information from image and video data -- is currently part of image-forensics AI deployed for check fraud detection.

Challenges of Implementing Anti-Fraud Technologies

The biggest challenge for organizations in implementing new anti-fraud technologies is -- no surprise -- budget and financial concerns. According to the report, 91% of respondents indicated budget and financial concerns as a challenge, with 78% identifying it as a major or moderate challenge.

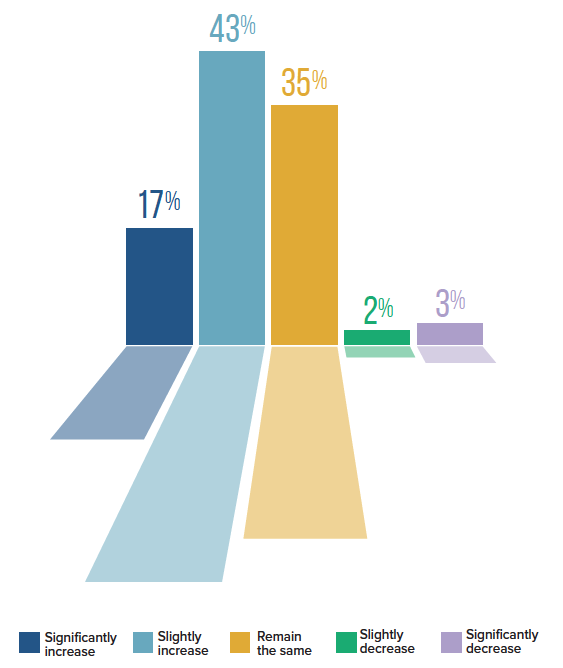

Still, 60% of organizations expect an increase in their anti-fraud technology budgets in the next two years.

The fight against fraud can feel like a battle to stay one step ahead of the fraud perpetrators, especially as the fraud risks that organizations face today are more dynamic and persistent than ever. Thankfully, anti-fraud professionals have a full suite of technologies they can deploy to combat these threats. From traditional data analytics to emerging options such as robotic process automation and computer vision analysis, anti-fraud technology plays a key role in many organizations’ fraud programs.

The image to the right shows how organizations’ anti-fraud technology budgets are expected to change in the next two years.

Source: Anti-Fraud Technology Benchmarking Report 2022

Fighting Fraud -- A Collaborative Effort?

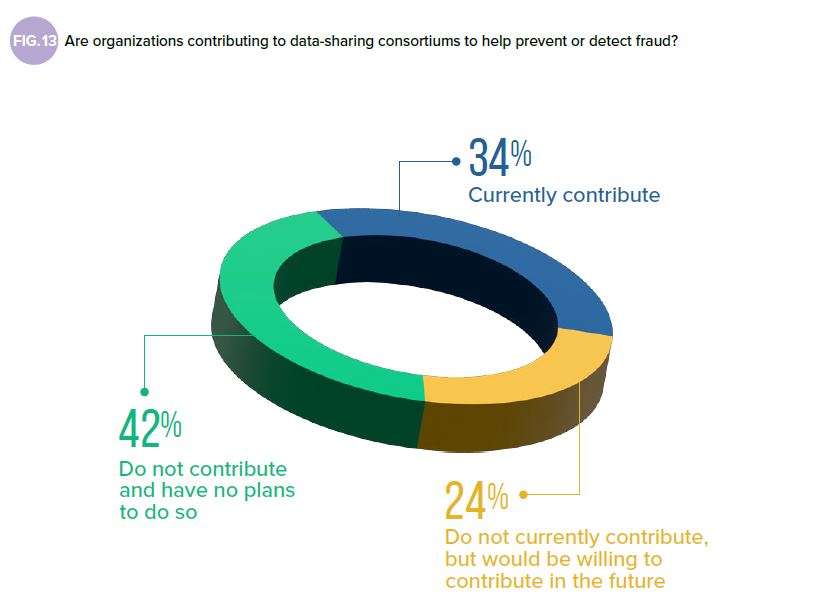

A fraud-fighting strategy that is gaining popularity is taking a more collaborative approach. According to the report:

- 34% of organizations are currently contributing to a data-sharing consortium

- 24% of organizations do not currently contribute to a data-sharing consortium, but would be willing to contribute in the future

- 42% of organizations do not currently contribute to a data-sharing consortiums, and have no plans to do so

Source: Anti-Fraud Technology Benchmarking Report 2022

While data-sharing consortiums for the banking sector can be problematic due to privacy policies, we are seeing financial institutions and their fraud leadership participating in meetings to discuss fraud trends, use cases, and strategic approaches. Currently, OrboGraph is facilitating the Check Fraud Roundtable -- a series of organized meetings to share experiences, trends, and prevalent fraud use cases, while identifying key technological barriers within on-us and deposit check fraud.

If you would like to participate in future roundtable sessions, please email marketing@orbograph.com.