Achieving the Right Balance Between Fraud Detection & Customer Experience

- Adoption of digital banking was relatively slow at first

- The pandemic greatly accelerated digital banking

- Banks that don't address fraud effectively lose customers

If adoption of digital banking and commerce was tenuous as first, a good deal of restraint was discarded when the pandemic took hold and visiting banks in person became impossible.

And, of course, with such large concentrations of new adopters jumping aboard, targeting by fraudsters was all but inevitable.

A post at McKinsey & Company explores a new approach to fighting fraud while enhancing customer experience on a large scale.

Increased digital adoption has enabled new forms of fraudulent activity and amplified the importance of effective fraud management for promoting growth and meeting customers' increasing expectations for digital experiences. Although most companies have improved their digital user interface and experience, many have struggled to effectively enhance fraud controls without impairing the client experience.

Many organizations report being overwhelmed by the sheer volume of fraud attempts. In financial services, for example, many banks are so inundated by fraudsters that they cannot meet online origination targets; they are unable to verify identities and authenticate customers while combating fraud.

More Sophisticated Scams Demand a New Approach

McKinsey & Company notes that, along with more targets available to them, the originators of fraud have become significantly more sophisticated -- it's no longer simply a lone "shady character in a basement" working independently.

They include nation-state actors, organized criminals, cyber terrorists, and insiders, as well as local fraud rings. Advances in technology present challenges as fraud attacks occur with greater frequency, speed, and effectiveness. Commonly used methods include phishing, destructive malware, social engineering, deep fakes, and fraud-as-a-service exploit kits.

McKinsey goes on to propose a new approach to fraud and the client experience, addressing this new reality. Two keys to their suggested approach are:

- Companies must strengthen core capabilities (the immune system)

- Companies must improve their abilities to continually identify and address vulnerabilities arising from new fraud methods and patterns

The Customer Factor: Striking a Balance

Also imperative is recognizing and effectively addressing the effect of fraud on customers:

Fraud is also hurting customers’ trust and willingness to use services. For example, more than 10 percent of credit and debit card users experienced fraud over a 12-month period. In most cases, these events not only prevent customers from running their transactions but also raise stress levels. In a survey by McKinsey of banking customers who were fraud victims, 70 percent reported having felt anxious, stressed, displeased, or frustrated when they were warned about potential fraud.

How fraud is addressed and handled can be the difference between retaining and losing significant amounts of depositors/customers:

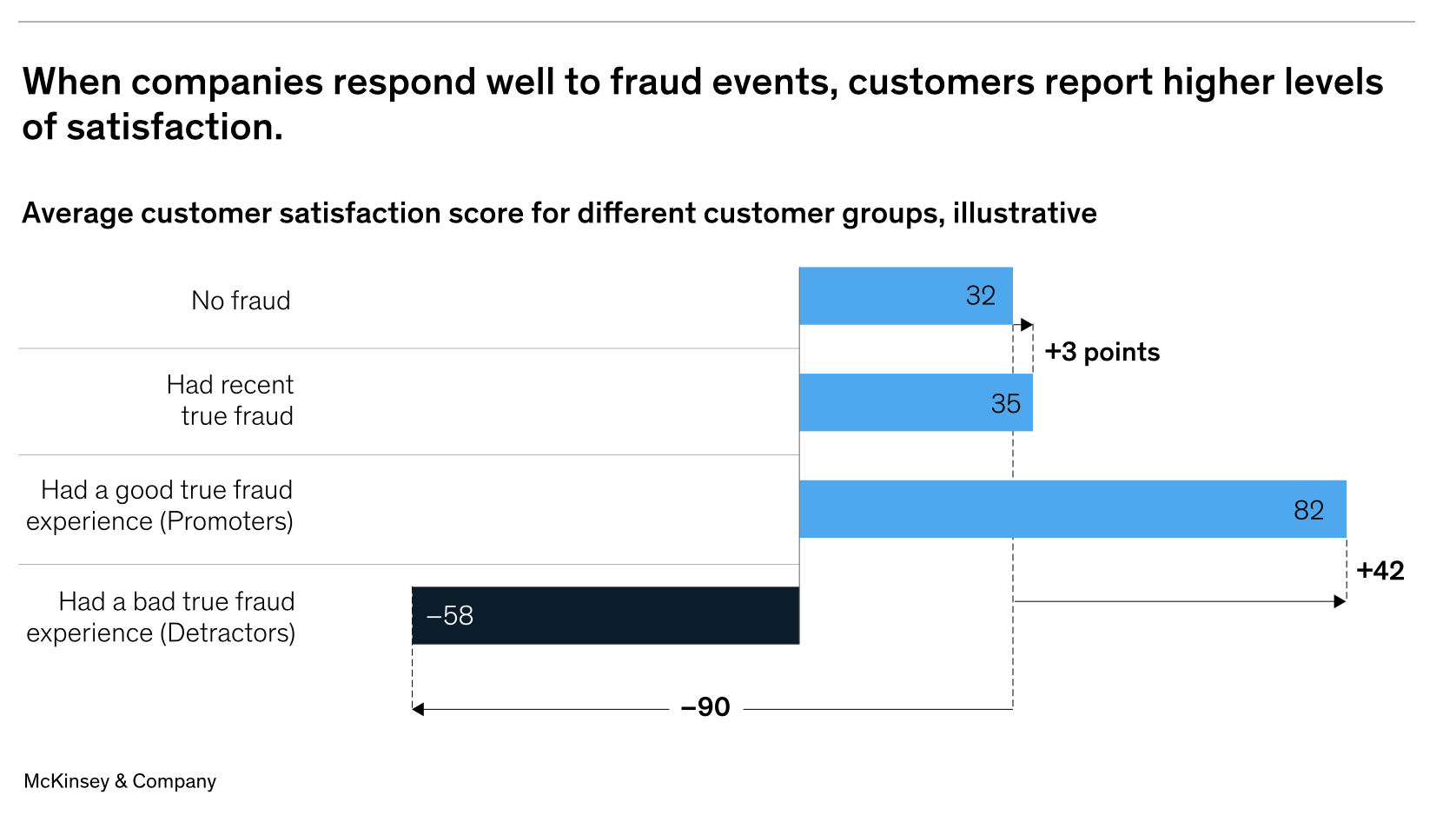

The same post-fraud survey made clear that customers perceive true fraud events—situations where fraud is not just suspected but actually occurring—as moments of truth that, on average, actually tend to increase their satisfaction with their service provider. But the impact in individual cases depends on how companies handle the fraud issue, with customer satisfaction ratings ranging from very high (customer satisfaction score of 82 points) to very low (customer satisfaction score of −58 points) (Exhibit 1). In addition, among “Detractors”—customers who had a bad experience related to the company’s handling of fraud—37 percent of all detractors closed the account or significantly decreased their use of it.

Source: McKinsey & Company

Put another way, banks that are able to effectively respond to and resolve their customers' issues with fraud are going to be rewarded with higher customer satisfaction and retention.

It's not, however, an easy balance to attain and maintain.

A fundamental tension exists between controlling fraud and optimizing customer experience, because tighter fraud and customer protection controls often add friction to the customer experience. The new approach combines a best-practice fraud model with customer experience considerations to strike a balance among several goals: loss prevention, customer protection, cost optimization, improved customer experience, and new business value.

"Choreographing" Success

We heartily agree with McKinsey and Company when they say organizations need to consider authentication, fraud management, and customer experience simultaneously—not individually, as they are often dealt with today. It's a "choreography" that balances effective fraud prevention with smooth interactions.

Poorly designed authentication experiences have a disproportionately negative impact on customer engagement, fraud mitigation, and operational efficiency. To combat threats and enhance customer experience, organizations need to redesign customer and internal operations and processes based on a continuous assessment of actual cases of fraud along key customer journeys.

As detailed in previous blog posts, any time the customer of a financial institution is victimized by fraud -- particularly check fraud -- that customer is inevitably disappointed and upset at the financial institution's inability to protect their funds. Perpetrators are able to commit check fraud by simply altering a check amount, adding "& NAME" to the payee field, or creating a counterfeit with information gathered online.

The customer, however, is simply left wondering, "How did the bank not catch this blatant fraud?"

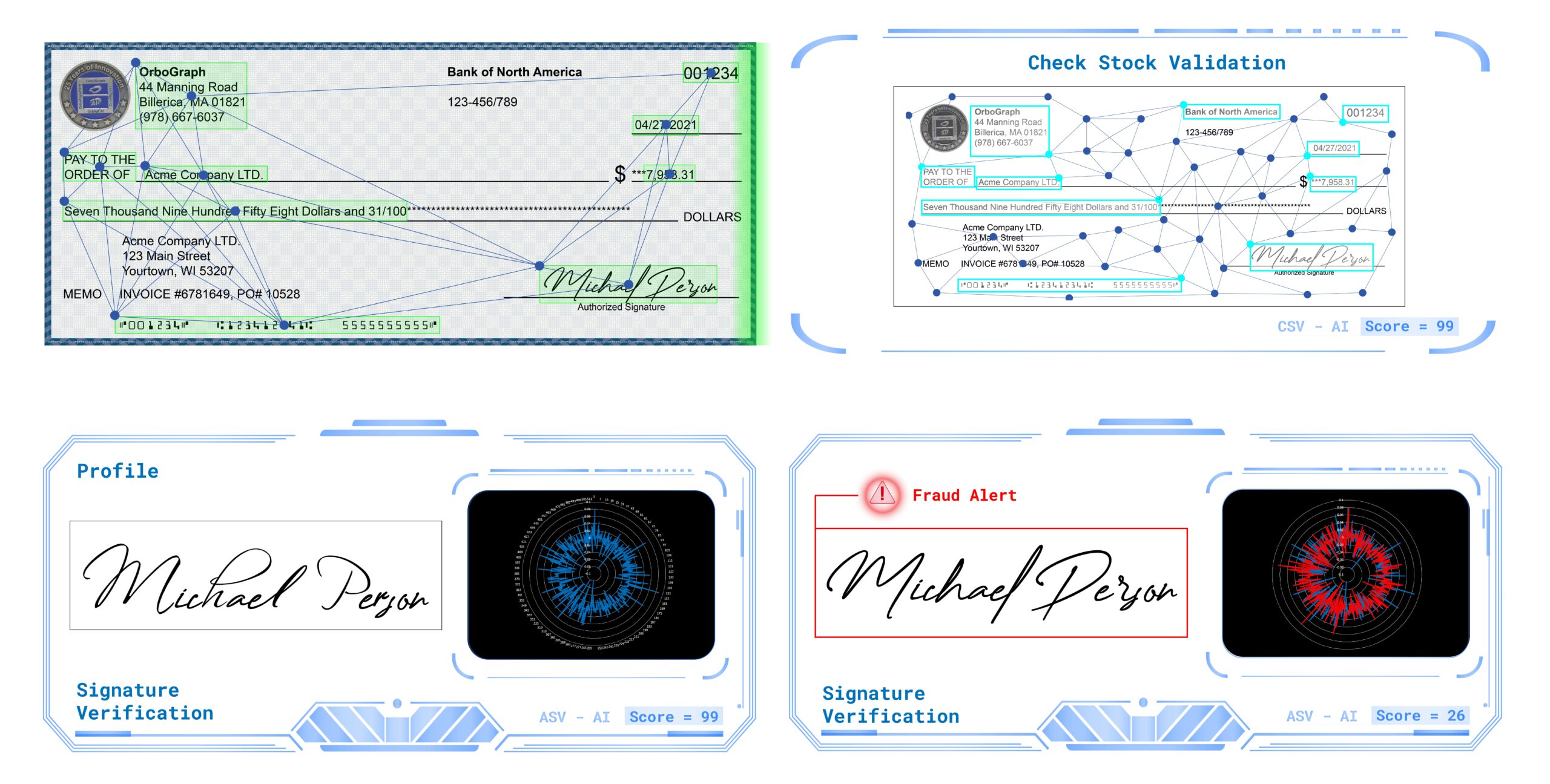

That's why banks are turning to image-forensic AI to analyze captured images of check, spotting counterfeits, forgeries, and alterations. It's impossible for banks to hire enough humans to review every check; AI and machine learning technology, however, are able to analyze hundreds of thousands of checks in a matter of minutes, reducing the number of items needed to be reviewed by the fraud department -- all before funds are lost -- preserving a positive customer experience.