AI Automation a Top Banking Trend in 2026

- AI-driven automation now spans chatbots, fraud monitoring, and robotic process automation

-

Advanced check processing AI achieves up to 99.8% read accuracy, minimizing manual work

-

GPU-powered systems double to quadruple throughput, making AI affordable for all banks

For decades, the banking industry has been chasing the elusive goal of automation -- alleviating their internal teams from laborious tasks and shifting to strategic tasks that drive revenue.

According to a new article from Startus Insights, the industry appears to be at the nexus point as financial institutions are deploying more AI technologies that can achieve true automation.

AI-driven automation is now embedded across front and back offices, from chatbots and virtual assistants to anti‑fraud systems and robotic process automation that removes manual tasks like data entry and reconciliation.

The article presents several examples from across the globe, including:

- Bank of America's Erica chatbot offering personalized financial advice and assistance to customers

- JPMorgan Chase deploying AI to monitor millions of transactions to flag suspicious activities

- Robotic Process Automation (RPA) to automate functions, including transaction processing and compliance

- AI to manage assets in its exchange-traded funds (ETFs)

- Automation of banking data entry and analysis

- AI-driven analytics to streamlines data analysis

These examples show that financial institutions are now trusting AI-powered systems on a large scale.

AI Automation for Check Processing

Over the past few years, the trust in AI-powered systems like OrboAnywhere has resulted in massive adoption across the industry to truly achieve straight-through-processing (STP) for checks. Previously, the industry relied heavily on legacy OCR technologies achieving around 80-85% accuracy and read rates. This left a significant portion to be manually entered by either the tellers or deposit operations.

However, AI-powered systems closed the gap. For instance, Anywhere Recognition harnesses the power of OrbNet AI™ technology -- OrboGraph's proprietary AI-based deep learning set of models -- to achieve 99%+ amount read rates and accuracy levels reaching as high as 99.8%. This effectively removes the need for manual intervention.

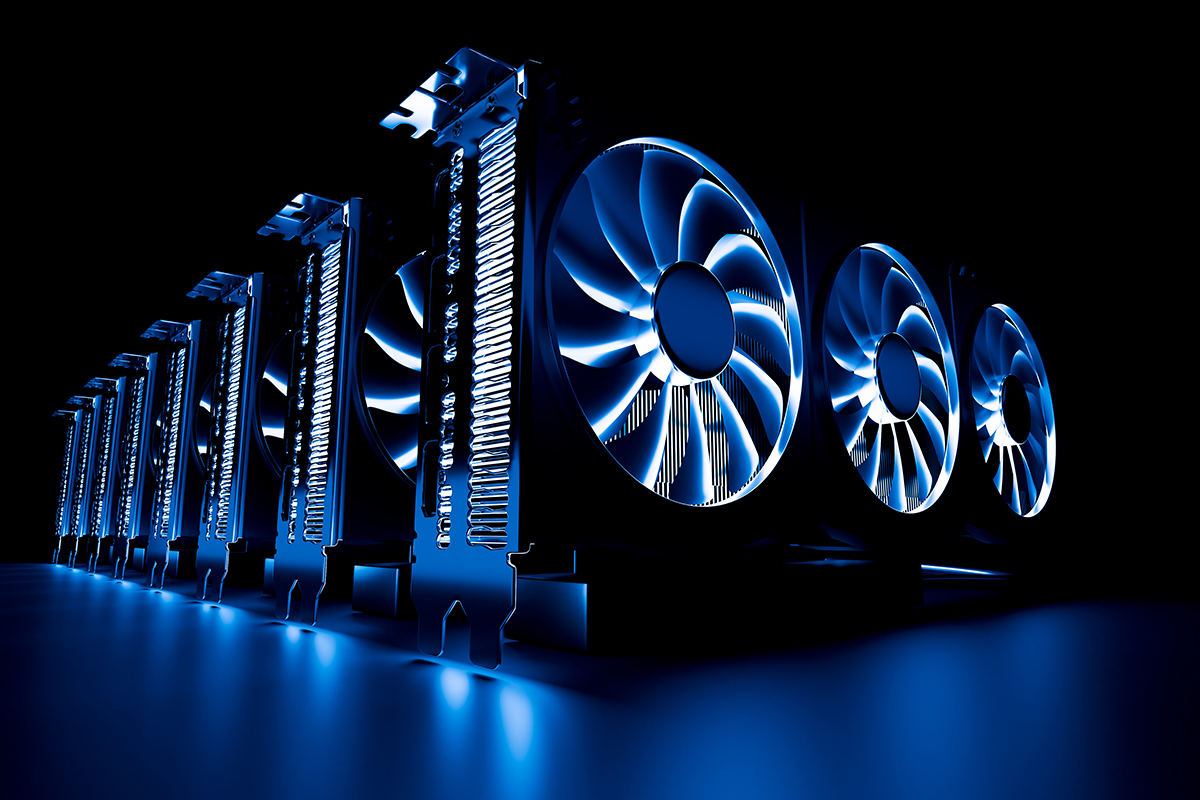

This is not limited to just accuracy, but speed as well. New innovations such as our OrboAnywhere Turbo 6.0 release increases throughput by 2X-4X. This is possible by leveraging Graphics Processing Unit (GPUs) which can process tens of thousands of items in seconds vs CPU based systems which requires hours to process. While many financial institutions were hesitant to deploy AI because of the cost, the market now offers a diverse range catering to various needs and budgets.

It's critical to note that not every AI application requires the most cutting-edge, top-of-the-line GPU. Depending on the complexity of the task or the number of items needing to be processed, mid-range or even entry-level GPUs can deliver impressive performance.

Additionally, for regional and small community banks, these solutions are also available to their service bureaus and core providers -- removing internal resources burden to deploy.

With AI Automation virtually at the fingertips of each financial institution, there's no reason to put off taking advantage of these ground-breaking technologies.